Sohn 2022 | John Collison in conversation with Stanley Druckenmiller

- 31:57 | “People ask me what I learned from George Soros—I thought when I went there I was going to learn what made the yen & the deutsche mark go up and down and that kind of thing, no—what I learned was: sizing is probably 70-80% of the equation. It’s not whether you’re right or wrong. It’s how much you make when you’re right, and how much you lose when you’re wrong. I’ve also found—as an investor—I believe in streaks. You see it in baseball, you see it in everything else. I see it investing. Sometimes you’re seeing the ball sometimes you’re not. One of my number one jobs is to know whether I’m hot or cold, and when I’m hot I’m supposed to turn the dial way up, not say “okay, I’m up 40% this year, this will look good at the end of the year, let’s go take a break” no, you’ve got to make hay while you’re hot. And then when you’re cold, the last thing you should do is try and make big bets to get back to even. You should tone yourself down. So, believe it or not, that’s part of the ‘all your eggs in one basket’. Not only do I have to see the investment that really excites me, I also have to see myself sort of being in a good trading rhythm.“

- Interviewer (John Collison): “I think this is so interesting this notion of, first off having hot and cold streaks, because people debate whether hot hands exist in basketball and all this sort of stuff, but kind of believing in that but also being kind of self-aware to know that ‘I am cold I’m going to do trades but just small ones to keep myself from doing anything stupid’ and then as you say, when you’re hot, really being able to size with conviction based on that. Do you know when other people are hot by the way so people at the firm now at Duquesne, do you know when to egg them on to size up their positions because you can tell they have it together?”

- Druckenmiller: “I size up their views, and the answer is yes. So, the dark art of technical analysis… There are technicians out there—they’re all rational, they all look a lot of history—no one runs more hot & cold than technicians. One of your main jobs if you follow technicians, is to know when they’re hot and know when they’re cold. Some of them get so cold you can actually fade them and go the other way because they’ve got themselves all twisted up—it’s more fun to follow one who’s hot and make money with them—but yeah, absolutely. I see guys within my own firm—analysts who recommend things—and they go on streaks too, or they get in an area and they they’re really hot, and my job as a trigger puller is to size them up.”

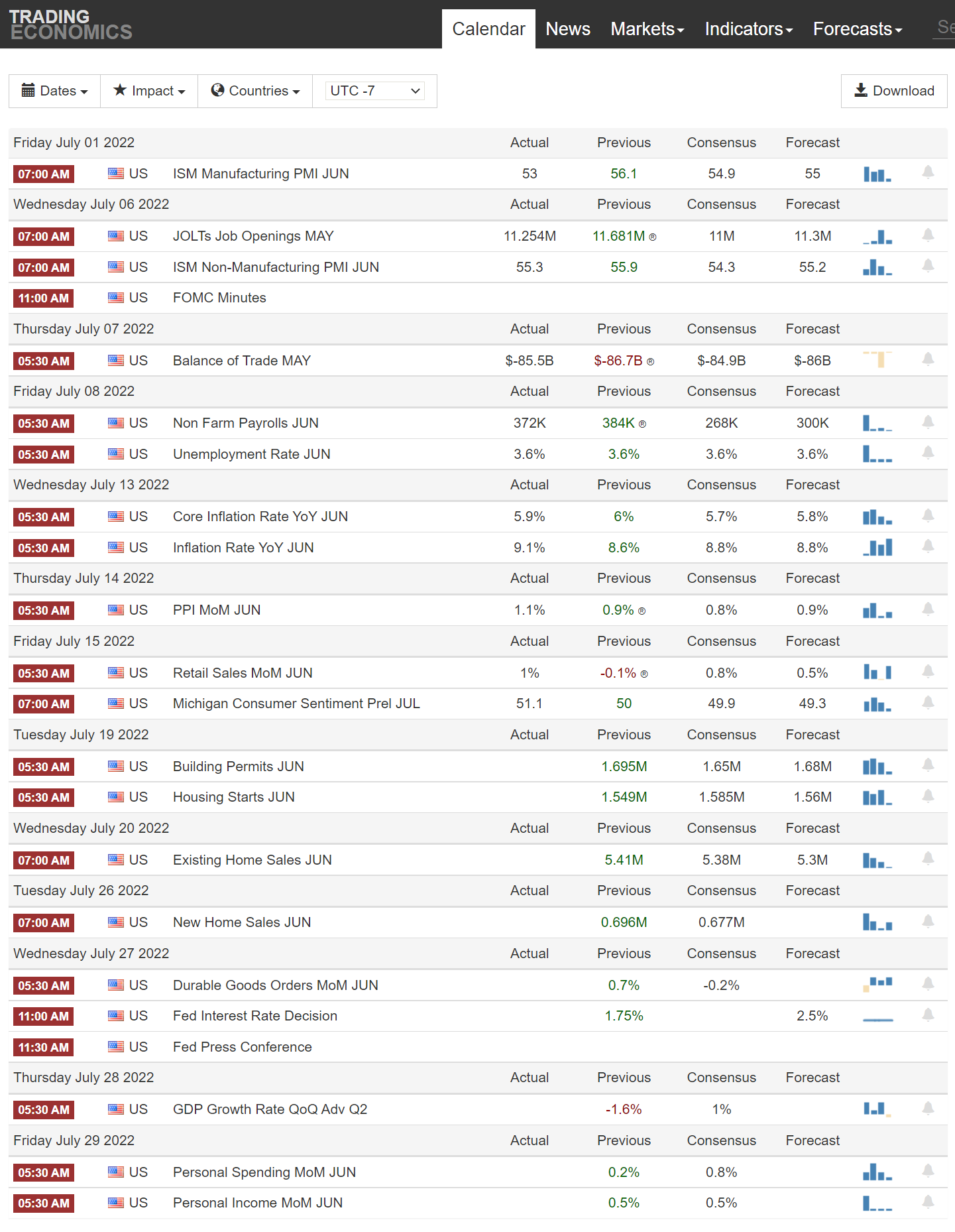

Must understand significance of Economic events. See below:

What is PMI

- PMI: Purchasing Managers Index

The Global Economy – Larry Summers in conversation with Jon Sopel

- Seems one significant point he makes is that trying to be self sufficient instead of globalized is a mistake. “We need intelligent globalization. De-globalization will be counter productive.”

- Says the next few years will not be easy years. “There will be a recession within the next few years.” Say’s we need to prepare for and take advantage of recession. When there are workers that may be idle, there need to be ‘shovel ready projects’ that they can be put to work on.

Unemployment rate (& Non Farm Payrolls) & Core Inflation Rate YoY & Inflation rate had the largest impacts/reactions