Currently have a cold, but am well rested and at home. Only frustrating thing is the small rush I’m in, I’m supposed to have a meeting in 20 minutes. I am willing to open the market, but recognize it may be folly to try and force something in this time frame, but given the small moves I generally look for it is not entirely unreasonable. I am back from Denver, from what was initially a stressful trip of anxiety, however, I mostly resolved the anxiety & feel more comfortable in my station than before I went, thanks to my own pilfering of information & discovery. I am opening the platform now. I am here to take crumbs, small slivers of any potential momentum. 2-3 points is all I’m aiming for. I am coming for crumbs. Going to take a shit first. Opening the platform now.

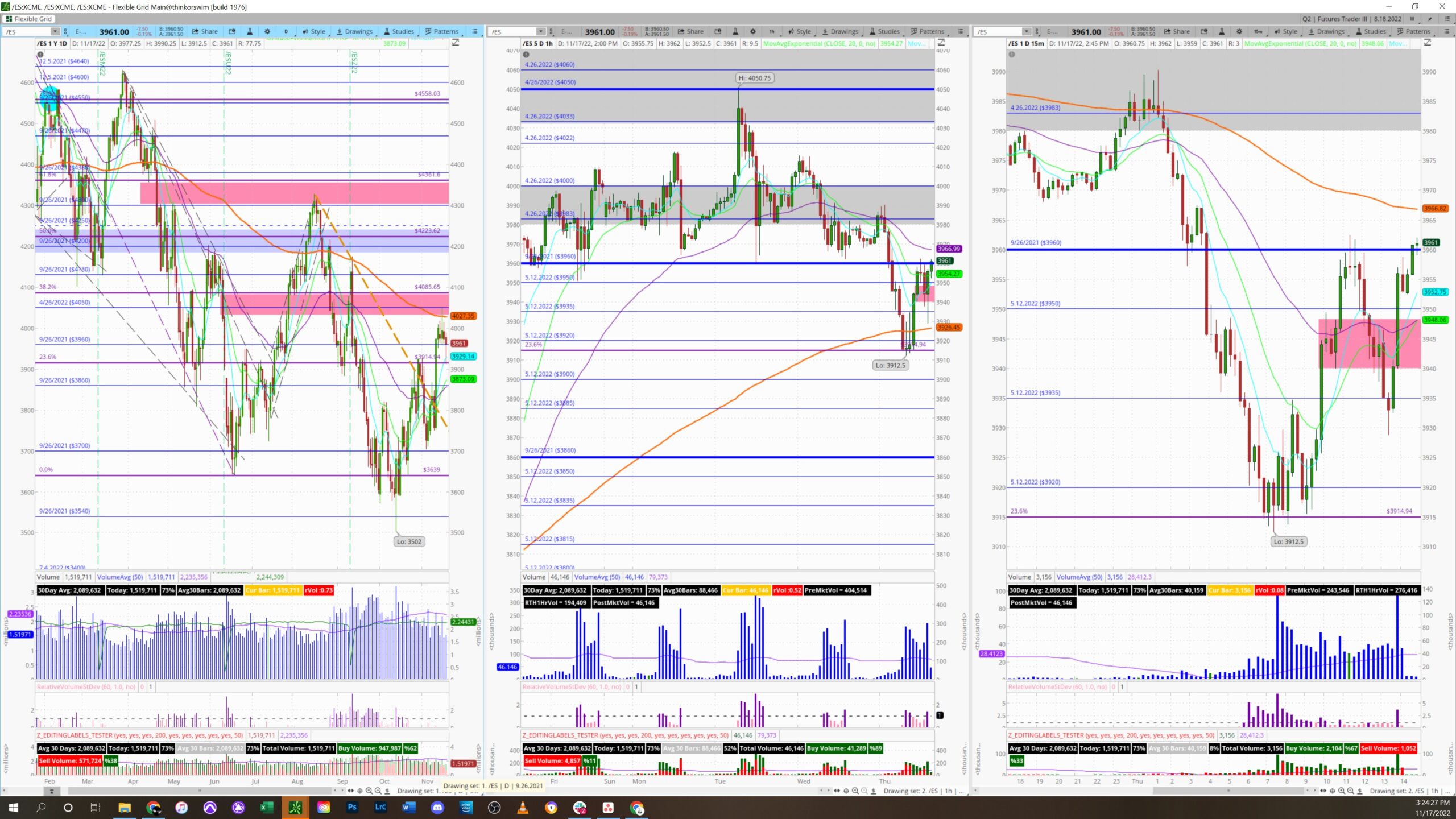

Things worked out. I saw what looked to be bearish price action beneath an hourly (3950) level, and approaching a $5 level of 3945. It was near a congestion zone but was continuing to act bearish. I entered short 1 contract. My thesis was that there looked to be basically a head & shoulders pattern on the 5 min & 15 minute, and at the very least a smallish bear flag. I initially had my stop at 3940, but after seeing the clarity of the pattern and wanting to test my own analysis and conviction I moved the stop lower. I was tested in my resolve as my initial stop was quickly reached, but having moved my stop, I didn’t get taken out. Price bounced back up and continued fluctuating. I resolved that if price reached up to 3950, then my thesis would be invalidated and I would take myself out. The congestion played out for the next 20-30 minutes, I had meetings and let the price action run while I was in them. Then the price dropped, I placed my stop not at the full measure of where the H&S implied it would run (which would have been 3920: height from bottom of shoulder to top of head was 20pts) but at the nearest hourly level of 3935. Price broke and took me out. My largest trade of the month.

I resolved to risk a little more on this trade because of the cushion I’ve built up this month, but I must be wary of my own flexibility and what the motivation behind it is. I told myself that my motivation behind this change in plan was that the price action seemed to be abundantly clear for a move in my direction of a greater size than my initial crumbs goal and so I listened to my analysis. I was rewarded for it but I must not over index my own capacity for analysis. There is a delicate balance to be struck between confidence & caution. I did well in striking that balance today, with a reasonable thesis & defined risk. This was a good trade.