Key Takeaways | 8.2.2021 | Monday

- Update & Refine Game Plan for Taking Profits.

- Begin experimenting with scaling out of trades

- Begin experimenting with trading on larger time frames

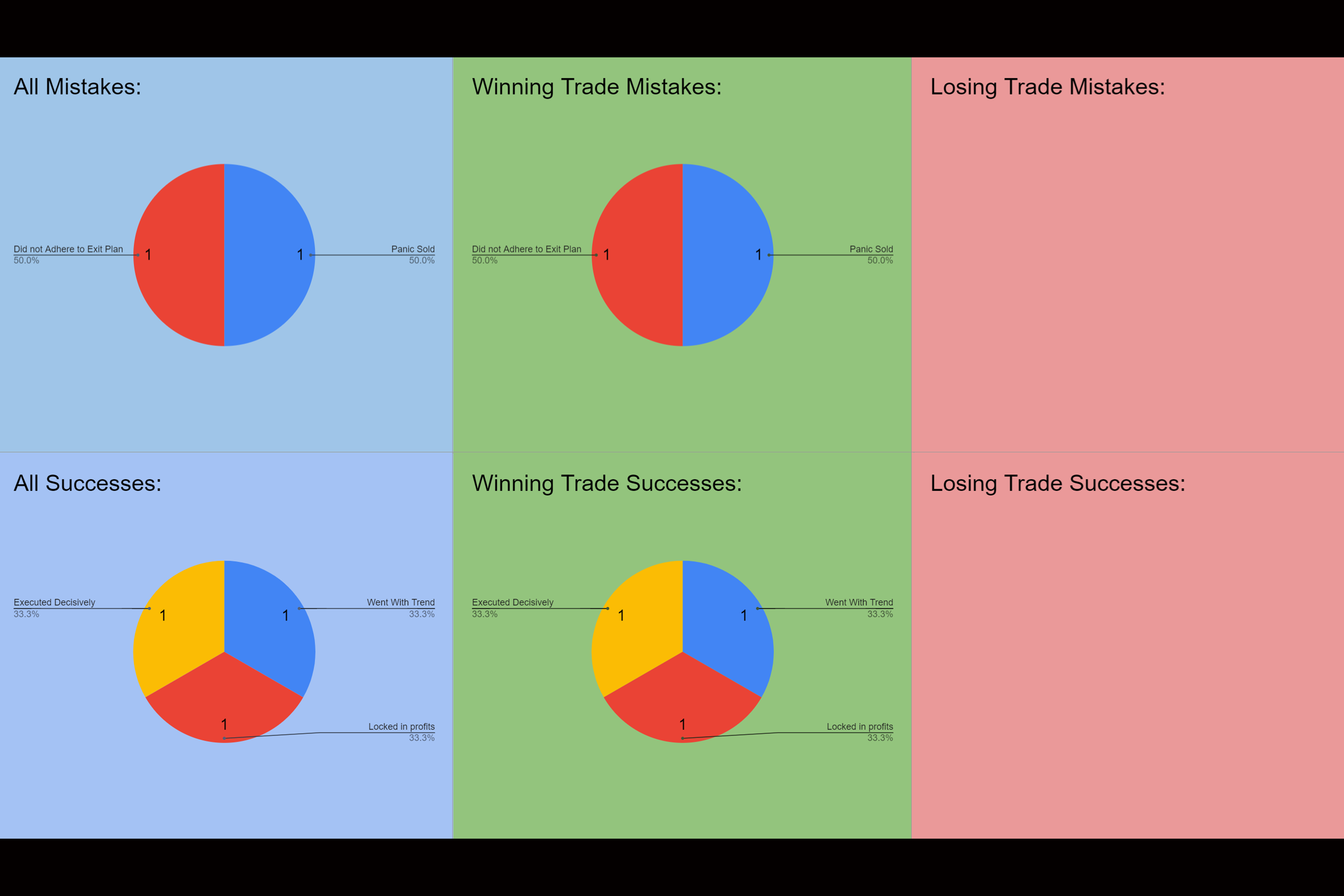

Mistakes | 8.2.2021 | Monday

- Did not have adequate plan for taking profits

- Panic sold, with no technical signal to sell

- Did not game plan for extraordinary circumstances

Successes | 8.2.2021 | Monday

- Protected Significant Profits

- Held through discomfort

- Trusted & trade levels

- Followed Game Plan

Activity Log | 8.2.2021 | Mon. | 4.7 hrs

- Traded

- Studied: Stan Druckenmiller, ITU Discord

- Trade Review

Traded, biggest day & scalp trade to date. Was able to get on voice with JR & talk to him with minimal interruption from the Neanderthal fuckwits. Silenced them by actually knowing what I was talking about & flaunting excessively complex option jargon until they fucked off. Was lucky to only have one to deal with. Began studying Stan Druckenmiller. Incredible resource. Will be studying further. Started Kiril Sokoloff Stan Druckenmiller Interview. Potent. Dig further into this channel. Began trade review of day, screen shotted trades.

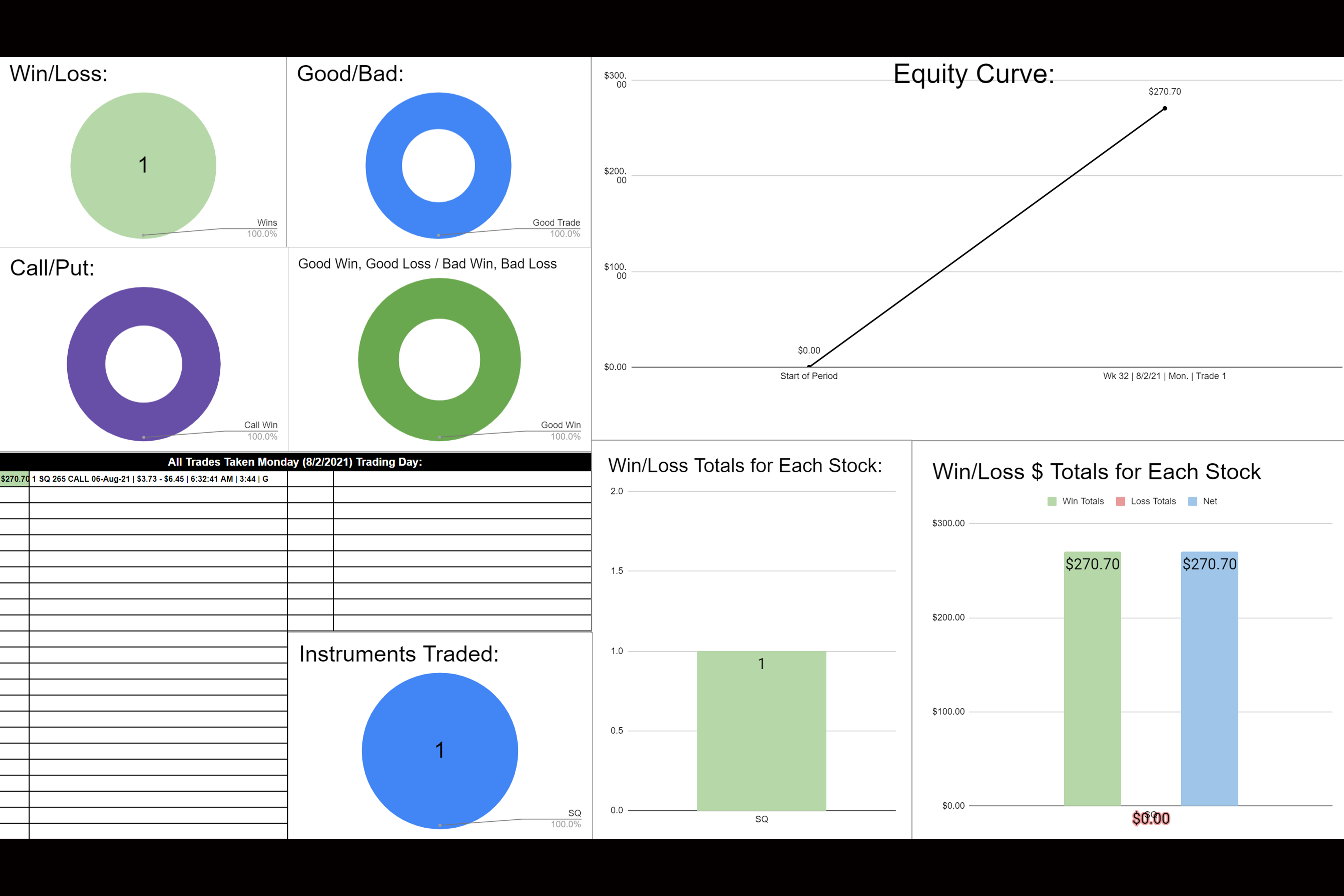

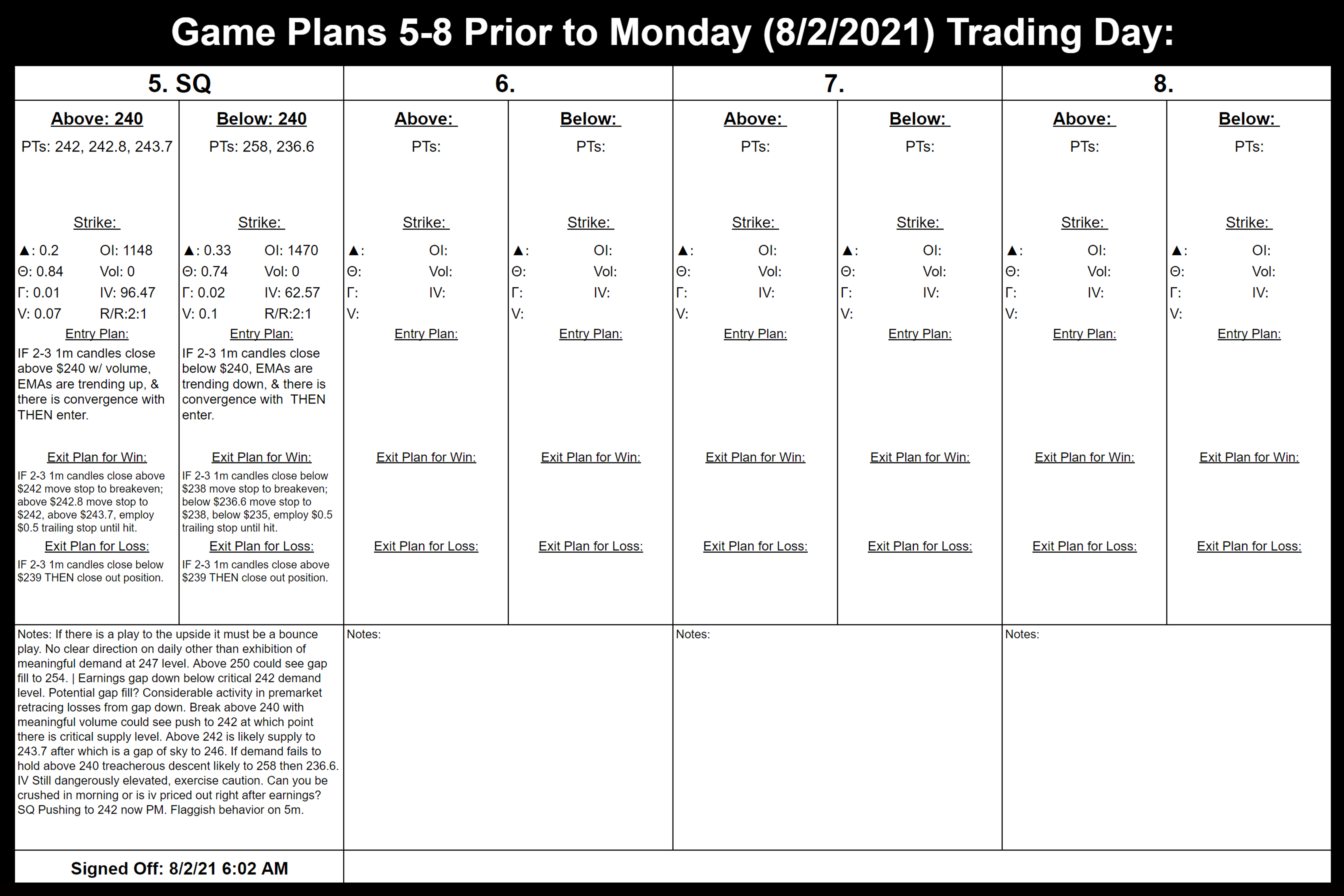

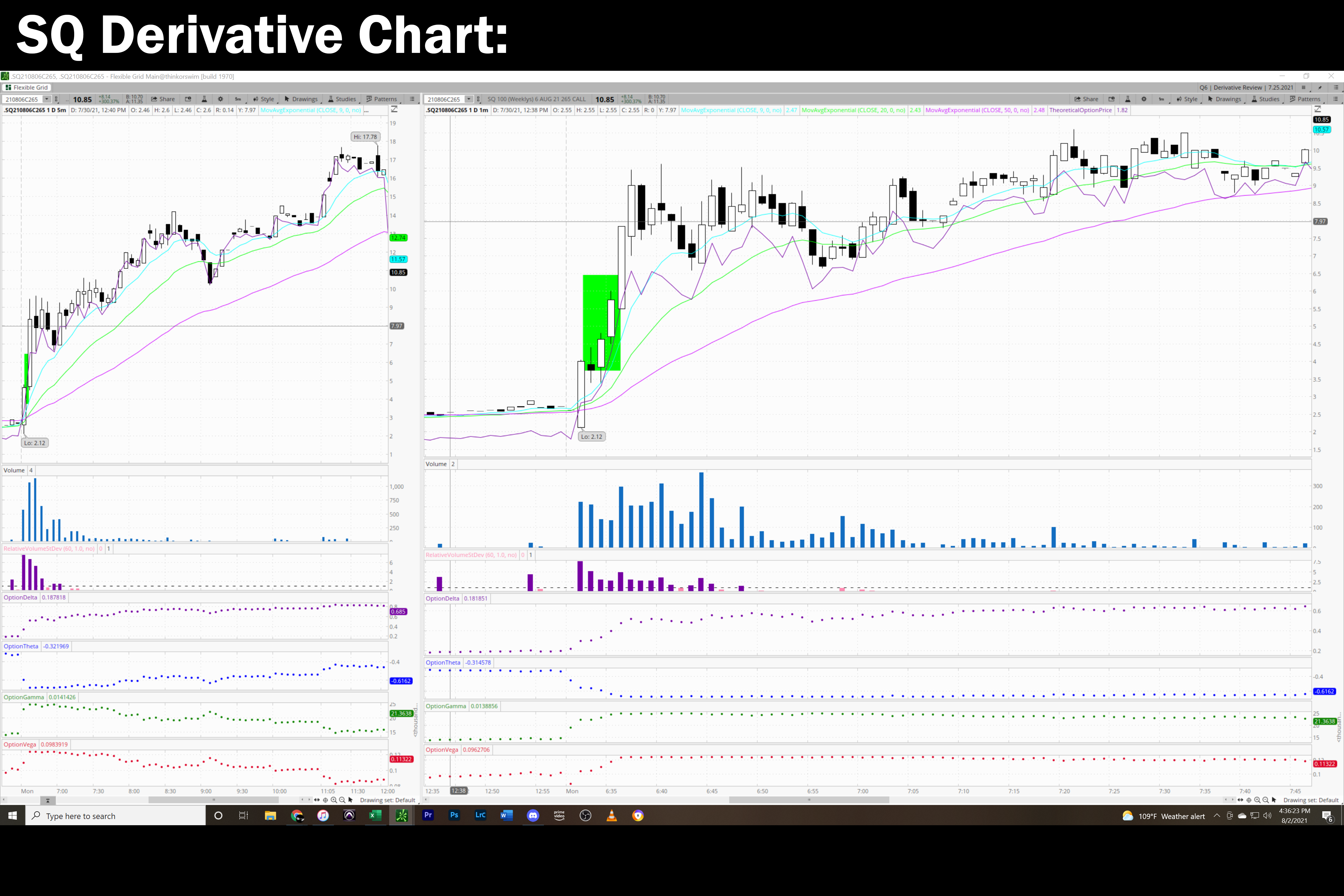

Trade 1 (SQ | $270.70 | 72.57%):

–Entered Because Saw SQ Pushing with extraordinary volume pre-market above key level I’d charted, tried to get in right at open but my market order sat for over 15 seconds without being filled. I was afraid I’d get filled at a crazy IV surge price, so I canceled the order then got back in two minutes later when i saw the price holding above 251.5 key level I had.

–Exited because my next significant key level was approaching & I wanted to protect profits. I wanted to sell into strength, did not want to hold through any deliberation demand might encounter at that level. I set a limit order near that key level with the hope that a surge up to that point would fill me. If I had been trading with multiple contracts this is where I would have sold off 60%-70% of them and held the remaining 40% to my next key level.

–Trade 1 Mistakes: Did not adhere to your Exit Plan. No Technical sign to sell; Panic Sold. Did not plan for extraordinary circumstances. There was no sign to sell, not even on one minute. You protected profits yes but at the cost of considerable upside. This may be a problem you can’t meaningfully address until you begin trading with multiple contracts. This was a problem of scaling out. You took profits at a reasonable level for the one contract you were in, and you captured a healthy move. You could not have predicted what was going to happen next and your execution—placing a limit order near the next level of significant supply—was sound. Especially considering the divergence this stock was having with QQQ, it was unknowable if the 262 supply level would have completely absorbed the demand & sent the price back down, pushed through completely, as it was. You exited without following your plan. Your plan was to wait for two candle closes below most recently surpassed level. You did not adhere to this plan. What’s been working for you is placing limit orders at imminent key levels and letting bursts of demand push into them. Whatever the 1 minute ATR is that should be THE MINIMUM amount you’re looking to & planning to capture. Any less than that is not giving the stock room to move. You did not plan adequately for SQ, you did not anticipate that if could move as much as it did. It surged in pre-market after you had completed your game-plan, negating the entry signals you’d initially outlined, the criteria you had were far too restrictive. Third Mistake, Could have left my initial order in, would have likely got better fill. Cancelled it out of fear I would get some insane IV Surge fill & then be behind the game. While this may likely have been what would have happened, there was no indication from the chart that the stock was going to go down. “If the reason you’re buying the stock hasn’t changed don’t get out”.

–Trade 1 Successes: I protected significant profits. I held on through some discomfort, I traded levels, I followed the plan that I’d made for the trade and capitalized in a meaningful way. This is my biggest single scalp trade to date, and I walked away with a win. I’m finding myself teetering on regret for this trade, but given the current status of my trading wherein I’m using only one contract, I feel the actions I took were appropriate. Yes there was more to be had on this trade, but I had planned to scalp, I had planned to be in and out, and that is what I did. |

–The better trade would have been trading with multiple contracts & scaling out of them on the ascent that this stock had.

-Trade 1 Key Takeaways: You must refine your Game Plans for Taking Profit | Your game plans for how to take profits are not up to date, and a bit flawed. You need to refine your game plans for taking profits. you need to begin experimenting with multiple contracts and scaling out. Taking profits at levels is sound, but you’re getting frustrated at the remaining upside you’re missing. Right now your strategy for exiting has been to place limit orders near the next key level, counting on surge of FOMO buyers to fill your order and enable you to walk away with profit. This has been working but you must refine this. –Begin experimenting with trading on larger time frames As per your plans you’ve been scalping, which is good, & you’ve done well to abide by your plans. But by only scalping you’re leaving a massive majority of a profitable move on the table. This is fine for the beginning, but just keep awareness that the future must entail you practicing capitalizing on larger moves.

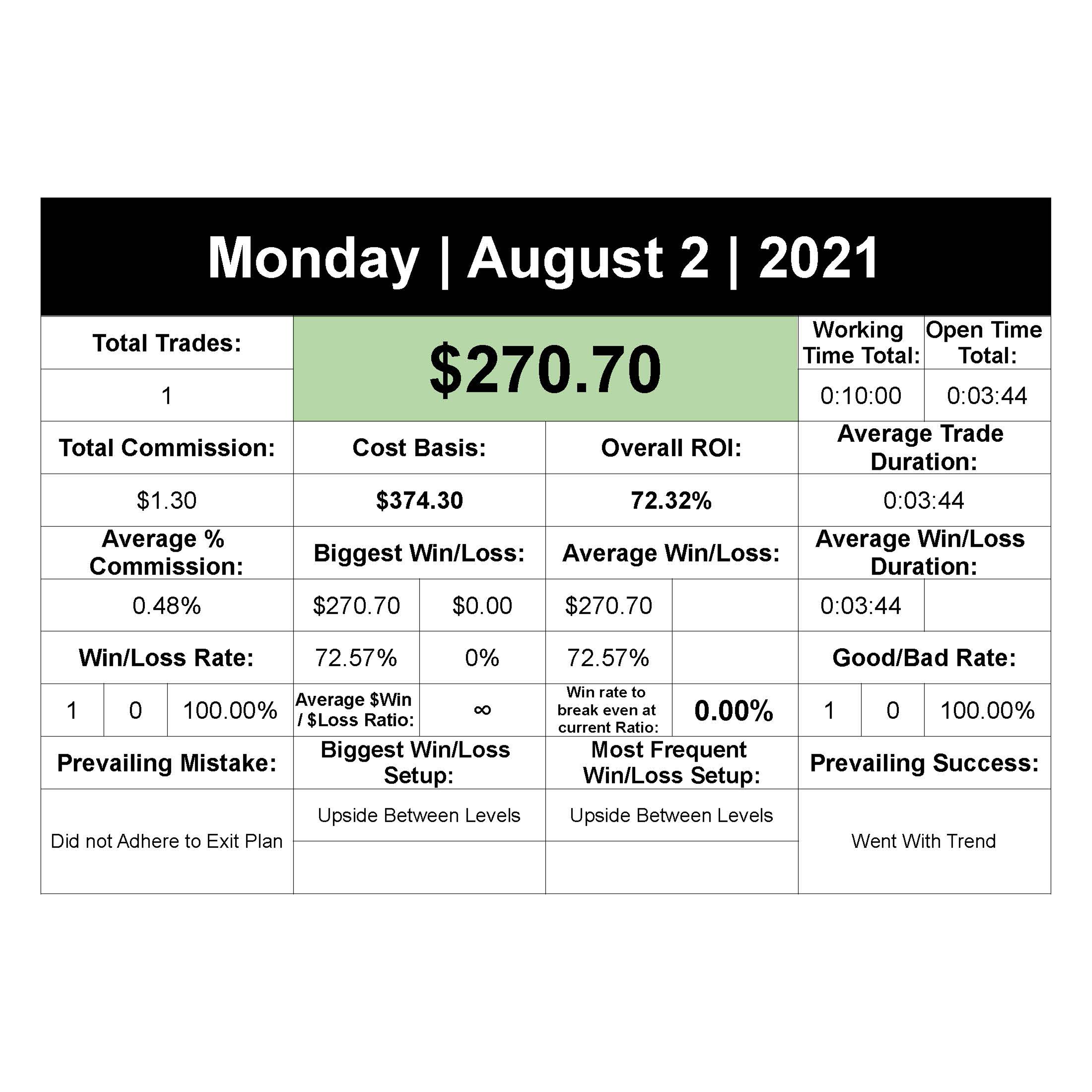

8.2.2021 Statistics:

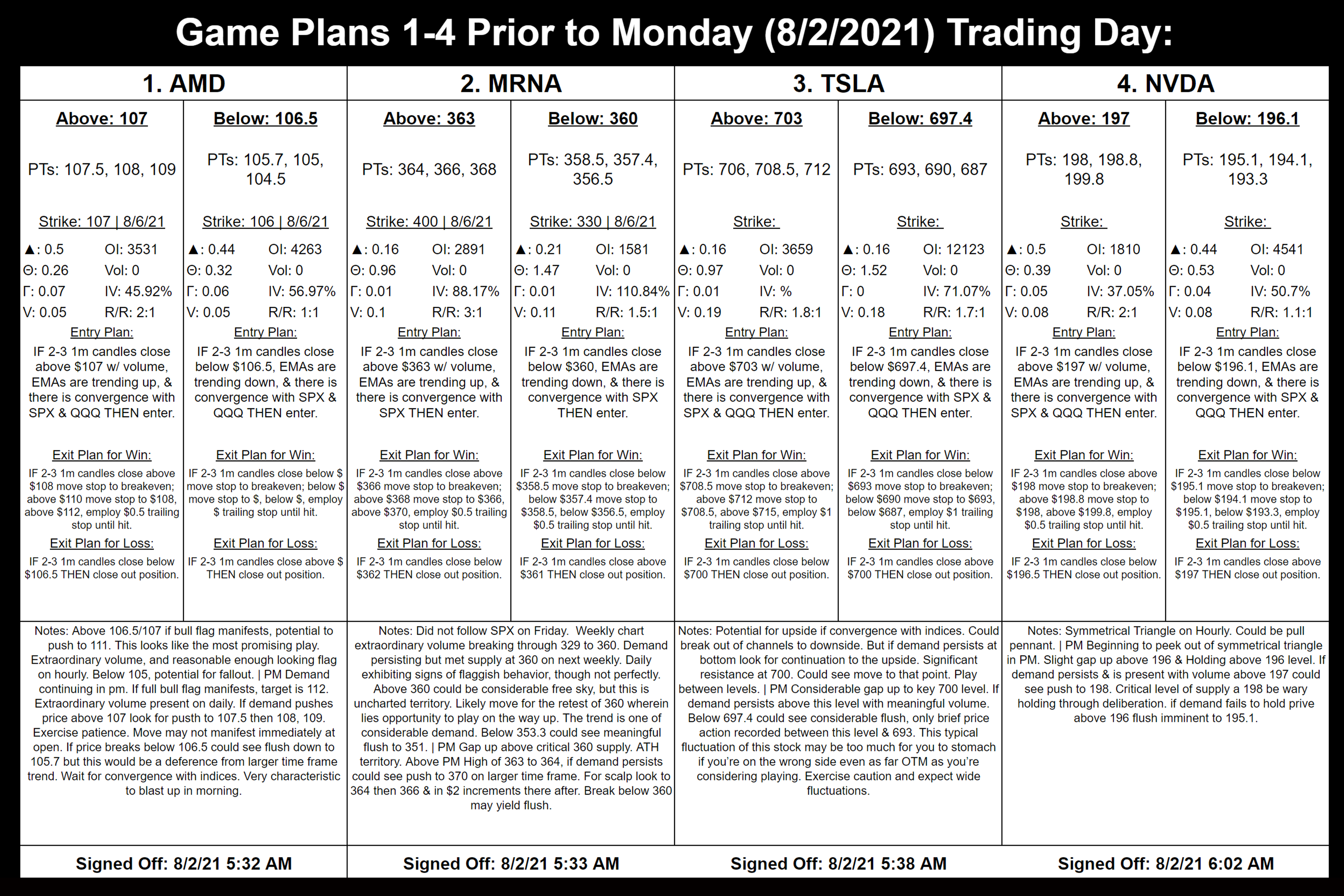

8.2.2021 Game Plan: