Almost finished building the layouts for each sector. Considering building out identical layouts for each industry as well, though this is ambitious as there are 69 of them, as opposed to just 11 for sectors. However, it may be worth while. It seems the stocks within industries move together—today for example, within the sector of communication services, which as a whole sold off heavily, the subsector (industry) of Interactive Media & services seems to have been responsible for the bulk of the sell off. And of the top 12 (by market cap) optionable stocks within the industry, 11 of them were red, suggesting convergence; correlation high correlation. Having seen that the sector was selling off, I could have identified the specific industry that was responsible for the move, and then picked a stock to short. This would have increased my odds of being right on the move, and this is an odds game. I believe I’m going to undertake building out the layouts for each industry—adding the tickers of the top 12 optionable stocks within each industry and saving the collection as it’s own layout, just as I’ve done for the top 12 optionable stocks within each sector. 2:27 PM | Phoenix | Chariot | Solace Computer

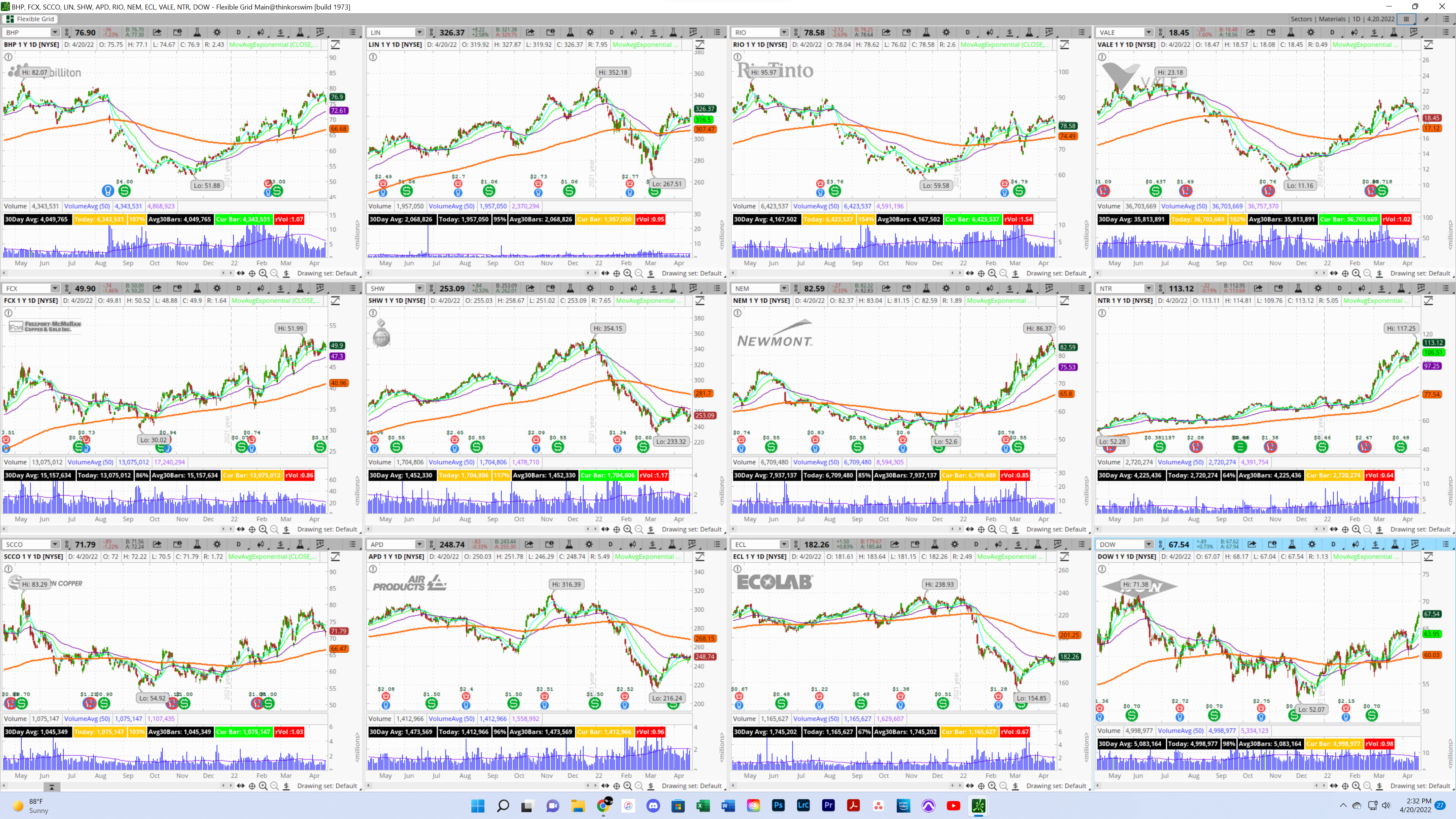

Examples of current layouts, overall sectors then breakdown of top 12 optionable stocks with each sector.

Real estate is and has been on a fucking tear. Strength in the sector. What is the significance of this. Real estate & consumer staples are ripping. Are these signs of recession fears? People flocking to ‘Safe’ assets? Necessary asset classes? All top 12 of stocks within real estate sector green today. of the 40 or so in view on my scan only 5 are red.

For potential upside, real estate, Health care, Materials, consumer staples. For potential downside continuation, communication services.