Key Takeaways | 9.7.2021 | Tuesday

- You must wait for CONFIRMATIONS for EXITS as well as ENTRIES. If there is no strong technical reason to sell, do not sell.

- You must add Day Trades to your repertoire along with Scalping & execute accordingly

- A good losing trade is one taken with proper confirmations.

- Adjust to idiosyncrasies of the 5m chart.

- Trust your levels & technical analysis.

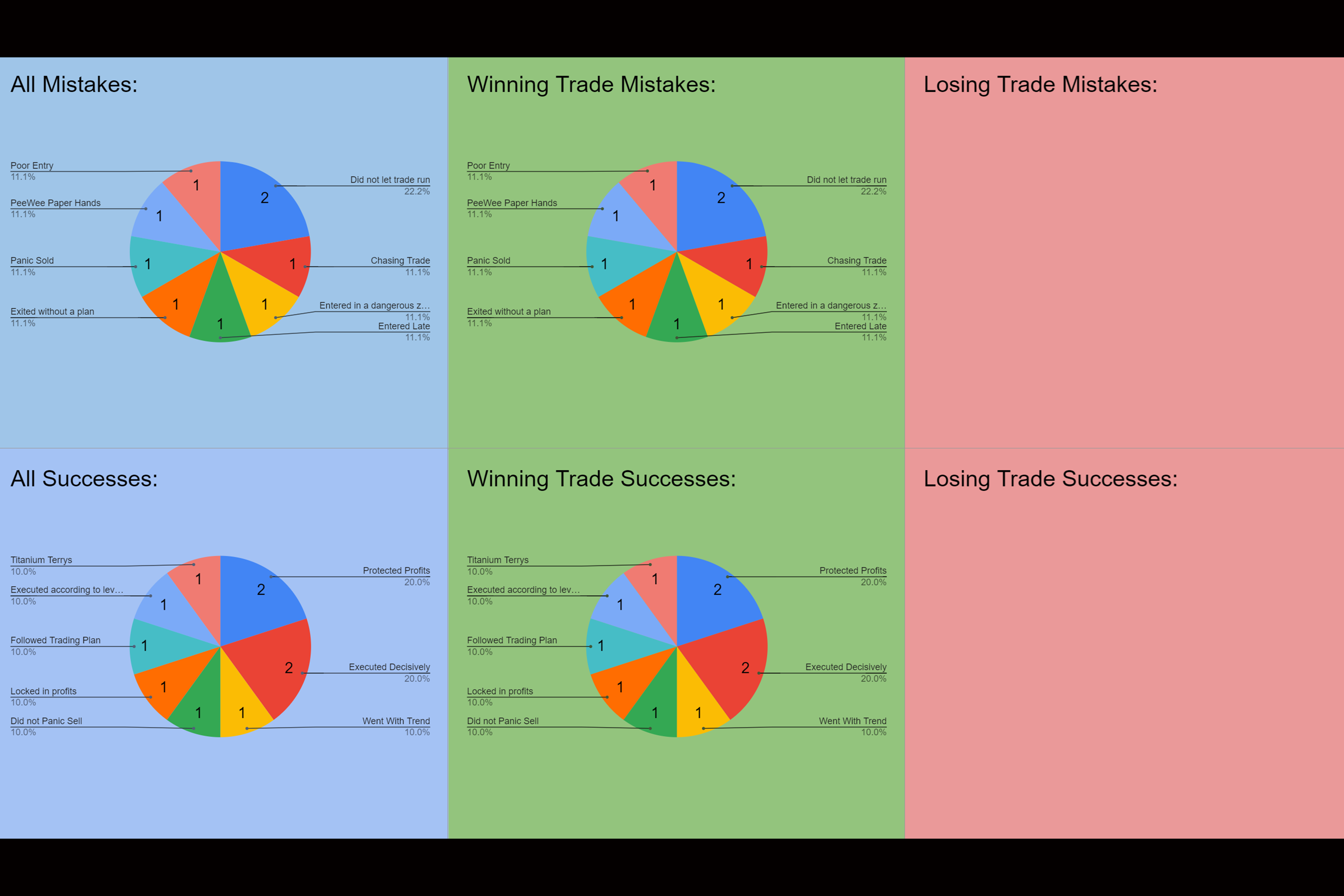

Mistakes | 9.7.2021 | Tuesday

- Peewee Paperhands

- Exited Trades without Technical Confirmations.

- Did not have faith in Levels & analysis

- Improper Trade Style. Scalped when I should have Day Traded

- Entered Late

- Chasing Trade

Successes | 9.7.2021 | Tuesday

- Good Entries

- In the right trades. Went with the trend of the issues & the overall market

- Executed decisively according to plans with multiple confirmations.

- Protected Profits

- Looked to larger time frames for confirmation & conviction in trade

- Titanium Terry

-Trade 1 (BA | $29.70 | 11.88%):

-Entered Because BA was pushing below planned 216 level with volume on 5m chart, EMAS were in favor & SPX was dumping

-Exited because Placed limit order near next 215 level and was taken out.

-Trade 1 Mistakes: Improper trade style. Should have day traded not scalped Given the strength of the dump in spy I could have held this longer, could have treated this as more of a day trade than a scalp, could have trusted the strength of the emas & held. Could have trusted that more than one level would have been taken out & held.

-Trade 1 Successes: I got in a reasonable trade according to my plan, with multiple confirmations and took profits at a level I’d planned. I had market convergence, I used the 5m chart & traded in the style I’d initially proposed |

-The better trade would have been holding this longer OR trading with more contracts and scaling out. This is what the best course of action would have been. Scalp high probability trades for the first leg, then take off size and let the 33% play out as more of a day trade. If you’re doing all the analysis, particularly on larger time frames & trading 5m, you should capitalize on larger moves. Overall solid enough trade while you build a cushion for the month & are continuing to refine SCALPING skill. DAY TRADING is next. |

-Trade 1 Key Takeaways: If there is no strong technical reason to sell, do not sell. You should wait for CONFIRMATIONS to SELL as well as to buy, & that is exemplified in this play. All indicators were confirming the strength of this move, but you did not capitalize on it to the fullest extent. Granted it was because your plan was to scalp so all in all you did the right thing, but this is insight for the future. Missed out on bulk of move, need to hold for longer, perhaps worth considering further out expirations. It may be time to switch to day trading not scalping. |

-Trade 2 (DOCU | $47.70 | 17.6%):

-Entered Because there was a Level break & multiple confirmations DOCU supply overwhelmed significant 308 demand level on 5m, pushed below, SPX & QQQ were both pushing down, EMAs were in favor on 5m.

-Exited because Placed limit order near next significant level, got taken out

-Trade 2 Mistakes: Entered Late, did not enter decisively you could have entered a bit sooner after the break of 308 and held a bit longer through the break of 304, you were deterred because it was a big level but For the plan of scalping this was well done,

-Trade 2 Successes: You had a plan, you had strong confirmations, you executed decisively on those confirmations and you took profits according to your plan to scalp |

-The better trade would have been a trade on a larger time horizon & different trade style i.e. Day Trade,. And holding until there was a strong technical reason to sell which there was none. This was the play of the day, and an incredible move retracing all of and more of the prior day’s gains, nearly $20 in the underlying. There was no strong technical indication the trend was reversing, on any of the time frames, so you could have been justified in holding. |

-Trade 2 Key Takeaways: Just as you need confirmation for entry, you must begin to necessitate CONFIRMATIONS for exiting trades as well. When an issue is showcasing strong price action you should let it run it’s course. This is a symptom of you trading small, only one contract, as the healthy way and the way I’d be comfortable addressing this issue would be to trade with multiple contracts, sclae out of 2/3 of the position and let the remaining run, so I’m locking in profits & then letting the price action determine the fate of the remaining contract |

-Trade 3 (TSLA | $10.70 | 3.92%):

-Entered Because Broke above 753 level I’d charted with strong momentum & referenced rama chat & she was bullish to 60.

-Exited because placed limit order below market price trailing up, when I saw deliberation at 755 level to protect any & all paper gains & protect green status on the day, limit order was hit.

-Trade 3 Mistakes: Peewee paper hand fuck. I was in a good trade with a solid entry & multiple confirmations. & got shaken out. Also, chasing trade. Nervous, this is first time trading tesla, & was affected by stigma that it is mercurial & difficult to trade. Need to act faster considering I’m trading with 5m now instead of 1m. was waiting for multiple candles subconsciously I think, when with 5 min, when scalping at least, this may be risking missing the move. Did not want to risk giving back any profits from the day & shook my self out of trade unnecessarily. May have fallen victim to slippage as limit was placed under where price was, but I forgot to screen record this morning, so I can’t verify. Also bit of a chase on this.

-Trade 3 Successes: Did not let winner become a loser, was vigilant about protecting downside & prior gains. But this is a manifestation of letting past trades affect current trades which is ultimately a mistake, although it protected my in this instance. I had a justified entry on a strong stock, was with the trend and whas in an appropriate contrack for my current tolerance level. |

-The better trade would have getting in earlier, at the first significant break of 745, trusting your levels there in, then holding on for longer and through the deliberation that took place. You ultimately did this in the trade after this, but you could have done it earlier. You could have referenced the 15m chart which would likely have allayed your fears. |

-Trade 3 Key Takeaways: Perhaps use the 1m for watching how price is reacting to EMAs, got scared off 5m seeing it so extended from EMAs. I’m too used to 1m which makes sense as it’s been the main time frame I’ve been watching for the last 8 months. need to adjust. |

-Trade 4 (TSLA | $101.70 | 32.08%):

-Entered Because TSLA was beginning to spike up again, was above key level, looked flaggish on the 15 min.

-Exited because had limit order placed just below next significant level & was taken out while I was away from computer

-Trade 4 Mistakes: The entry was poor; in that I was chasing the surge I saw. Should have planned for this to be a day trade earlier in the process but considering this is the beginning of my trading with 5m and even considering more of a day trading style, this was a decent foray & was fortunately rewarded with profit.

-Trade 4 Successes: Titanium terry. I trusted the analysis and the levels and I let the trade work itself out, even though it was uncomfortable. |

-The better trade would have been getting in earlier in the development of the level break of 740 and holding onto this trade to juice it for more of what it was worth. I should have recognized flag behavior on daily. perhaps flags should only be qualified on daily. |

-Trade 4 Key Takeaways: You must be willing to lose. You must give trades time to work out, and you must TRUST YOUR LEVELS. The risk to reward becomes astronomically greater when you give trades time to develop. You are doing your analysis of the stocks on larger time frames yet not letting the action play out on larger time frames. You must adjust. Held this, had a limit order set and was taken out while away from computer. Giving trades time to work out. Trading levels, and being willing to lose. Being willing to lose to let the technical play out. |

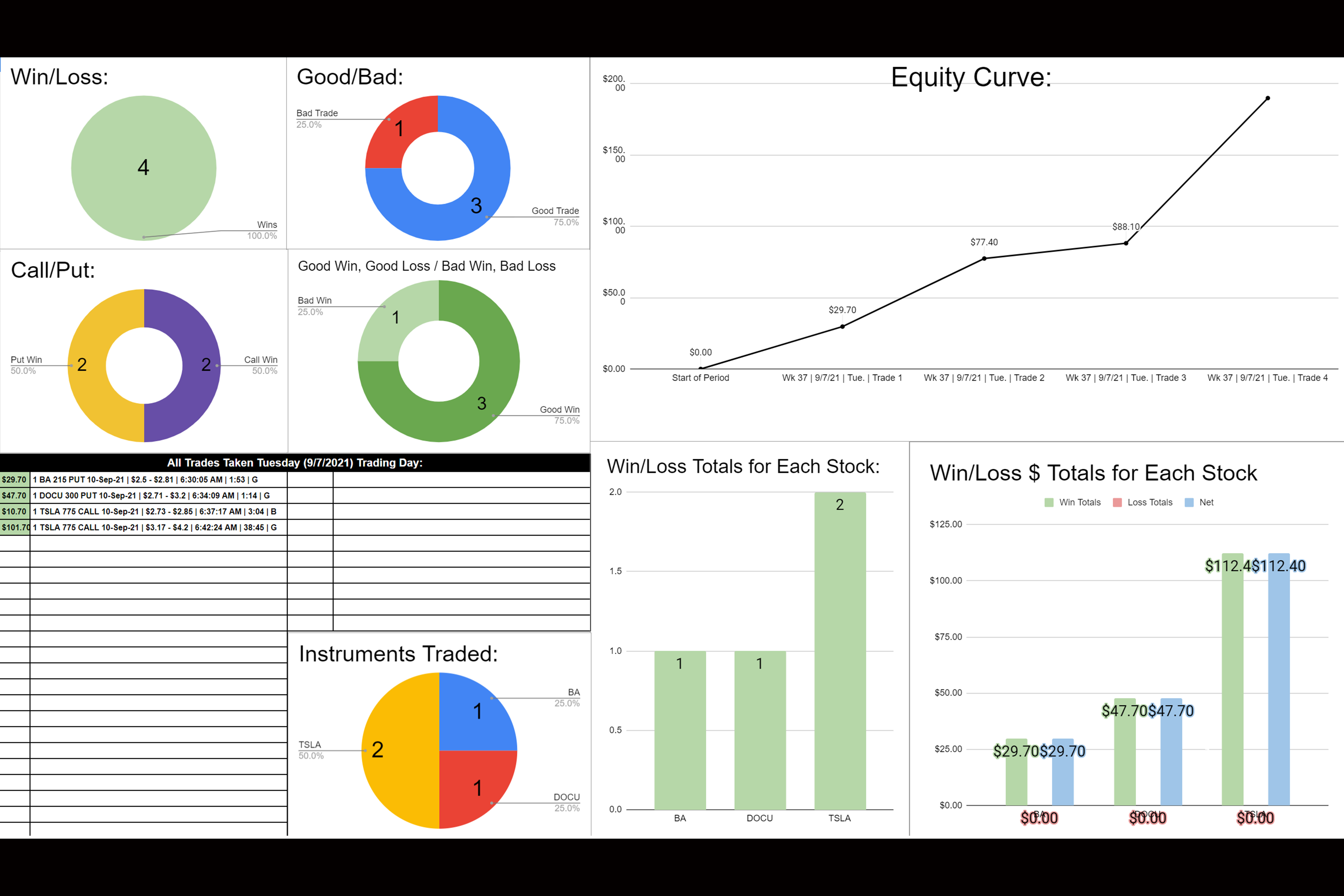

9.7.2021 Statistics:

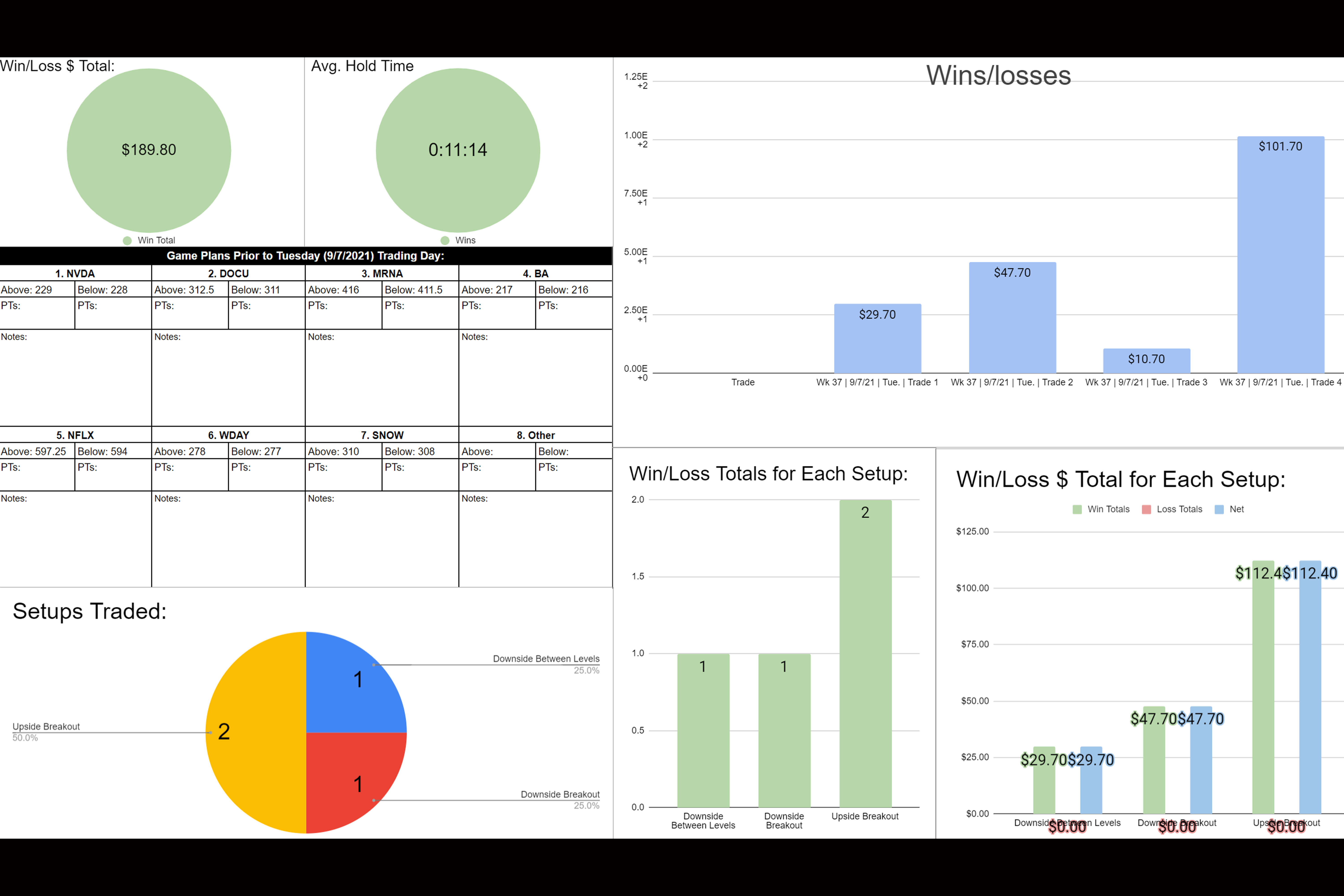

9.7.2021 Game Plans: