Watching Paul Volcker Ray Dalio Video, at 22:08, Dalio says Volcker’s tightening in 1980 caused the greatest downturn since the great depression, but the charts don’t reflect this. There was only a 24% downturn. There was a 50% downturn in 1973-1974

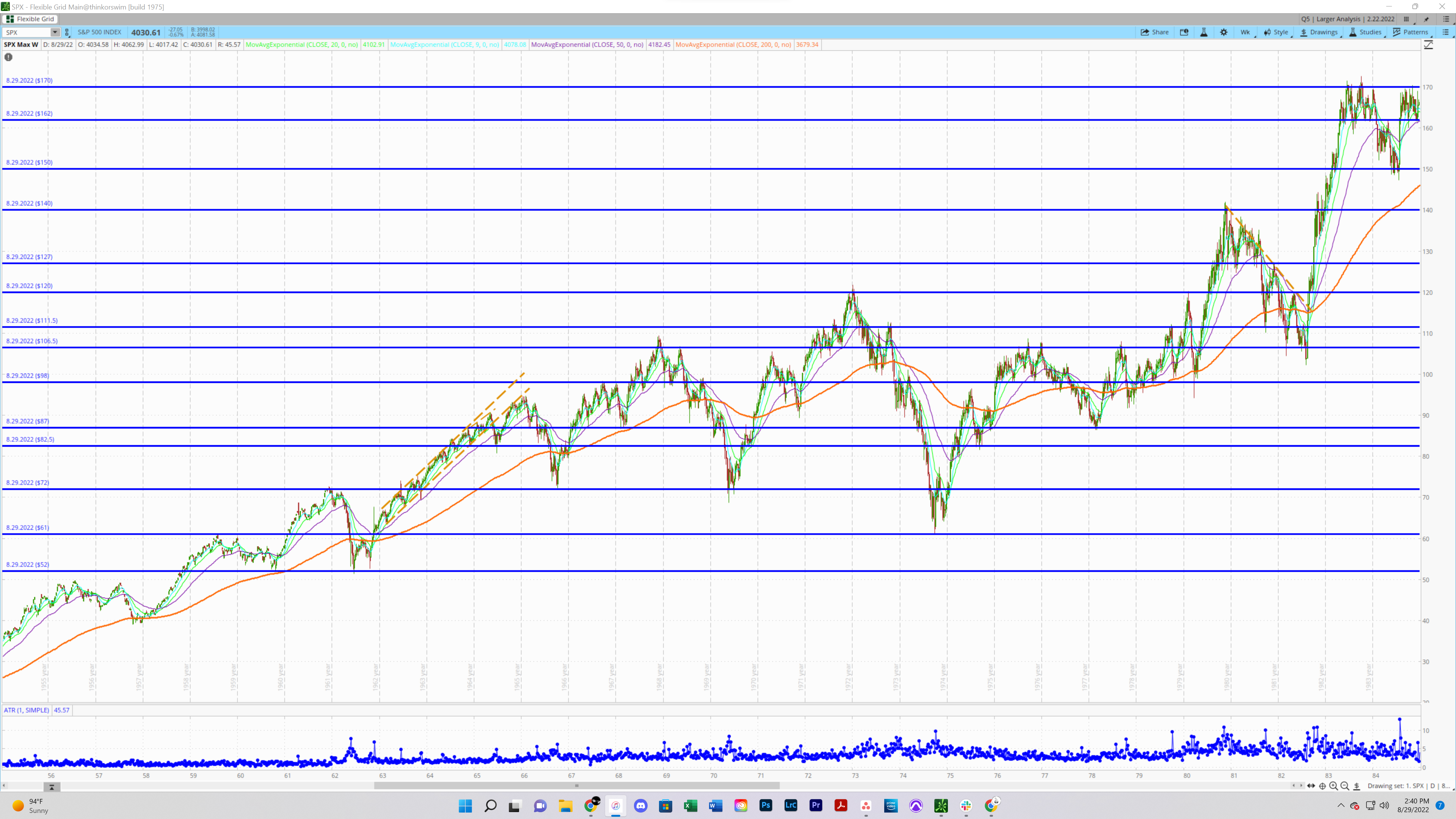

1955 -1985

On weekly timeframes so many patterns seem to stand out, and the price action of supply and demand shines through with a considerable clarity. H&S type formations, Double Bottom type formations, all of which, of course, are just loose shapes that reflect the record of demand and supply.

Is it appropriate to consider The Fed as a market participant, just one with disproportionate power. The Fed’s actions displaying on the chart just as any other market participant would.