Key Takeaways | 7.21.2021 | Wednesday

- Consider practicing trading on larger time frames

- Exercise patience waiting for moves to manifest. Moves don’t always happen right at the open

Mistakes | 7.21.2021 | Wednesday

- Did not protect >50% profit

- Let another trade affect my perspective on current trade

Successes | 7.21.2021 | Wednesday

- Had faith in & executed off of my levels

- Protected profits

- Made & followed game plans

Activity Log | 7.21.2021 | Wed. | 2.72 hrs

- Traded: 6.21.2021

- Charted

- Game Planned: 6.21.2021

- Studied: ITU Discord

Charting & Trade prep in the morning, then traded. Followed up trading with beginning to compile screenshots of trade day. Spent a bit of time on discord listening to JR talk, but it was ruined by the fucking neandertal idiot fucks posturing as real traders continuing to talk over JR.

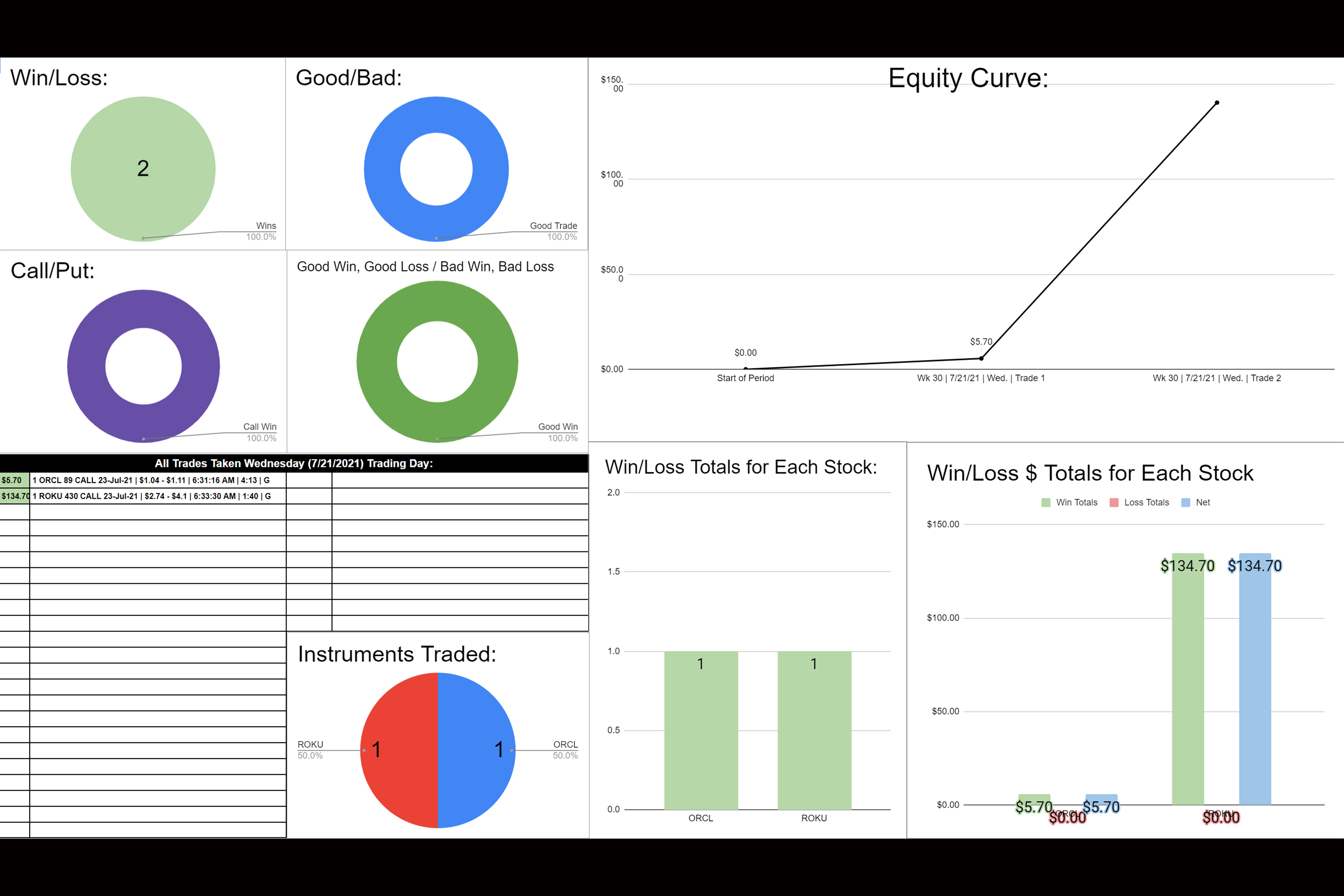

Trade 1 (ORCL | $5.70 | 5.48%):

–Entered Because Price pushed above my level & there was convergence with QQQ & SPY.

–Exited because I had closed out another profitable trade (ROKU) & ORCL was deliberating. Wanted to lock in profits & remain green on the day without giving anything back. Set limit order & was hit.

–Trade 1 Mistakes: I could have closed out the position a bit higher. Did not protect >50% Profits

–Trade 1 Successes: Protected profits well enough and ended on a high note. I did not hold and hope. I took the profits to cement my green status on the day.

–The better trade would have been one on a longer timeline with a further out expiration, but as this was not the plan going into the trade, I can’t qualify it as a better option. I could have closed out the trade at a higher point, anticipating that it might not move straight to my next target, and in doing so captured more of the move.

–Trade 1 Key Takeaways: Trading on a larger time frame with further out expirations would have yielded greater results. Your analysis was on point for larger time frames (1hr. See game plan), and you capitalized on momentum within—and in the direction of—those larger tides.

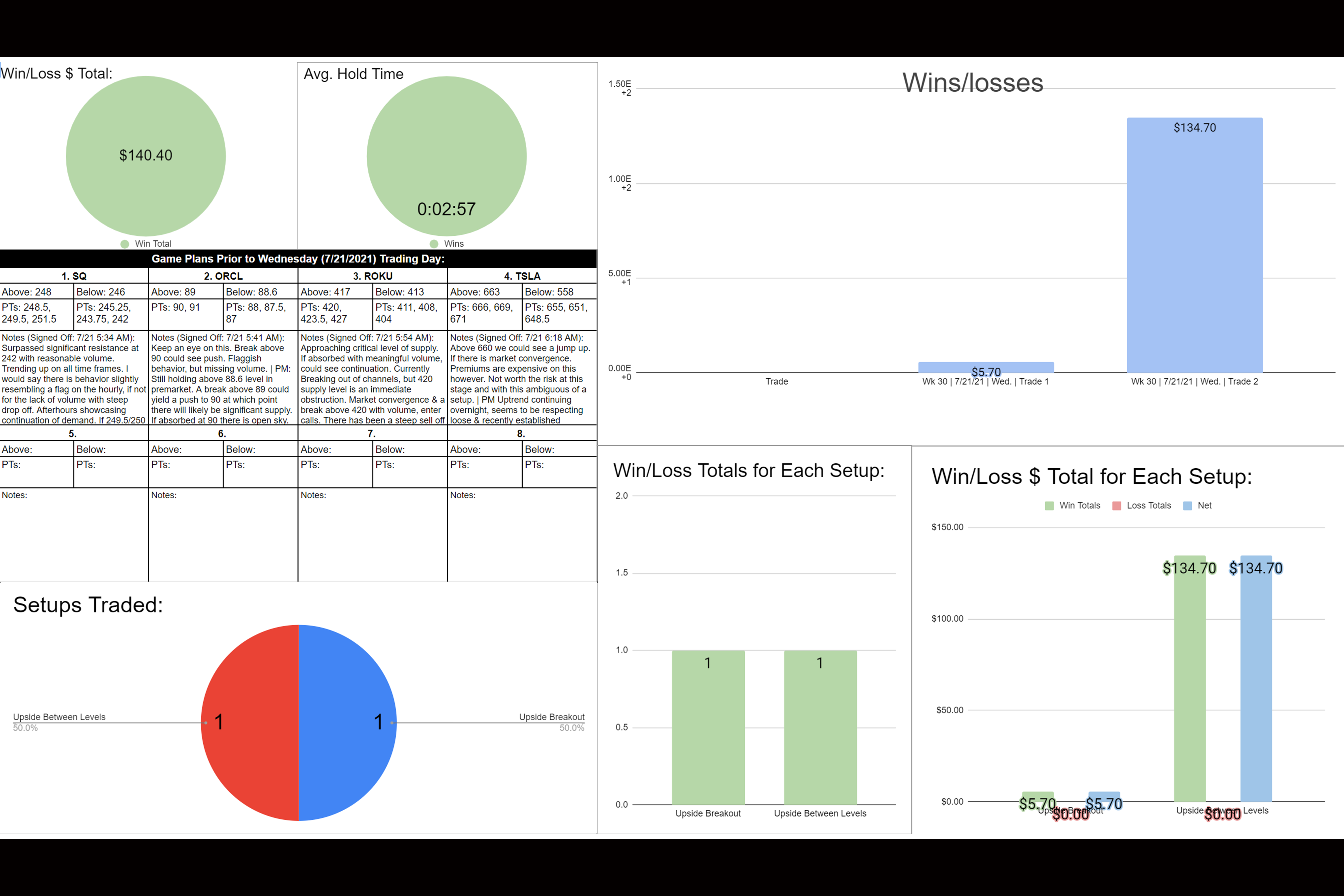

Trade 2 (ROKU | $134.70 | 49.16%):

–Entered Because price broke above 417 level I’d charted with significant volume on 1m, QQQ & SPX were between level ranges and pushing up, saw massive volume on ROKU candle & executed immediately.

–Exited because massive supply level was imminent at 420, my game plan had been to scalp and I was up well enough. I did not want to hold through potential deliberation at supply level given that the plan for this trade was to be a scalp between levels. I placed limit order around the 420 level and waited for fill.

-Trade 2 Mistakes: This was a beautiful trade. I’m happy with this trade. Trading on longer time frames would have yielded greater results, but again that was not the plan going into the trade. It is however, a meaningful insight to consider stepping into the future: Consider trading on larger time frames.

–Trade 2 Successes: Executed decisively, had a plan & stuck to the plan, had faith in & followed my levels. This may be my best trade to date. I went in knowing I was going to scalp, knowing my levels & criteria, following the trend, protecting my profits, and exiting gracefully. If I trade like this every trade, I will be alright.

–The better trade would have been: there was a bit more upside to be had on the contract, but I capitalized on the bulk of the short move. I could have gotten in at the break of the earlier 415 level, but the more secure confirmations came at my entry.

-Trade 2 Key Takeaways: beautiful trade for what your game plan was, which was a quick scalp. Other than that, same takeaway as trade above: Trading on a larger time frame with further out expirations would have yielded greater results. Your analysis was on for larger time frames, and you capitalized on momentum within those larger tides. As you continue to improve, consider taking on trades on larger time frames, which you are already doing Technical Analysis on.

7.21.2021 Statistics:

7.21.2021 Game Plan: