6.23.2021 Key Takeaways:

- Must develop a stronger stomach for fluctuations. Trust your levels & give trades time to work out. Hold your onyx stone during trade to keep your trigger happy exit finger from exiting out of fear.

- Must follow your game plan on EXITS as well as ENTRIES. Exercise patience & resolve, giving trades time to work out, and trusting your levels

- Trust your levels & play in between them. Give trade time to work out & candles to close near your levels.

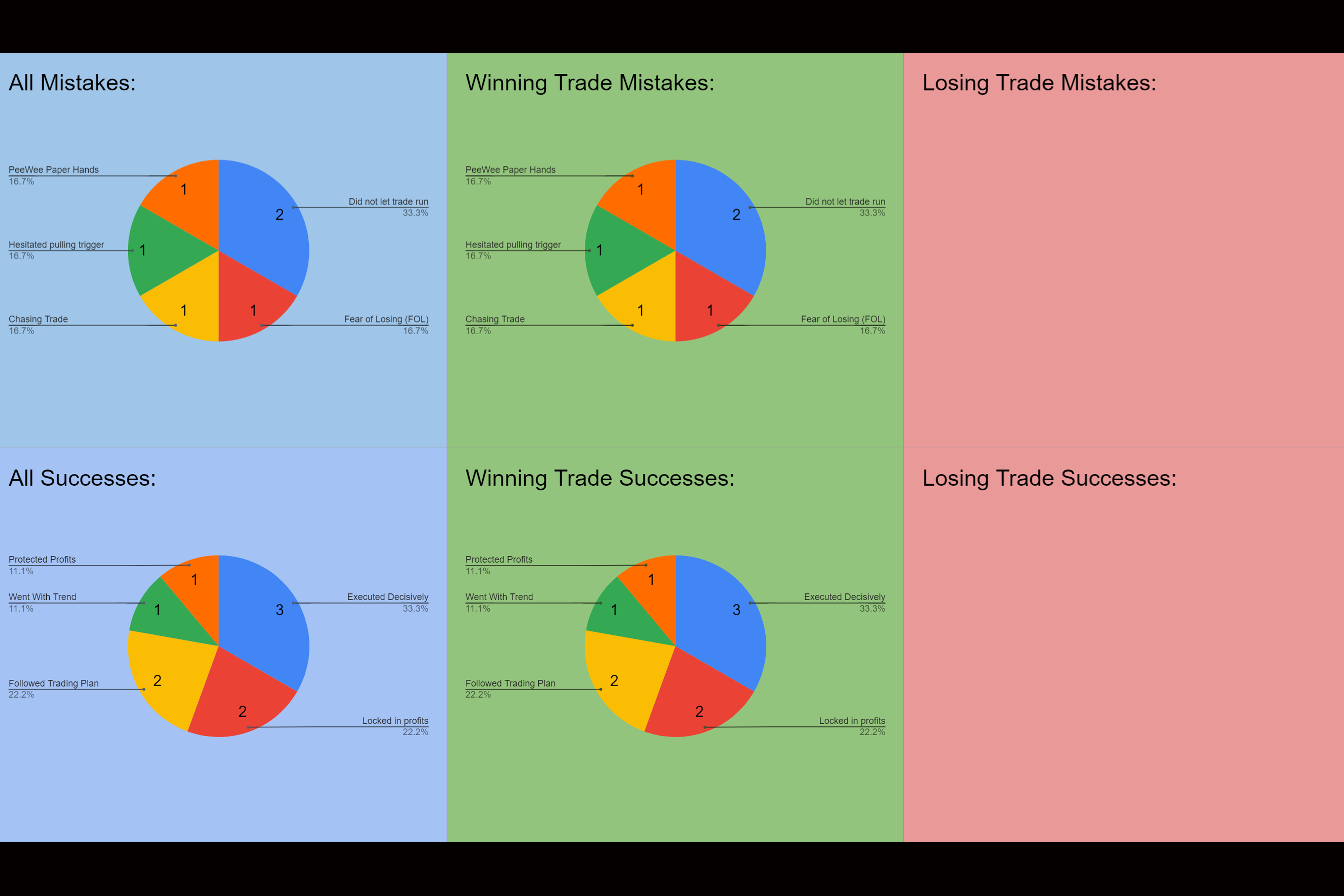

Mistakes | 6.23.2021 | Wednesday

- Late Entry.

- Peewee Paper-hands. Did not Trust Levels. Employ Onyx stone.

- Peewee Paper-hands. Did not Trust Levels. Employ Onyx stone.

Successes | 6.23.2021 | Wednesday

- Followed Game plans

- Executed Decisively

- Protected Profits

Activity Log | 6.23.2021 | Wed. | 5.63 hrs

- Game Planned: 6.23.2021

- Charted

- Traded

- Studied: Youtube

Game planned, charted, traded. Studied trading ‘My $37,386 Trading Week’ . Studied Great Depression finished ‘The Great Depression 3 – New Deal, New York’ & ‘The Great Depression 4 – We have a plan’. Studied ‘A Really Dopey Options Trading Concept’ | 338 min

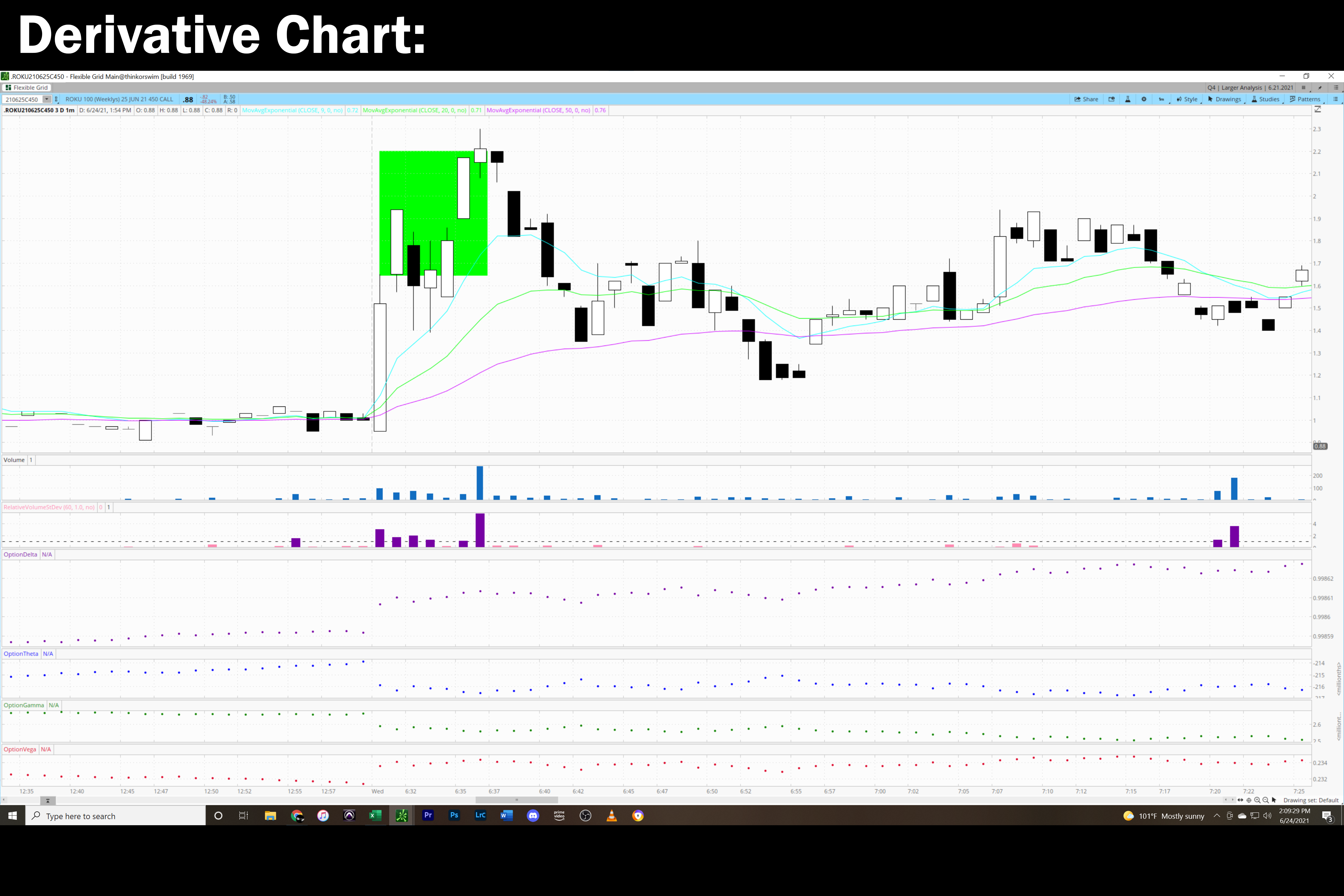

Trade 1 (ROKU | $54.70 | 33.35%):

-Entered Because had multiple confirmations. Saw ROKU Surge above 1st key level straight through second key level, Saw QQQ pushing as well from bottom of demand level with room before next supply level was reached, all EMA’s on all time frames were in my favor on ROKU & had basis of bull flag pattern on hourly from day before backing my thesis. SPX was pushing as well with room to next supply level.

-Exited because ROKU was approaching next key level & had tested it, I wanted to protect profits & be done trading for the day so I closed out my position.

-Trade 1 Mistakes: I bought at the very top of the surge & suffered some slippage because of my moderate chasing. I also could have played the strike I had initially chosen which was closer to at the money, but I’m not yet comfortable with the fluctuations that come with more expensive contracts. I could have gotten in a bit earlier, right on the open above my first key level rather than hesitating, but hind sight is 20 20 & I was watching to see if demand would hold price above my level. I could have waited for a bit of a pullback before entering. Otherwise, there’s not much more I could have done, I nearly captured the top of the small move I was playing for. Had I decided this was a longer-term trade there would have been more to be capitalized on but my plan was to scalp and that’s what I executed on.

-Trade 1 Successes: I had a thorough plan, I waited for healthy confirmation, I held through some deliberation & trusted my levels, & I protected a healthy amount of paper profits. Overall, this is a trade I’m proud.

-The better trade would have been not much of a better trade to be had, based on what my plan going into the trade was. Capitalizing on the remaining upside to be had on a longer time frame that I could have anticipated based on the hourly Bull Flag that manifested the day before, but my plan had been to scalp, be in and out quickly and capitalize on 1 or 2 level breaks, & that’s it. I could have gotten in a bit earlier at the very moment my first level was broken but I’m still a bit timid when it comes to trading the open & I wanted to wait to see strength behind the move & see another level broken through. All in All, For what my plan was there’s not much more I could have done, nor a better trade I could have taken. I’m proud of this trade, the plan behind it, & it’s execution.

-Trade 1 Key Takeaways: Must develop a stronger stomach for fluctuations. Trust your levels & give trades time to work out. Hold your onyx stone during trade to keep your trigger happy exit finger preoccupied & keep yourself from exiting out of fear. I gave this trade time to work out, and part of it was not intentional, I was distracted watching other trades. I had I been just watching this it’s likely I would’ve paper handed it & gotten out much earlier than I did. but I would only ever just glance at it, see it was still above my levels & then look away & let it work out. I need bring this type of execution to my trades more consciously, I need to develop the stomach for fluctuations. I am slowly but surely doing so but it must remain top of mind so that It’s a skill I cultivate with meaningful intent. |

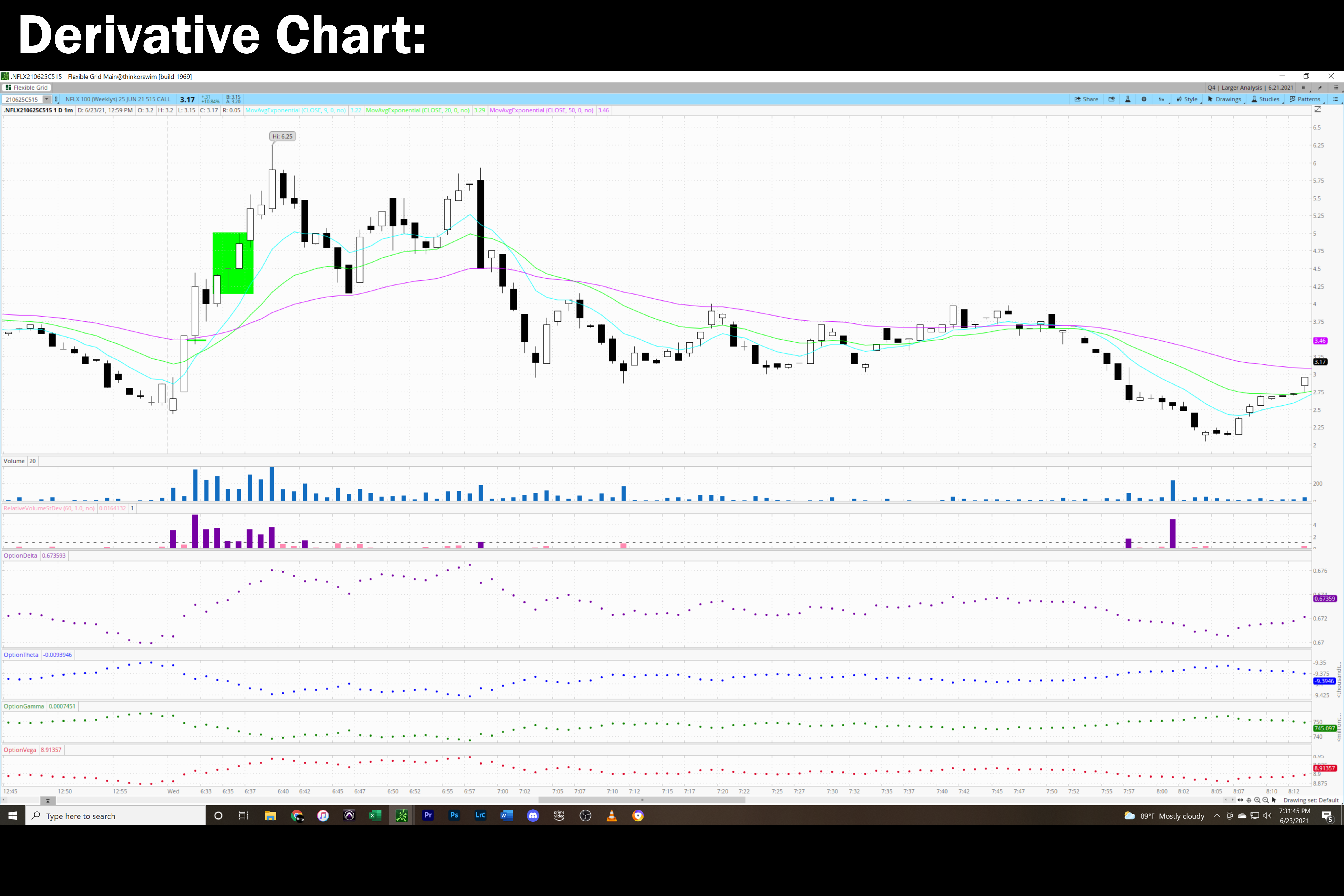

Trade 2 (NFLX | $0.70 | 0.2%):

-Entered Because NFLX Surged through key 510 level & QQQ had massive surge up as well—pushing into all-time highs I believe. On these surges & level breaks as confirmation I entered

-Exited because Out of fear of losing paper gains. Got pillaged by slippage. I Placed what I thought was protective stop at 3.85, but was filled at 3.5. Need to reconsider these ‘protective’ stops, it seems downside flushes often skewer premium & I get caught holding slippage bag.

-Trade 2 Mistakes: Did not give the trade time to work out. did not trust levels, Fear of fluctuations & paper hands. placing a protective stop instead of letting price action work out. Fear of losing paper gains.

-Trade 2 Successes: Executed decisively had multiple confirmations, went with the trend (attempted to) Protected profits. |

-The better trade would have been just holding on. just letting the trade work out and holding tight while things played out. Time moves slower, I feel tense, which is likely a reflection that I’m still not quite comfortable with this size of trade which I am slowly getting used to. seconds feel like minutes of agony & I tapped out. I was punished by slippage. | Hold your onyx stone during trade to keep your trigger happy exit finger from exiting out of fear.

-Trade 2 Key Takeaways: Must follow your game plan on EXITS as well as ENTRIES. exercise patience & resolve trades time to work out, and trusting your levels Must adhere to plan of letting candles close. Protecting profits is a healthy practice and you have done well in doing so but you must begin to exercise patience & resolve in following your plans to the letter, giving trades time to work out, and trusting your levels |(edited)

Trade 3 (NFLX | $83.70 | 20.17%):

-Entered Because I had multiple confirmations. NFLX Broke my next level of 512 after a brief consolidation, the trend was up and there was a healthy gap between my entry & the next level

-Exited because NFLX broke through my level & was approaching the next significant supply level of 515. I was up well enough on the trade & wanted to protect profits, so I placed a stop just above the 515-level hoping that a surge would hit it once IV was factored in. This was different than the strategy I usually employ of just having a trailing stop follow the price up. It worked out well enough for me on this occasion even though I did leave some upside on the table after my exit.

-Trade 3 Mistakes: I could have let the trade run a bit more & gave it more time to react to my next level, but I wanted to protect profits and walk away green for the day.

-Trade 3 Successes: I entered decisively with multiple confirmations, & I protected my profits to walk away green. |

-The better trade would have been holding a bit longer & waiting to see what the reaction would have been at my next level, but, hindsight is 20 / 20 & given my goal of ending green on the day and not having any certainty on what exactly was going to happen & having seen the indices beginning to show signs of weakness, I’m glad I got out when I did even though I missed out on considerable upside with the next pump up |

-Trade 3 Key Takeaways: Trust your levels & play in between them. Give trade time to work out & candles to close near your levels. |

End of session notes & overview (6:43:35 am): FOMO is indefinitely inbound. very well likely that I’m going to have missed significant upside of moves but I’m in a place where I want to stop while I’m ahead and continue a win streak as long as I can to begin to bolster more confidence in my own capacities as a technician and a trader. I was not willing to let what is my biggest day day trading devolve into a loss even if it’s at the expense of significant upside. I am willing to walk away, do my due diligence that I believe has led me to this success I’ve had, and then come back again fresh tomorrow. 6:43:35.

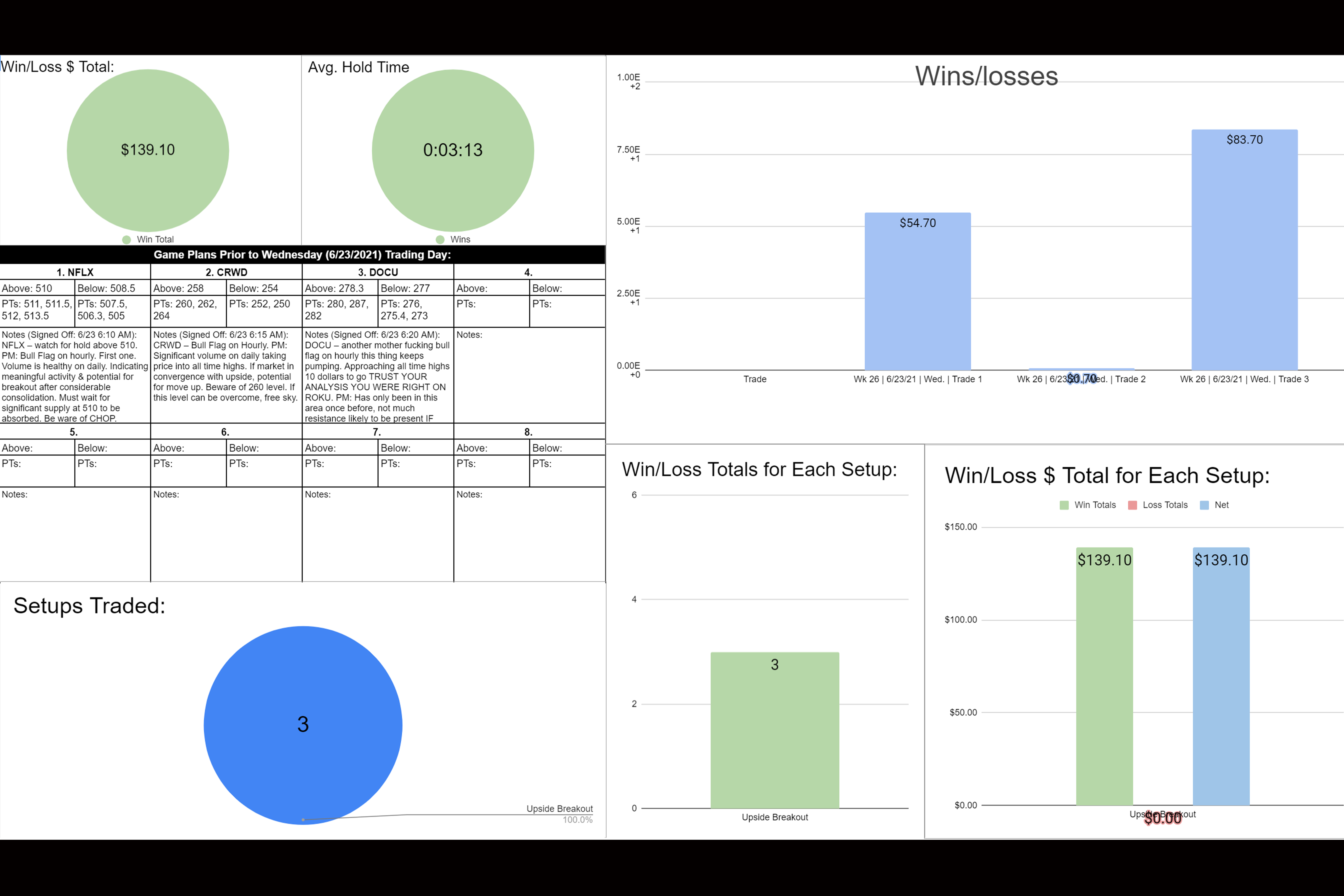

6.23.2021 Statistics:

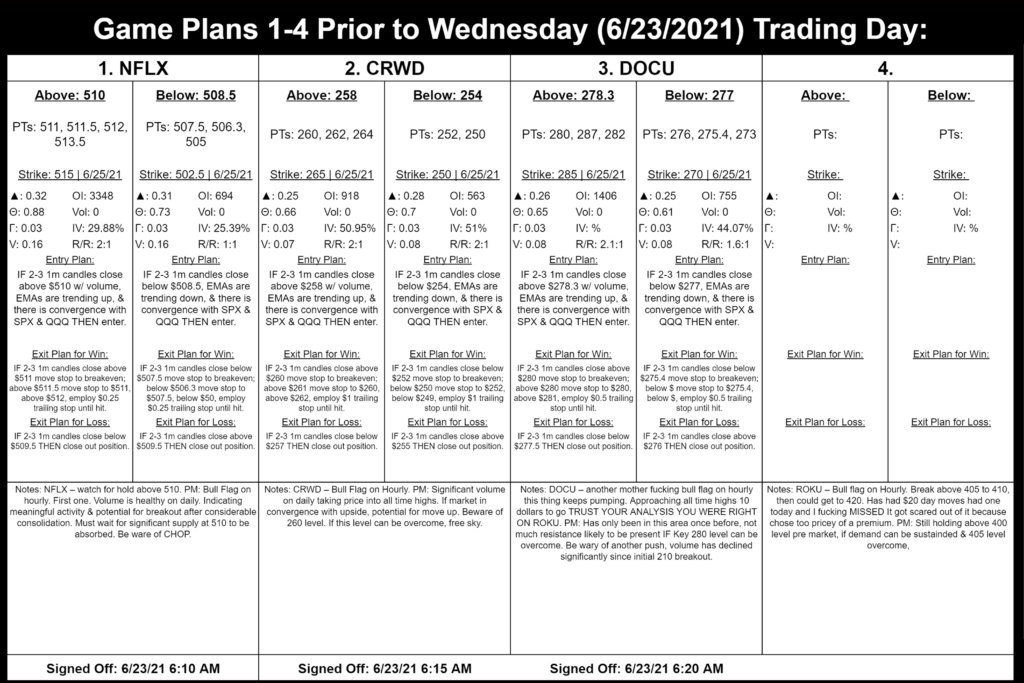

6.23.2021 Game Plan: