Key Takeaways | 8.24.2021 | Tuesday

- Take GOOD losses and trust that over a number of trades you WILL come out on top

- Do not trade off 1m. Must trade off 5m. Do not justify entries based on 1m patterns.

- Be prepared to lose 50% on every options trade. 50% should be assumed base risk

- Ensure liquidity in contracts before trading

- Set Alerts for Stocks. You can’t watch all of them at once

- Do not bring emotions from prior losses into new trades.

- Do not succumb to GREED

Mistakes | 8.24.2021 | Tuesday

- Did not consider overall market conditions

- Peewee Paperhands

- Trading based on 1m instead of 5m

- Traded Illiquid Contract

- Did not protect 50% of profits

- Went against trend on larger time horizon

Successes | 8.24.2021 | Tuesday

- Respected & had faith in levels for entries & exits

- Cut Losses & Managed losing trades well

- Sold into strength on winning trades

- Generally exited trades unemotionally

- Titanium Terry moment

Activity Log | 8.24.2021 | Tue. | 7.62 hrs

- Charted | 8.24

- Traded | 8.24

- Studied | Stan Druckenmiller

Traded. First losing day in at least 2 months. Updated Weekly Activity log for the first time in what surely is a couple months. Exported all Weekly Stats, preparing to publish weekly, then monthly trade journals, likely won’t complete today. Listened to Stanly Druckenmiller interviews while working on this, got insight into what he defines as the ‘inside of the market’ i.e. auto stocks, building stocks, banks, russell 2000, retail equities. See beginning of linked video (Stanley Druckenmiller on Economy, Stocks, Bonds, Trump, Fed: Full Interview) for quote. Listening to On The Brink: Henry M. Paulson Jr. (Audiobook hours do not count)

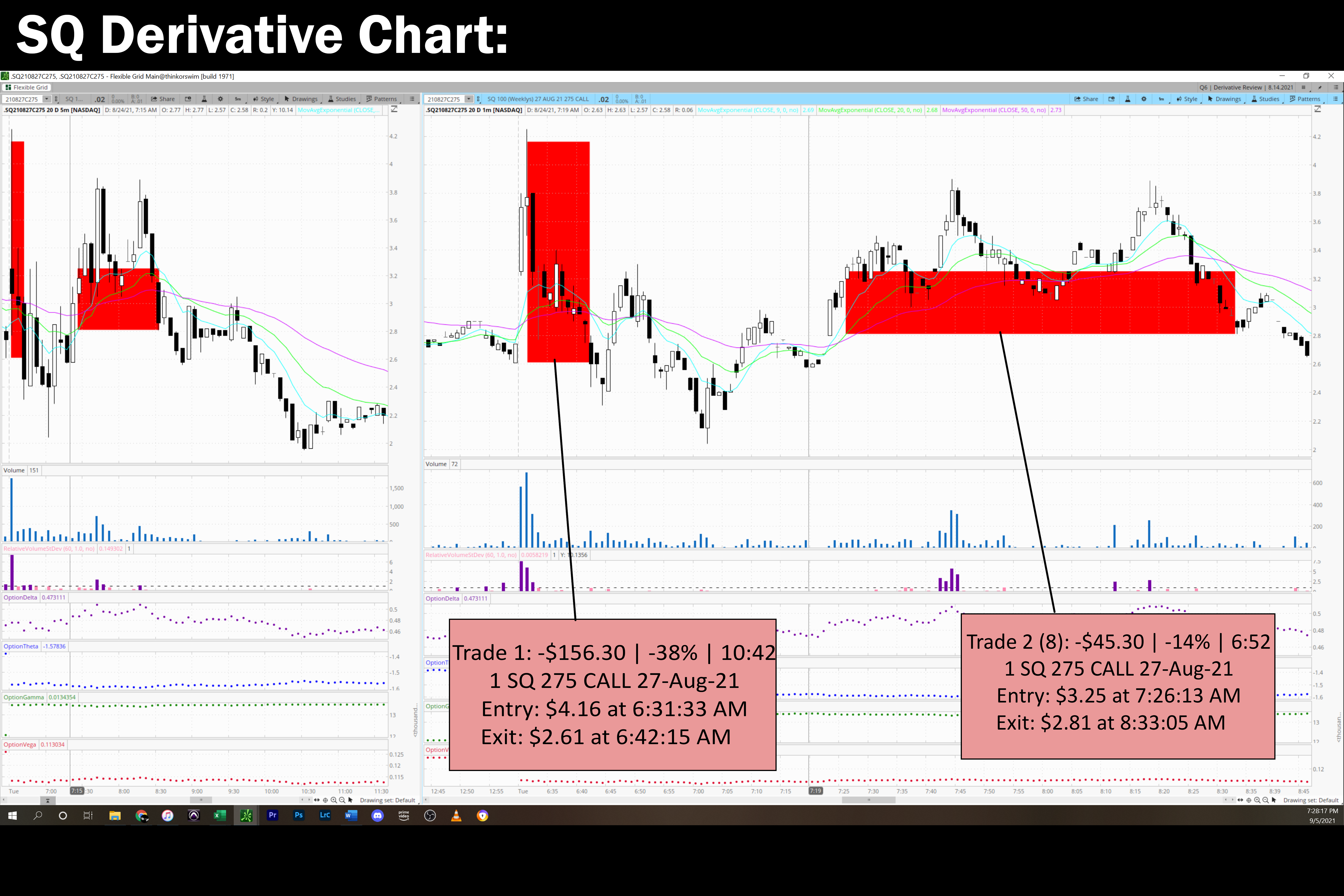

-Trade 1 (SQ | -$156.30 | -37.57%):

-Entered Because Saw price breaking 273 level I’d charted out after some deliberation at the open & saw that 111 & spx were both pushing up above meaningful resistance levels.

-Exited because Price closed after next demand level below entry and this was my plan for taking a loss

-Trade 1 Mistakes: Did not consider or take into account that market was at all-time highs & likely to deliberate. Could have gotten out when the trade didn’t push up immediately, as you were expecting. Given that your plan was to scalp, when the trade did not show continuation, you could have exited, but you wanted to see if a level below would hold, and had determined to do so before the trade. The mistake was not holding fast to the distinction of this being a scalp, treating it like a day trade. This was a challenge though, as there was choppy action here and sometimes all it takes is waiting for a level to hold, so all in all, I’m glad I did this.

-Trade 1 Successes: Held on and waited for confirmation of trend change before exiting, while this was for a loss, it was a done well, and is a habit you’ve been working to cultivate, that in theory, will help you remain in trades that do need some time to work out. |

-The better trade would have been no trade, you should have exhibited more caution & waited for more overall market direction, you got caught in chop |

-Trade 1 Key Takeaways: First loss I’ve taken in a while, could have had tighter stops, need to determine & specify better stop loss levels for SCALPS as opposed to day trades. Given that the intent for this trade was to scalp, the stop level should not have been as wide as you had it. But again, there have been plenty of times when your stops have been too tight and you missed out as a result. Perhaps given that the level that was broken below was so significant on a larger time frame that should have been insight to cut. |

-Trade 2 (NVDA | -$45.30 | -14.61%):

-Entered Because Saw Nvda breaking below level on 1m

-Exited because Nvda was breaking back above next level & got shaken out.

-Trade 2 Mistakes: Paper handedness & did not give trade time to play out. Trading on too short of time frames & getting shaken out by 1m price action

-Trade 2 Successes: Cut what was ultimately not a strong trade. Cut losses |

-The better trade would have been waiting for confirmation before taking loss. You got scared out of the trade, had you let the candles close you could have come back to secure profits. |

-Trade 2 Key Takeaways: Do not trade based on 1m chart. It’s noise too often. WAIT for CONFIRMATIONS for exits AS WELL AS ENTRIES. With options trades you should just walk in prepared to lose 50%. that’s just the nature of the game, particularly if you’re going to wait for levels to be respected. Even if your r:R is only 1:1, the rate of your winning trades is enough that you will be profitable. If you pick high quality setups & maintain a win rate greater than 50% you can afford to take 1:1 trades. Consider this |

-Trade 3 (SNAP | $39.40 | 15.27%):

-Entered Because Snap pushed below key 75.3 level With qqq also pushing below key level

-Exited because Took profit at first target level with 66% of position

-Trade 3 Mistakes: Could have entered at first break of level prior, Traded illiquid contract. Should have checked liquidity prior.

-Trade 3 Successes: . You set a profit target and took profits when it was reached, you held through a retracement and waited to see what price action did at ema levels. This is the way to trade. |

-The better trade would have been entering on the first level break and finding a more liquid contract. |

-Trade 3 Key Takeaways: Ensure liquidity in contracts before trading |

-Trade 4 (SNAP | $8.70 | 6.74%):

-Entered Because Entry from prior trade

-Exited because Price did not reach next level, was retracing back towards most recent level, wanted to protect profits.

-Trade 4 Mistakes: should have protected more profits in choppy market, but could not have known that price would not push to next level. did not let winner become loser This was a reasonable trade,

-Trade 4 Successes: Protected profits, did not let winner become loser |

-The better trade would have been volume spike on one minute with trend shifting back up could have warned of potential chop or reversal, could have exited earlier. Holding this trade for the rest of the day would have paid off as snap continued to dump though it took another hour for the move to manifest. Not worth the wait though for the stress it would have caused you & considering this wasn’t your plan you made the right call. |

-Trade 4 Key Takeaways: Ensure you’re trading contracts with liquidity. Pay attention to volume. Know when to switch from scalp to day trade. |

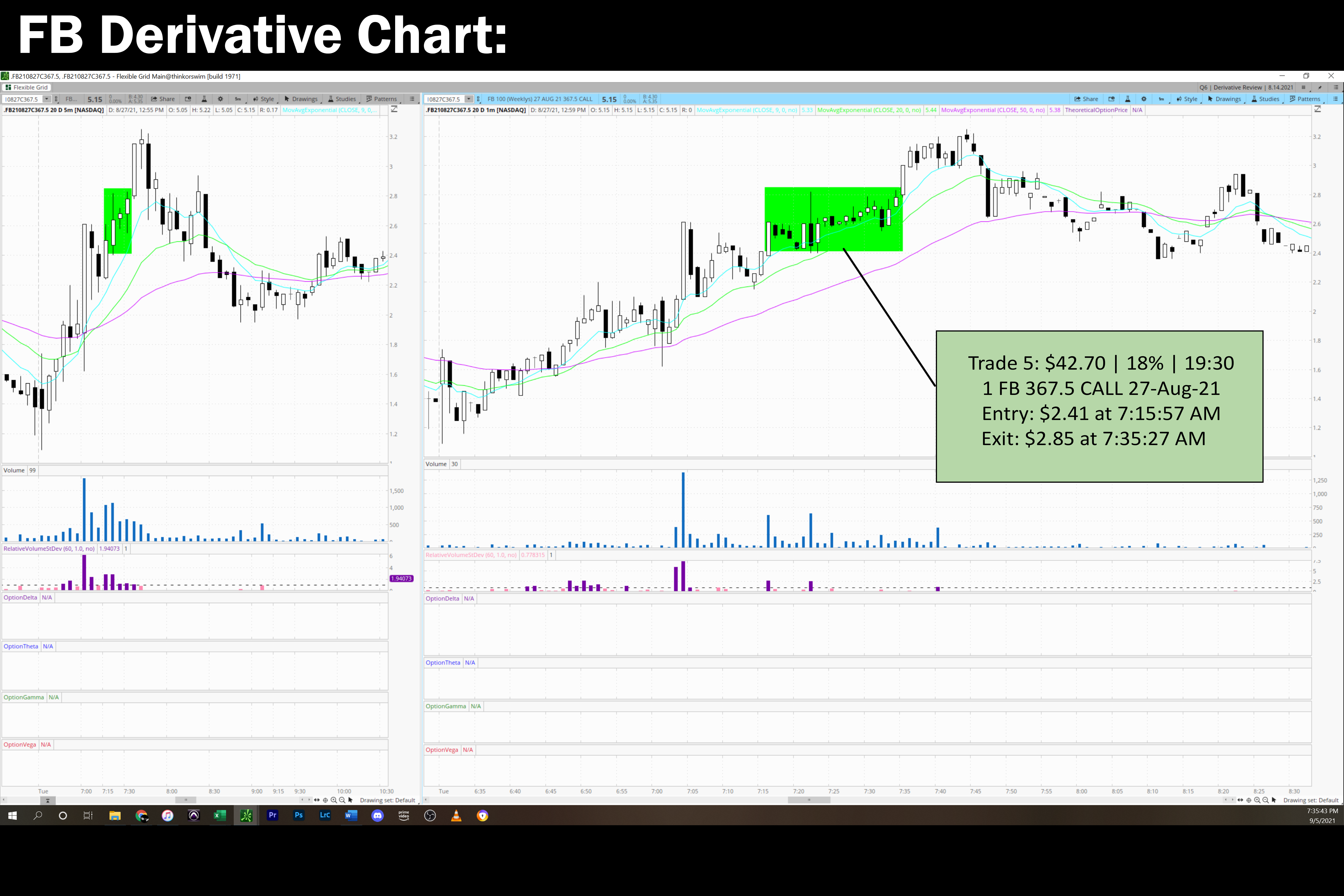

-Trade 5 (FB | $42.70 | 17.72%):

-Entered Because saw break of level with volume, & overall market convergence This was called out by alicia, had levels charted for facebook even though it was not on my game plan,

-Exited because next level was overtaken & took out my limit order

-Trade 5 Mistakes: This was a bit of a chase, you were a little late on the play

-Trade 5 Successes: You executed according to your plan, you sold into strength you were not greedy & you traded according to your levels. |

-The better trade would have been Entering earlier, but it couldn’t be helped, this stock wasn’t on your watchlist, though you did have levels charted |

-Trade 5 Key Takeaways: Need to have alerts set for stocks. Cannot possibly be watching all potential plays at once. |

-Trade 6 (AMD | -$102.60 | -33.1%):

-Entered Because saw a bUlL fLaG on 1 min. Stupid. Did not consider larger time frames, which would have suggested trend was not in favor of upside play

-Exited because Price reached level I’d said I’d take loss at

-Trade 6 Mistakes: Went against larger trend, used pattern on 1m to justify entry, trying to make up for prior losses & trading poorly as a result. bringing emotion from past trades into this trade. over trading.

-Trade 6 Successes: my management of the loss was good in that I traded the levels I’d charted. I bore the loss according to levels, which is a skill I’ve been meaning to work on & implemented here. If I can couple this exit taking with good entries on trending trades it should bode well |

-The better trade would have been This is a trade you should not have entered. |

-Trade 6 Key Takeaways: Do not justify entrys based on 1m chart patterns. Do not ignore larger time frame ema trend particularly 15minute & hourly |

-Trade 7 (AMD | -$60.30 | -38.9%):

-Entered Because Same entry from last trade

-Exited because Next level was reached

-Trade 7 Mistakes: Should not have been in this trade

-Trade 7 Successes: Cut losses at well planned level & held until that point which is principled trading |

-The better trade would have been You should not have been in this trade to begin with |

-Trade 7 Key Takeaways: |

-Trade 8 (SQ | -$45.30 | -13.94%):

-Entered Because Price had broken out of and was holding significant level

-Exited because winner became loser, emas had switched direction & price was approaching significant level with no volume.

-Trade 8 Mistakes: Should have taken profit when I was profitable. Did not protect 50% of profits out of greed and wanting to make up losses This was a good enough entry but you were greedy and did not protect profits even though you were given 2 solid chances to do so.

-Trade 8 Successes: Great entry |

-The better trade would have been The better trade would have been taking profit at the next level & being happy with that. you got in a reasonable trade and you would have been rewarded but you got greedy & desperate trying to make up for past losses. |

-Trade 8 Key Takeaways: Do not get greedy. do not bring emotions from prior losses into next trade. Trade your fucking levels & take profits. Do not get greedy trying to make up for prior losses. You don’t need to capture full move. |

End of Session Notes & Overview: Rough day. Did great preparation, and first half of trades were alright, losses taken were healthy & reasonable. Should have stopped at certain point. the first bad trade was the amd trade. This was an unnecessary trade. Hoping to win back some profits, likewise with SQ, was holding and hoping. Was unable to sleep last night despite early bedtime. Not sure when I finally fell asleep but definitely possible I got less than 6 hours which is red flag. May need to make rule, only allowed to trade 3 times per day. Today negated profits from last week, to the T lmao.

8.24.2021 Statistics:

8.24.2021 Game Plans: