Overview: Best trade to date, biggest scalp to date, & continuation of solidification of knowledge procured through July from OptionHub. Discovered Stan Druckenmiller & thoroughly studied unravel video. Key takeaway from which was that after so many confirmations you must pull the trigger, you can still lose even with all the confirmations in the world, but you must pull the trigger when you have them, and then over a series of trades you will emerge profitable. Became cognizant of the importance of determining time horizon of trade before entry.

Key Takeaways | Week 32 | 2021

- Update & Refine Game Plan for Taking Profits.

- Begin experimenting with scaling out of trades

- Begin experimenting with trading on larger time frames

- After so many confirmations in your favor you MUST pull the trigger

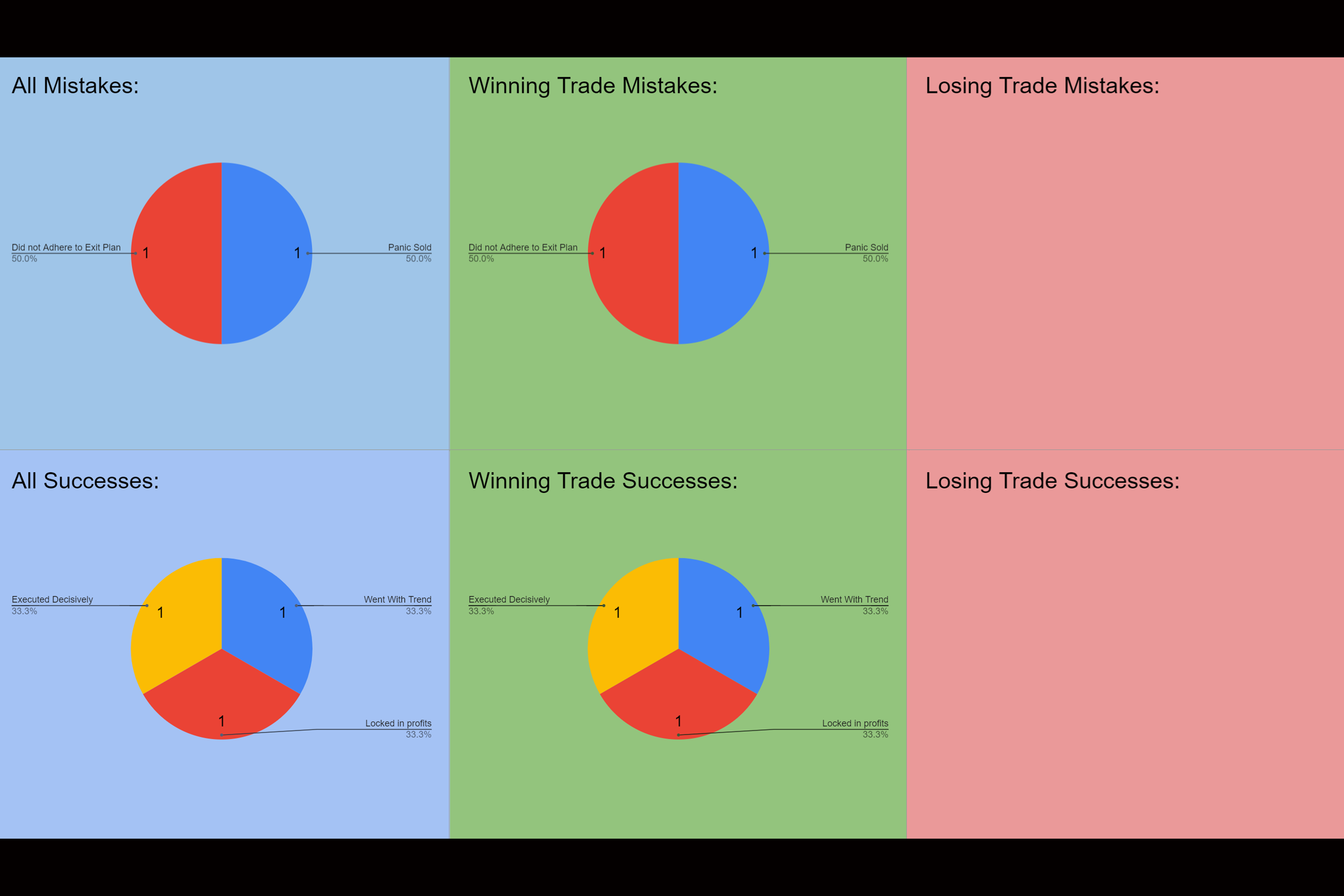

Mistakes | Week 32 | 2021

- Did not have adequate plan for taking profits

- Panic sold, with no technical signal to sell

- Did not game plan for extraordinary circumstances

Successes | Week 32 | 2021

- Protected Significant Profits

- Held through discomfort

- Trusted & trade levels

- Followed Game Plan

- Walked away while I was ahead

Activity Log | Week 32 | 2021 | 23.78 hrs

- Traded | 8.2.2021

- Charted | (8.6)

