Feeling refreshed enough. Don’t want to overthink too much. Had what may be helpful revelation over the last few days in building out scythe app: to conceptualizing trading as an activity of creation, to enter with purpose and intent with the realization that my engagement with the market is a form of creation: creation of profit or of loss. This perspective may not hold and may not be useful but for the time being, because of the focus it begs on my action, it may be worth exploring. You are actively creating an outcome, your choices are the building blocks of the creation of an outcome. If you can align your choices wisely, you can shape the result of the creation. Inaction is a choice as much as action, and it is your responsibility to make the choices that align with the vision you’re looking to create. Opening the platform now.

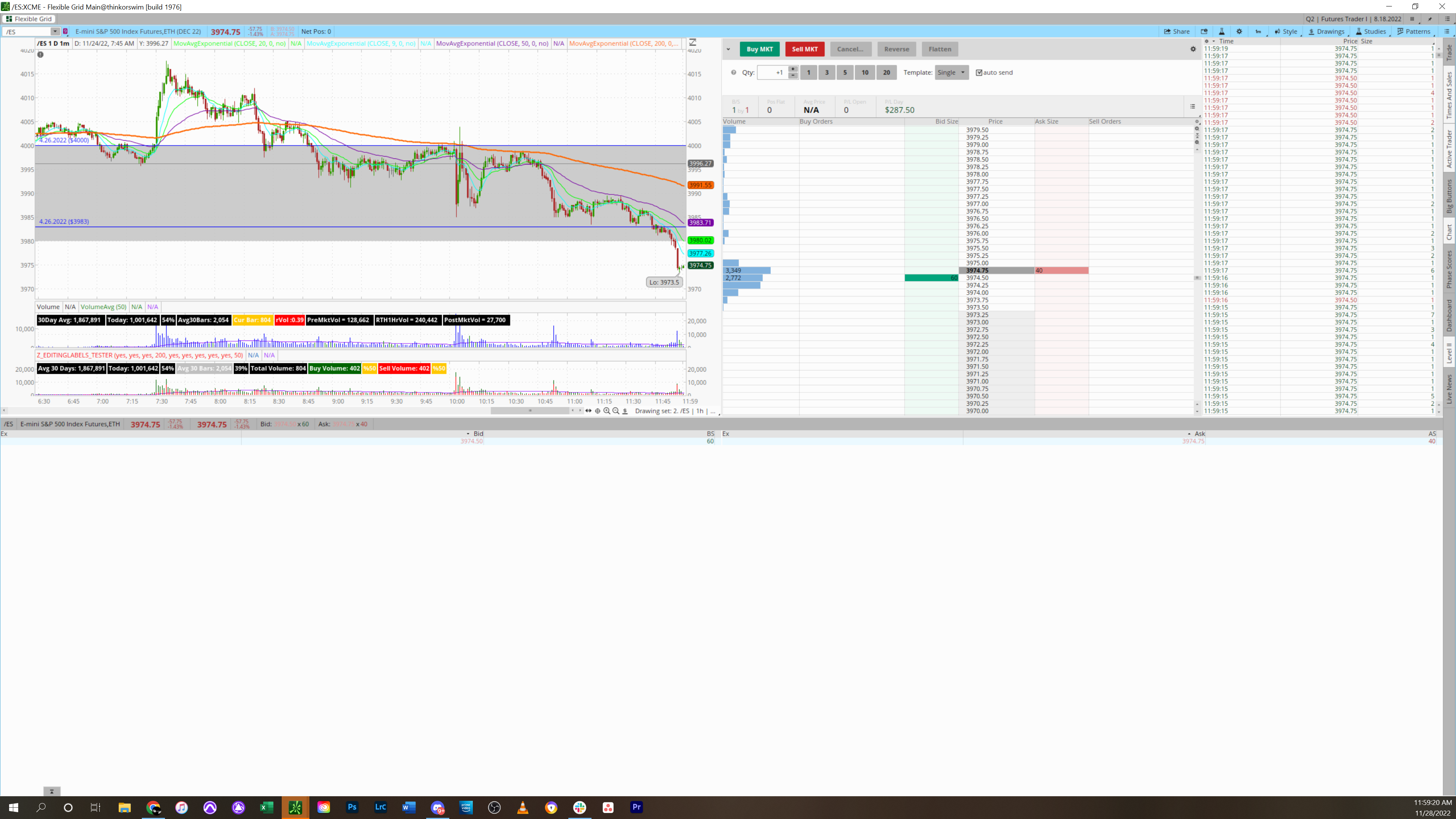

A steep selloff just took place and rebounded from 3983 level, the pattern looks like the selloff could continue but it’s not abundantly clear as the price already rebounded once from this level. Inaction is likely the best choice at this juncture. Price continued to exhibit weakness, in short now. I may be asking for too much, once again stepping outside the goal of crumbs is seeming to hurt me. If I end up winning on this trade it will have been with much anxiety, and more risk than I should be putting on at this juncture. Had I been aiming for crumbs I would have been rewarded by now. Still in but moved stop up. Everything seems to be reasonably favorable. ADD is down trending, pattern is bearish, Tick is now currently bearish. I’ve placed my stop below the level (3983) which may be a mistake, but the measuring of the pattern calls for a move below it at least a point or two. This may be my folly again: asking for too much. Had my original stop at 3983.25 which now would have been taken out, but moved it. and am now waiting in agony as price rocked back up again. Is this the sign of an institutional buyer accumulating a position. there are massive volume spikes every time the price approaches this 3983 level, then it recedes back down to it. I’ve placed my stop at 3981.25 and will not move it again. This is a reflection of my analysis, my conviction, and a price to justify the original risk of the trade. I could have it at 3983, but seeing the price action now, it seems that if it touches that level, it’s bound to go below it, so I may as well stick to my guns with what I’m seeing. My stop is at 3988.25 now, moved down from 3990.25 as the price action has trailed below, so if the price bounces completely against me I’ll be taken out for a small loss. 3983 was touched, now it seems folly, risking profits for an extra meager $75 but my thesis is standing and I’m holding to my commitment here, only thing I might do is move my stop loss to break even.

Price target reached. Logging the fuck off, cannot stand to see price go lower. Walking away with reasonable profits. Thesis played out well enough for me to walk away.

It seems, for now, I have been rewarded for my mindset of ‘Creation’, however it will necessitate stringent discipline to remember it, and employ it, at all times. You must employ it when things are bad for you as well as good. Your choices are the tools of creation & you must align them with the outcome you desire to create.

Logging back into the platform for screenshots of the charts, nothing more. Will likely see price having gone far beyond my target just to taunt me. Will see.

Sure enough, a significant dump as large as my profit did manifest just after I exited. I took my profits and left. I stuck to my choices, I took what I came for which was already more than what crumbs I usually gun for, and I took what was within a safe realm of the possibility for the measuring pattern I’d identified. This is good enough and a choice that for this juncture aligns with the trajectory I want to set myself on: slowly & steadily upwards.