First day back in Drip office. Only potential red flag is I was unable to get a full 8 hours of sleep last night. I clocked in a solid 6, likely because I consumed coffee too late in the afternoon. I’ve since created a new designation in the scythe app to illustrate nights of sleep following consumption of coffee after 12pm: the sleep coloration will be light yellow. Other than this, I feel relatively calm & am centering myself in the mental framework that my activity in the market is a form of creation; my choices are the ingredients for the outcome that I create and I must be conscious in deploying them in such a way that the outcome I want to create is most likely. That being said, I need to take a shit, and I believe that being proactive in clearing my bowels is a choice that will facilitate augmented focus necessary to make well timed market choices. Back. Exercise intent & self control. The test will be to make conscious creative choices even when you’re behind. Inaction is as much of a choice as action. Opening the market now.

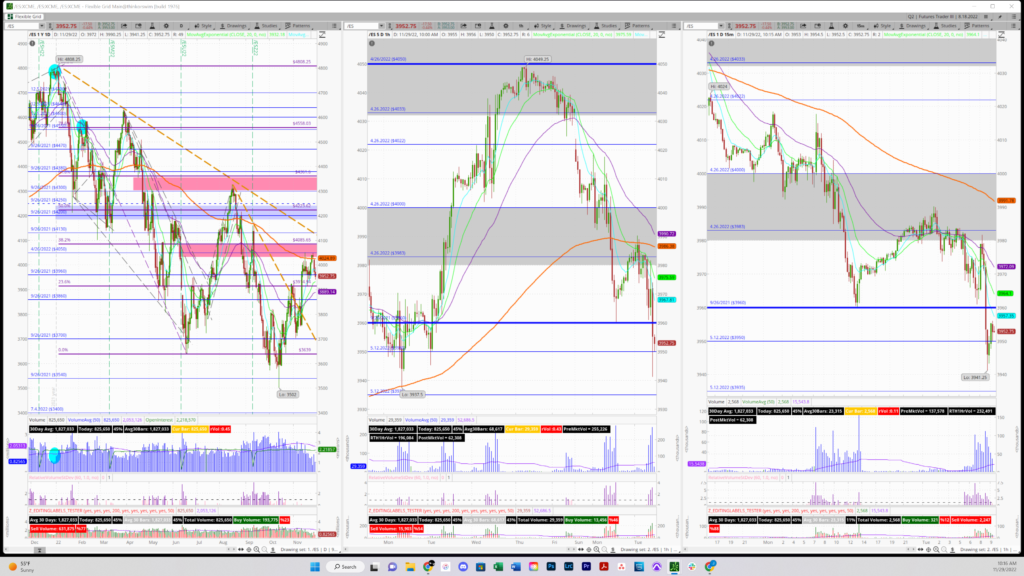

Pretty much immediately entered short. There was a considerable flush to the downside and a retracement back to an hourly level where the price was teetering right when I opened the platform. A good entry point, I took action. Now is to decide how long to hold this. Similar to yesterday there seems to be something of a flag forming, the measurement of which would suggest considerable more downside. We’re hovering around 3950 now and if this is a true flag , it could dump to 3930. I wouldn’t and should not count on the full movement playing out, but it’s not unreasonable to expect at least 3940.

Taken out for a loss of $200. I had my stop in a healthy enough place, though now the price is retracing from it of course. If there is another course of action I do not yet have conviction in it, and should wait to develop some kind of thesis before entering. My impulse was to just get in going the opposite direction, but I need to curb that impulse and wait. the market is not going anywhere and there is still yet opportunity.

Chased when I shouldn’t have, the lure of the action was too much, I need a better tolerance. Then entered again when it moved back down. Stopping now with a considerable loss, the bulk of which coming from my first trade. It’s proving to be more & more of the case that I need to go for smaller wins and have 1:1 risk to reward. I need to be shooting for 100-150 at most. So far every win that has been larger than that has sewed the seeds for greater losses the next day, or shortly thereafter. I am not in a position to be able to hold against adverse price movement. I must beware areas below and above daily levels. How many times must the story play out for me to learn the lesson. There is likely considerable demand in the space below daily levels. If there is an initial break and flush that’s one thing to be capitalized on, but the demand below them is great. I’m tempted to get back in, it seems price may finally go in my favor, but again, I’m just being taunted by the price action and should cut my losses now while they’re reasonably manageable.

I’ve entered again, tick was going down, the trend line seems to be breaking, the add is trending down. my stop is at break even. Likely going to get taken out, but if a wave of selling persists, this may be the continuation I was looking for.

Got back in. Looking at phone saw rejection form daily level back down 10 points. Got in short expecting break of 50, rebound. Got in again, internet was going out, exited trade to be safe. Another loss. Poor trading. Creating an outcome of a loss.