- Organized | Activity Log (D)

- Created | Change in Greeks over trade duration calculator

- Read | Options as a Strategic Investment Chapter on Option Buying, The New Trading for a Living

- Refined | Data Journal (Added Multiple Time Horizons to calculate missed/saved profits), (Compute Change in Greeks over duration of trade)

- Reviewed | 8.2.2021

- Studied | Larry McMillian, Option Pricing Models, Time & Sales, Black-Schoels Model, Trinomial Option Pricing, Exotic Option, American Option Pricing, ITU Discord, Unravel Trading, Stan Druckenmiller & Family, Highest Paying Careers, Sandy Gottesman

- Updated | Activity log (D)

Overview: Most meaningful activities were discovering Stan Druckenmiller & studying him in significant way, thoroughly studying Unravel Trading video & taking notes, & Creating Option Greek calculator to compute change in Greeks over duration of trade plus refining input section for derivative highs & lows on different time horizons. Did deep study of the tape on video play back of my trades this week, determined that to read the tape, and truly absorb every tick is likely impossible particularly during surges when hundreds of transactions are flying past per second. Though there is still mastery be had. Ordered ‘Options as a Strategic Investment’ & discovered Larry McMillian Youtube page & market analysis/overview. Created change in Greeks over trade duration calculator within trading module in data journal. Rebuilt input section for derivative & underlying lows & highs during, & after trades in data journal module, Added different time horizons (Scalp, Day Trade, Swing) to calculate & visualize missed profits, percent of move captured. Read New Trading for a Living while in wilderness with Carl. Better week this week, more focus on Caduceus, & some deep focus achieved.

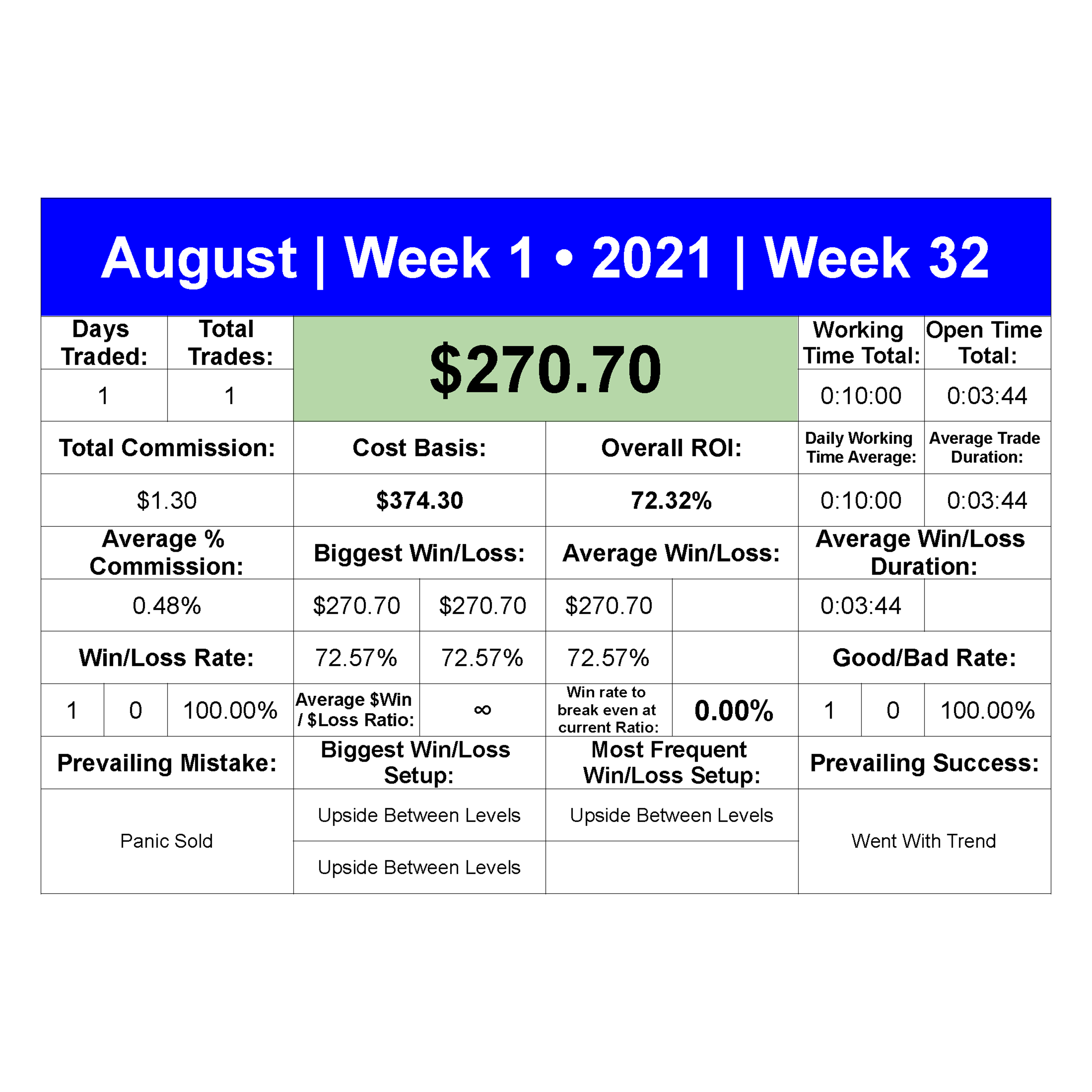

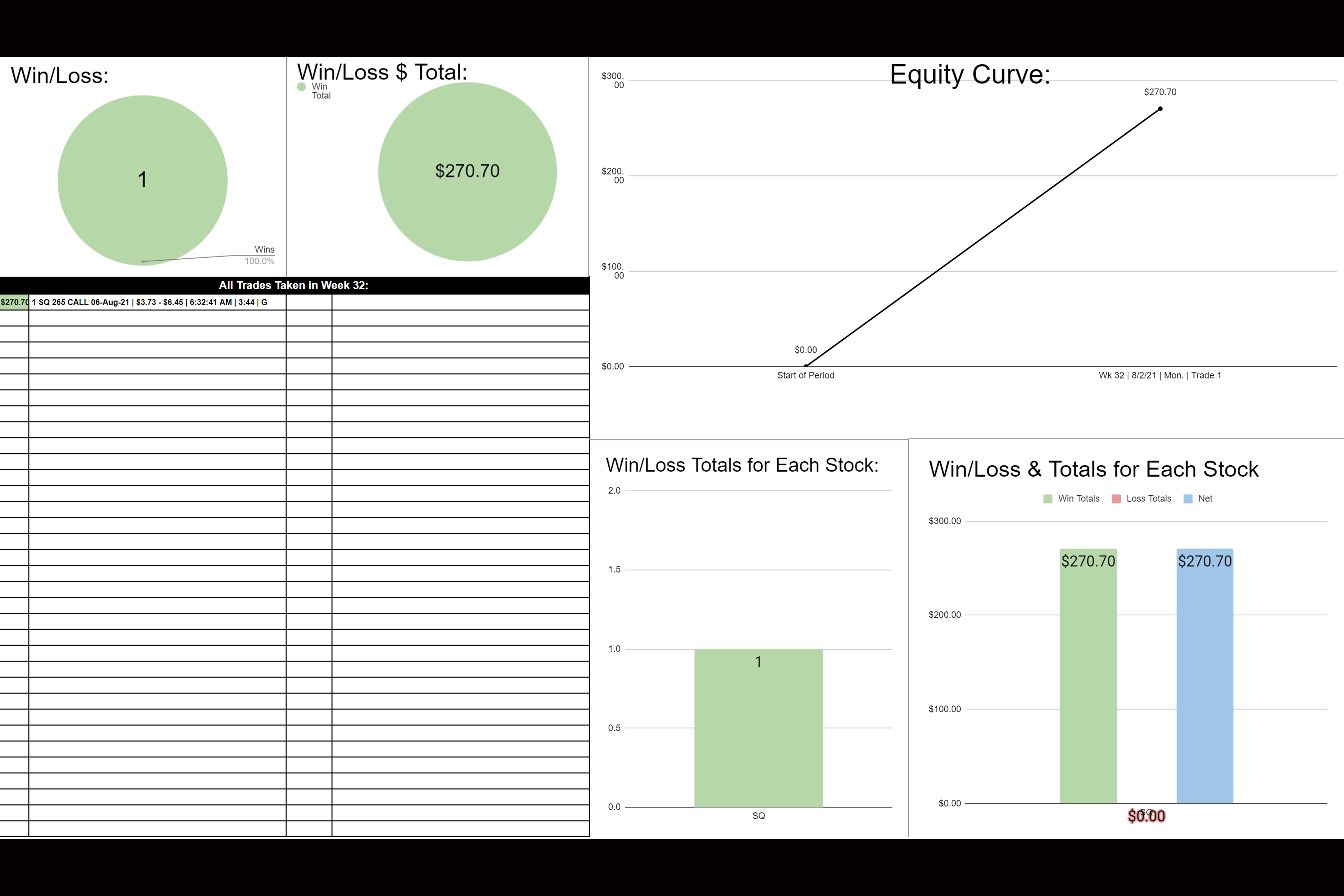

