Overview: Solid week of trading with key insights distilled. Executed 2 scaling out trades to success, & took away key insight about trading in different sectors. Internalized what it means to trade only high quality setups, & solidified more confidence in the trading style I’ve embraced of scalping between levels. Must embrace trading on 5m not 1m.

Key Takeaways | Week 33 | 2021

- You must NEVER trade Carelessly. There is NO benefit to disregarding discipline.

- DO NOT CULTIVATE HABITS THAT WILL LEAD TO LONG TERM FAILURE.

- Do not cultivate the seeds of failure.

- The most efficient use of time is to trade flawlessly to the extent that you know how.

- Scalping between levels in the direction of a larger trend is a viable strategy.

- Only execute on the crème de la crème.

- Consider the context of the overall market & the issue’s place in the grander ecosystem before trading.

- You shine in the first 15 minutes. Refine what you’re doing well at.

- Be ready to switch and play downside. Levels still apply.

- Must ensure liquidity in chosen contract.

- Must have faith in analysis & greater trend on larger time horizons.

- Must observe & gain insight into unique price action of each new issue you trade BEFORE trading.

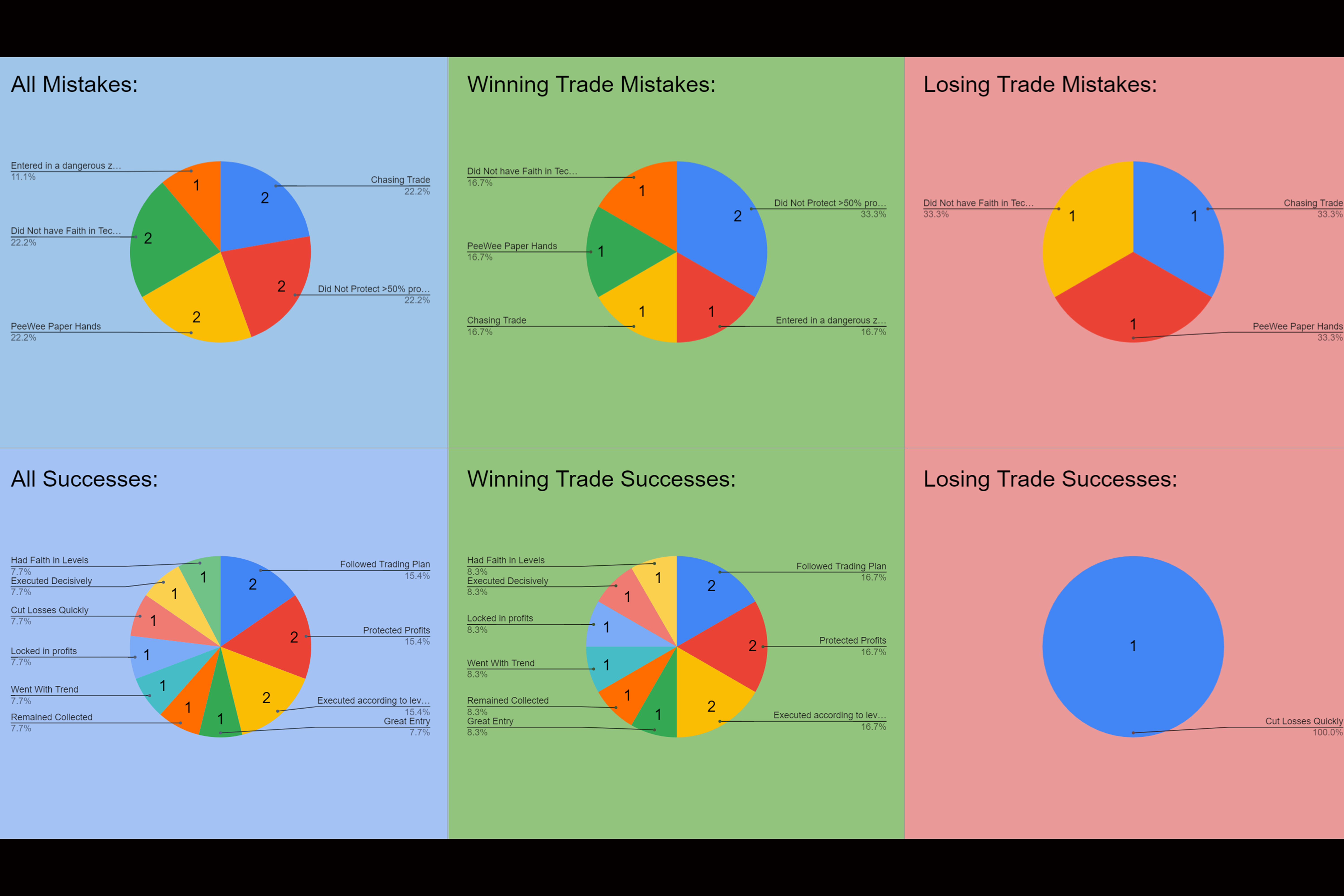

Mistakes | Week 33 | 2021

- Peewee Paper Hands.

- Trading off 1m instead of 5m.

- Inappropriate trade style; Did not plan trade style.

- Did not familiarize yourself with price action & employ appropriate trade style accordingly.

- Did not ensure liquidity in contracts prior to trade.

- Did not protect 50% of profit.

- Chasing trade

- Followed external trade suggestion. Never do this.

- Failed to consider the the greater market context before entering trade.

Successes | Week 33 | 2021

- Followed Game Plan

- Traded Levels

- Successfully executed first Scaling out Trade

- Executed Excellent, prescient analysis

- Did not let winner become loser

- Titanium Terry

- Held through pullback with reasonable justification.

- Exited on signs of weakness.

Activity Log | Week 33 | 2021 | 27.73 hrs

- Traded | (8.10, 8.12)

- Charted | (8.11, 8.12)

- Created | Stages of Understanding Tool/Visual

- Game Planned | (8.10, 8.12)

- Organized | Activity Log (D)

- Refined | Data Journal (Game Plan Matrix, Potential Profit Calculator), Goal Visualizer Tool

- Reviewed | 8.10.2021, 8.12.2021

- Studied | ETFs, Open Interest, Float, Closely Held Shares, Public vs Private Companies, Jessie Livermore, John Paulson, ITU Discord, SMB Capital, Optionhub, Money Flow, Order Flow, Umar Ashraf, UK SpreadBetting, Zarayab Discord (1st Day)

Overview: Traded 2 days, Created Stages of Understanding Visual, Refined goal visualizer tool & refined awareness of goals & time in between them, Joined Zaryab discord, Talked w/ Dragon & JR on discord for first time in months, Studied deeply Open Interest, Float, Closely Held Shares, & significance of open interest & meaning of it to options, caught up on some Option Hub. Joined Zaryab discord, finished up building out potential profit calculator within trade module. Had a day on voice with Dragon & JR for first time in a few months. Opened first intentional trade swing on Apple at JRs suggestion. First time opening swing with intent to swing & with profits I can afford to lose now that I’ve accrued some. Caught up reading over discord channels. Executed through trade review of 8.10 in time to be able to trade 8.12. Got up to date on daily activity logs on day of Lyre Raven work, & was able to put in some time studying option hub, closing in on gap of videos remaining.

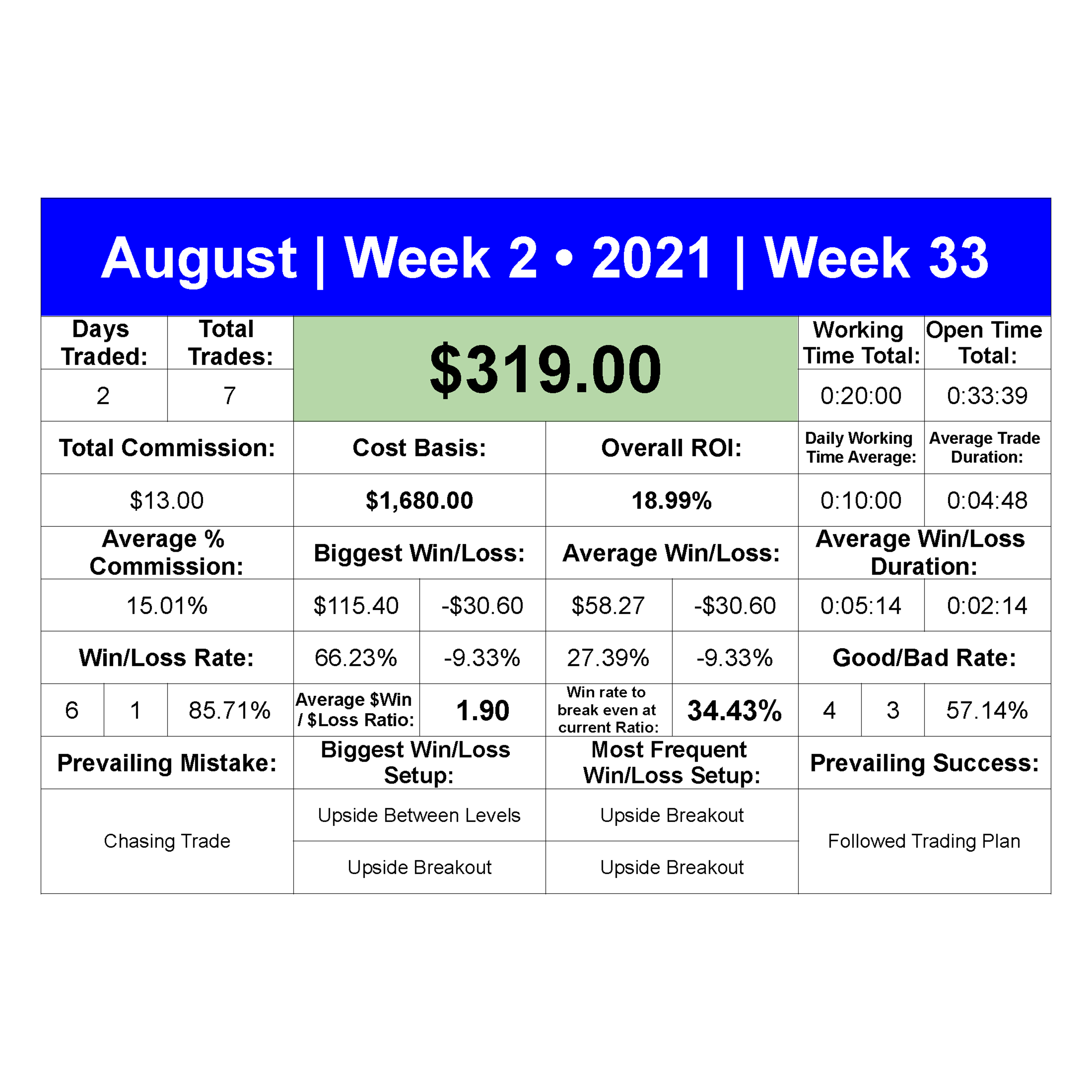

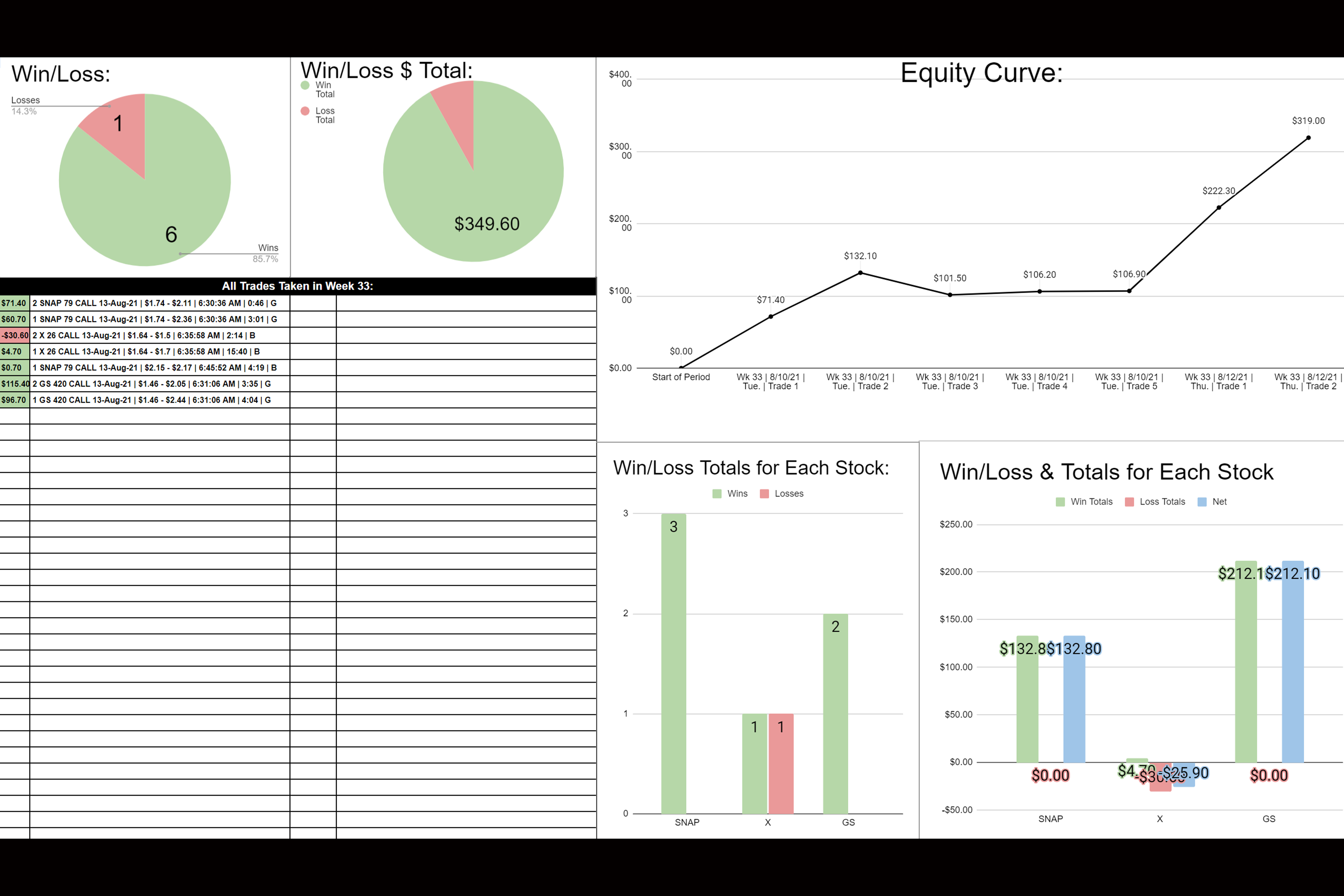

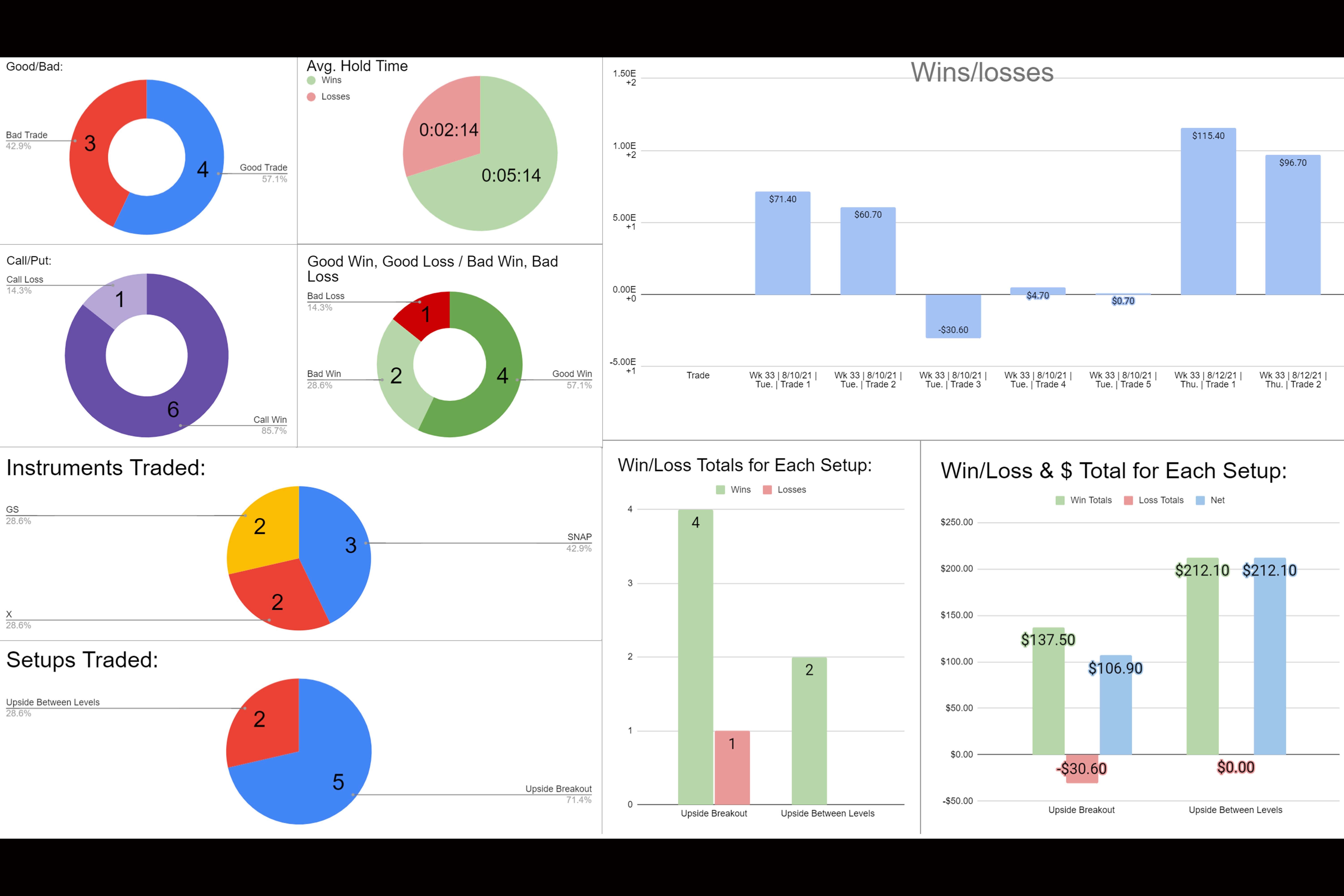

Week 33 | 2021 Statistics: