You were able to make a comeback, & of the poor trades you made, you also made one of your best trades to date. You executed on your resolve to hold trades until there were reasonable & measurable reasons to exit & while you took some pain from such rules, you also reaped the benefits of them as well.

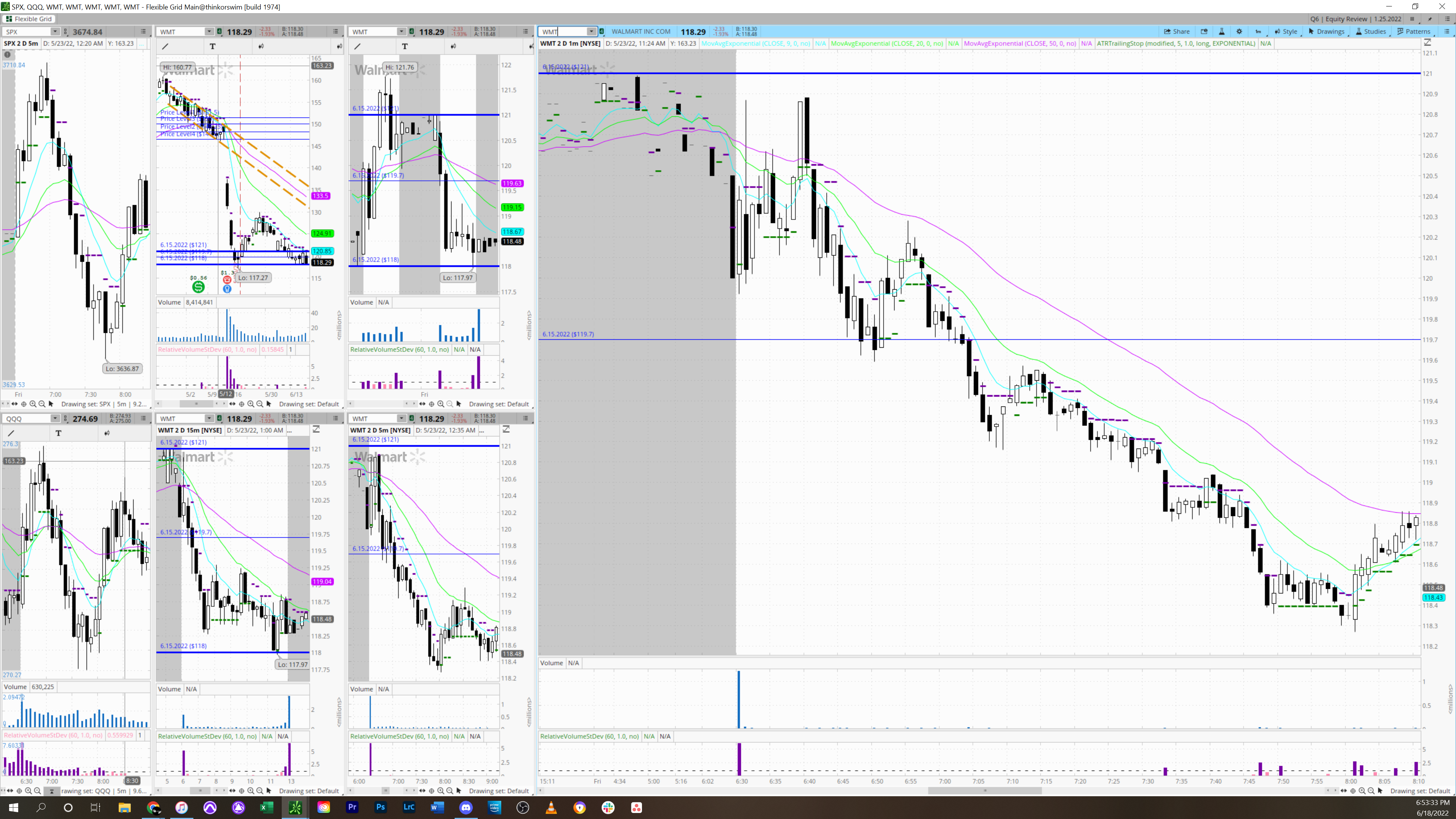

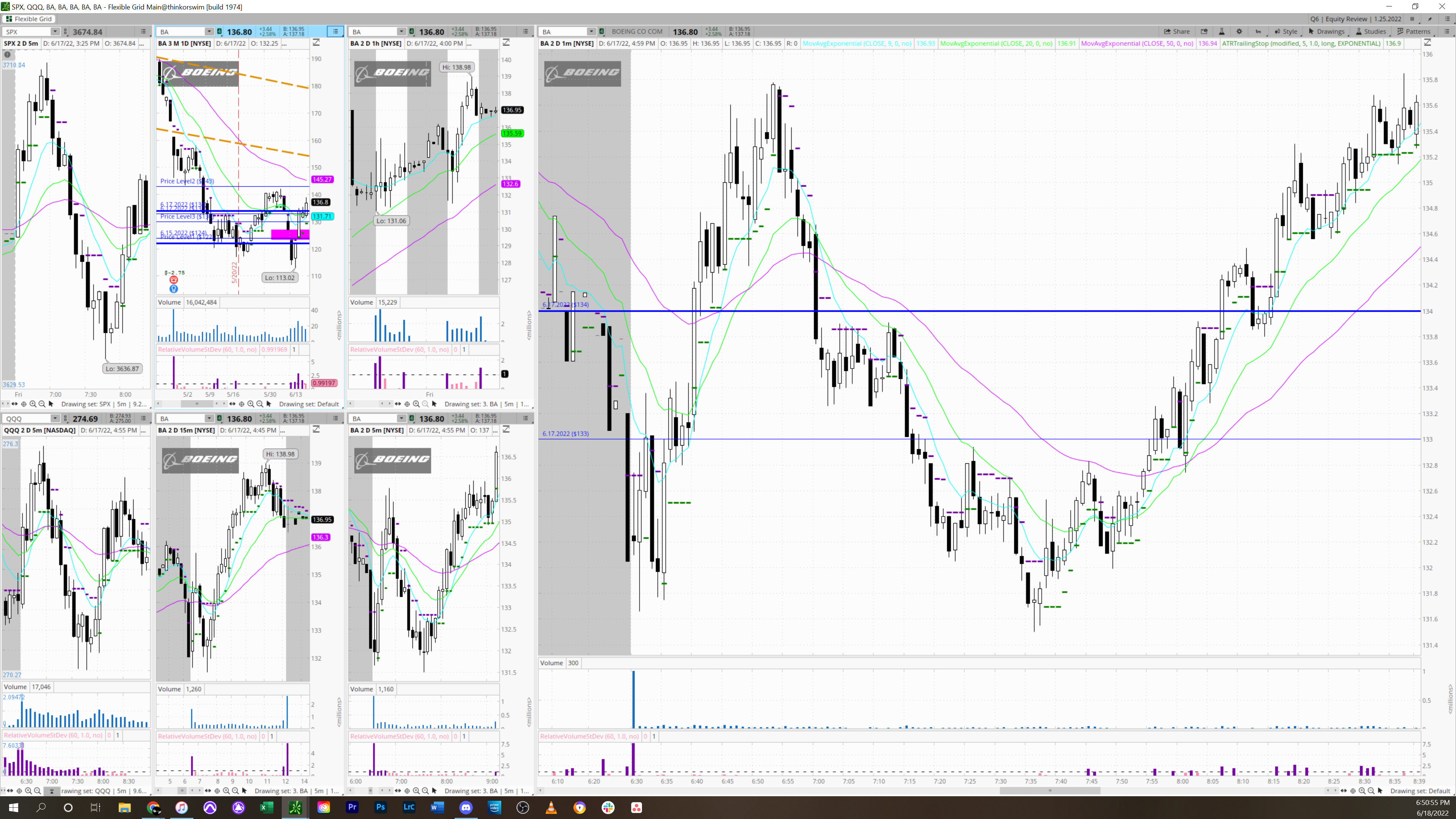

Your biggest mistakes came from not respecting the daily charts of the issues you decided to trade, only looking at the short term premarket picture. Namely your BA short & the VZ Short. Had you looked more closely at the daily charts you would have seen upside strength that should have made you more cautious taking any sort of trade against it, you would have hopefully realized that the odds were less in your favor given the current of the larger time frame strength to the upside. You need to restructure your charts of the sector layouts to cure this ailment, as you currently have daily charts showing but they’re showing to wide of a timeline, over a year. You need to have the charts laid out the same way you have them laid out on your multi watch layout.

For the spy trade & the CVX trade you made, you did an excellent job, and in retrospect you did deserve to be green on the day, despite your initial mistakes. Your analysis on CVX was clear & sound & you traded according to it. Your only mistake was not holding onto your trade longer & believing in your analysis with more conviction. But you capitalized on a significant portion of the move & should not criticize yourself too harshly.

Though your first loss was hefty, you took it trying to abide by the rules you’d set for yourself (namely waiting for 3 1 minute candles to close above whatever level or mark you’d designated as your stop point). In this circumstance the holding went sharply against you, it might be qorth scaling out of your size for each candle that closes above your mark, so you don’t get caught in unlucky spikes that are still within the technicalities of your rule. That or come up with a rule for spike situations. All things considered, the way you took the loss was well done. It was the trade itself that was erroneous & one you shouldn’t had been in, but that part has been addressed.