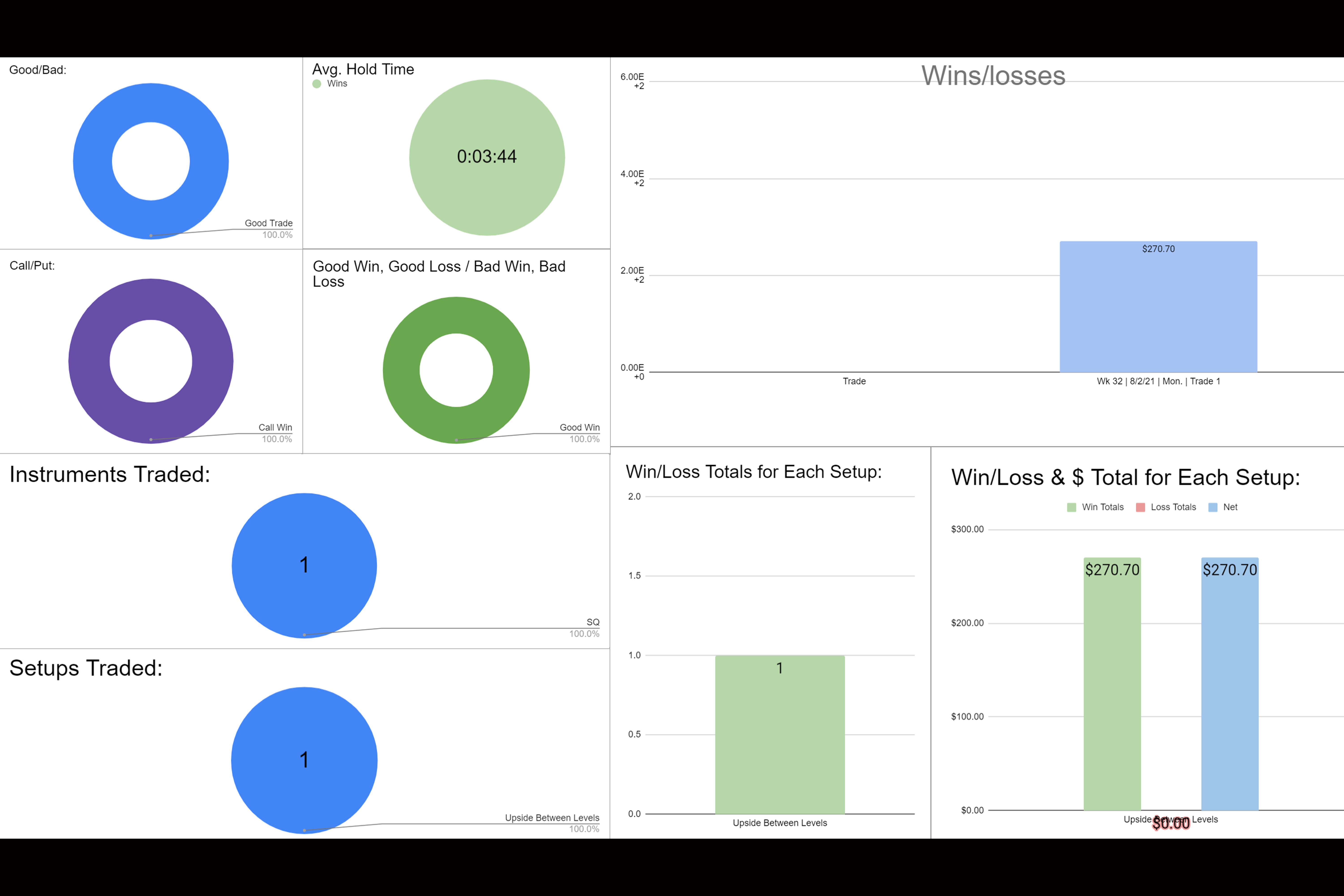

Week 32 | 2021 Statistics: