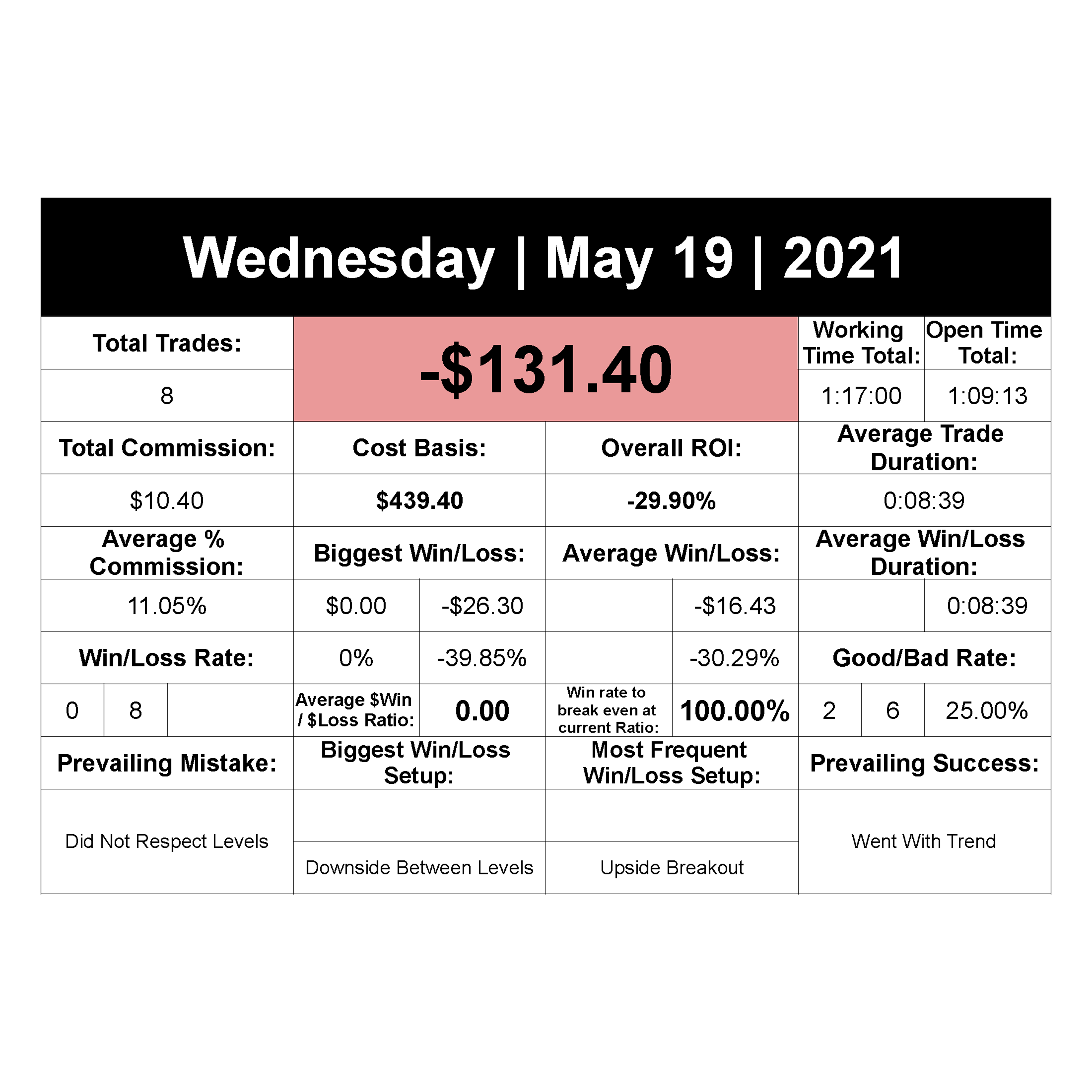

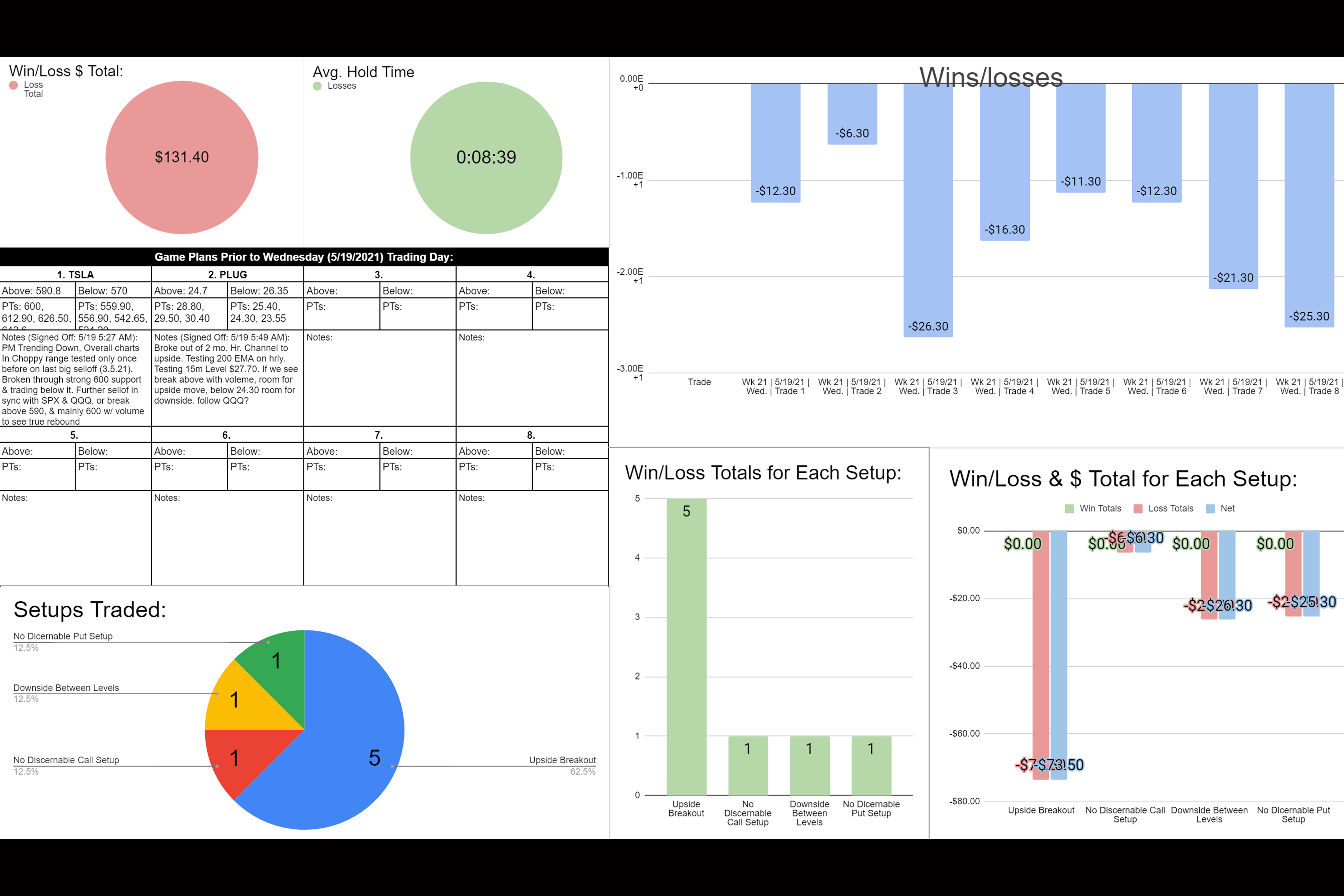

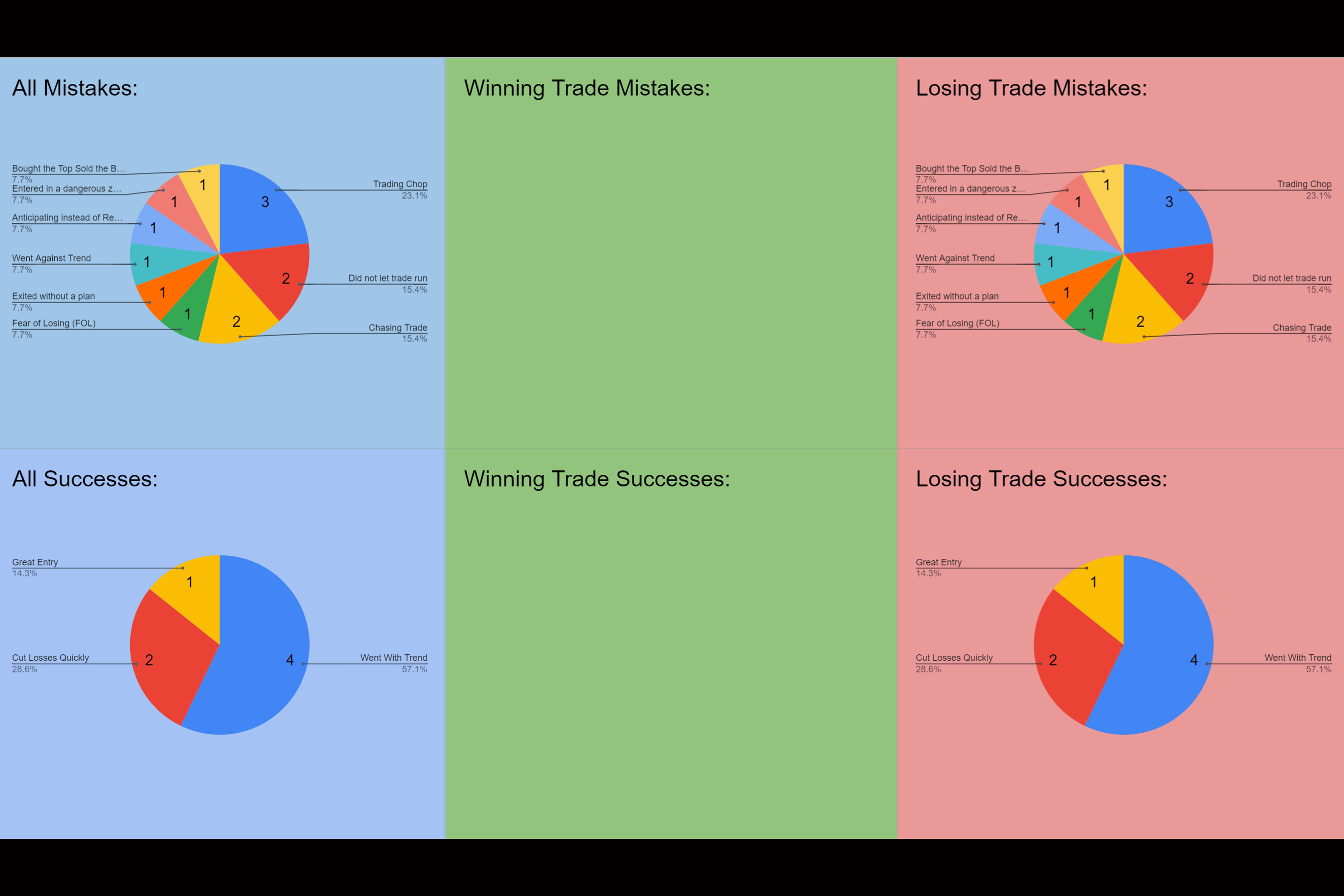

5.19.2021 Overview:

Trade performance today was abysmal and, frankly, embarrassing to share. But I’m committed to doing so because I want to be transparent & thorough in review of my performance.

Yesterday was my second day trading options on stocks other than Apple. I failed to trade based on underlying stock price action and took quite a few losses because I’d set a limit stop loss on the options based on how much I wanted to lose, not based on how the underlying instrument moved. If I’m not comfortable with the swings in the option based on the underlying support/resistance targets, then I shouldn’t trade it. I also could have saved myself from some of the pain of yesterday had I waited for stronger confirmation on the issues I was trading, and not entered choppy situations. No need to read all of the below but I want it posted for posterity. Losses inbound:

Trade 1 (FB | -$12.30):

Entered Because I thought there was a flag, was with trend, wanted to be in for move.

Exited because my stop limit was hit on option.

Mistakes: Should have traded more based on underlying levels, support was not tested or broken, had I held, could have been payoff, as stock did continue moving in direction of trade

Successes: Went with trend, took the loss, but this is proving to be costly, but did go with trend, had thesis and entered. |

Trade 2 (MARA | -$6.30):

Entered on excitement of the push to the upside & price crossing above both the 9 & 20 emas on 1 and 5 min chart.

Exited because my stop loss was hit on the option and the price action on the underlying had a dip.

Mistakes: This was another case of maybe giving the stock more time to work out, and respecting underlying levels rather than just strict option stop losses. I had no reason for WHY I put the stop loss where I did other than I didn’t want to lose more than that prescribed amount on the trade, but because of this logic ended up losing a lot more over course of day applying this tactic to other issues.

Successes: While I did cut losses well enough that’s turning into a problem, cutting losses is good if they are cut the RIGHT WAY, in this case there were no planned underlying factors justifying the exit. |

Trade 3 (TSLA | -$26.30):

Entered Because saw qqq & spy holding below ema’s and seemingly flushing downwards, thought tsla was bearish given ema’s & PA.

Exited because got spooked out by massive green spike that caused 1m ema’s to cross over in direction opposite of my trade, qqq also reversed from red to green on me.

Mistakes: Should have respected the levels I’d charted earlier; I went with the trend well enough, but it must be in conjunction with my levels as well. Overall, however, this was a choppy issue to be trading, would have been better off staying out of it to preserve capital. also, should have noted that SPX & QQQ were at levels and had not closed below them on the 5 min chart, particularly strong levels on SPX

Successes: Entered well enough, had ema confirmation, although it was weak. |

Trade 4 (TSLA | -$16.30):

Entered Because Turned around trying to catch reversal based on massive green 1m candle that shook me out on puts. also used 9, 20, & 50 emas having crossed as justification to go long as well as now green qqq & spx.

Exited because Faked out. exited because stop loss on option was hit.

Mistakes: Just getting whipped around, one, should not be trading chop like this at all, and should not be chasing trades, should be a little more thorough with criteria for entry, make plan based on levels AND trend. but trading chop like this also grinded away my capital.

Successes: This was a poor, emotional trade, thought I just needed to get on other side of stock based on last loss but got whipped around instead & burned money. |

Trade 5 (PLUG | -$11.30):

Entered Because Broke and held above level id’ charted earlier, emas were in my favor.

Exited because my mother FUCKING stop loss was too tight and not based on any underlying levels, only based on arbitrary amount I was willing to lose, which haunted me, as not long after my exit the stock continued it’s propulsion upwards and I’d have been able to walk away with a decent profit had I given the issue time to work out.

Mistakes: Stops too tight and not based on underlying instrument. Should have had exit based more on levels of underlying not based on arbitrary pain threshold dollar amount.

Successes: Great entry, break of a level and confirmed with ema trend. |

Trade 6 (WMT | -$12.30):

Entered Because I saw the stock skyrocketing and I wanted in. Not a good reason. Chased.

Exited because my stop loss was hit on option, this time it worked out well enough in my favor, as premium plummeted later on.

Mistakes: Chasing trade, got hyped on price action, and rationalized it with some dumb excuse like ‘tech stocks are suffering so retail stocks will be strong.

Successes: went with trend well enough but was late and chased this. |

Trade 7 (WMT | -$21.30):

Entered Because I was emotional & dumb, also revenge trading, thought that I was going to miss another surge up. FOMO

Exited because Stop loss was hit.

Mistakes: many emotional mistakes. FOMO, Chasing Trade

Successes: None on this one. got out quickly enough.

Trade 8 (TSLA | -$25.30):

Entered Because Thought tesla was going to dump, but this was a classic mistake of anticipating instead of reacting. My thesis might have been good enough, but I did not wait for confirmation.

Exited because Got out because my stop loss was hit, an arbitrary stop loss value not based on the underlying, but this time it worked out in my favor.

Mistakes: Anticipating instead of reacting.

Successes: cut losses quickly.

5.19.2021 Statistics: