Key Takeaways | 8.12.2021 | Thursday

- The most efficient use of time is to trade flawlessly to the extent that you know how.

- Scalping between levels in the direction of a larger trend is a viable strategy.

- Only execute on the crème de la crème.

- Consider the context of the overall market & the issue’s place in the grander ecosystem before trading.

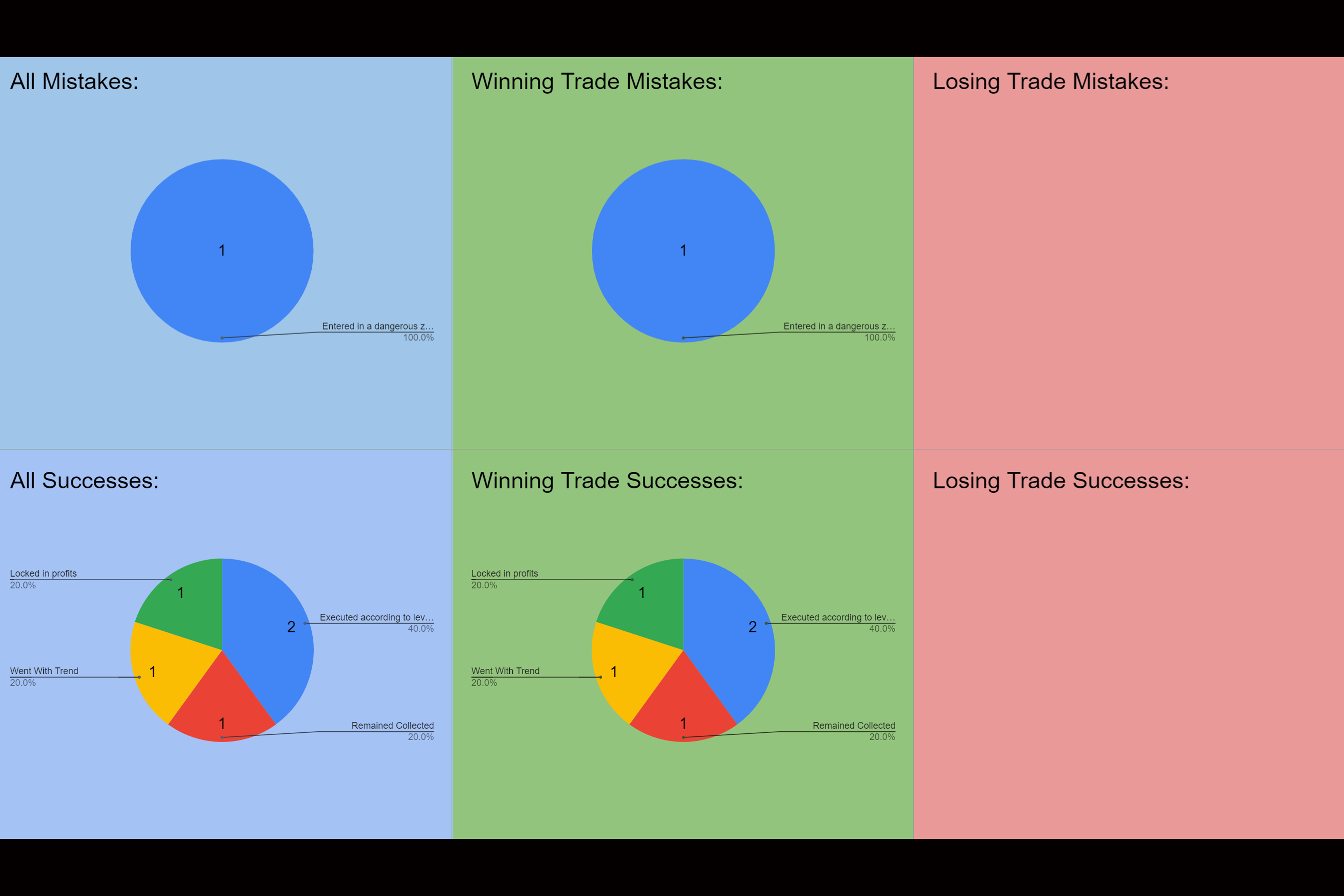

Mistakes | 8.12.2021 | Thursday

- Failed to consider the greater market context before entering trade.

Successes | 8.12.2021 | Thursday

- Titanium Terry T’s.

- Held through pullback with reasonable justification.

- Exited on signs of weakness.

Activity Log | 8.12.2021 | Thu. | 3.45 hrs

- Charted

- Game Planned

- Traded: 8.12.2021

- Organized: Activity Log

- Studied: Optionhub, Money Flow, Order Flow

Organized activity log at different coffee shops while doing Lyre Raven work. Took advantage of time working from laptop & studied option hub. Studied Order flow & Money flow & got more thorough understanding of both graduating to conceptualized stage and beginning to inch into understood stage of stages of understanding.

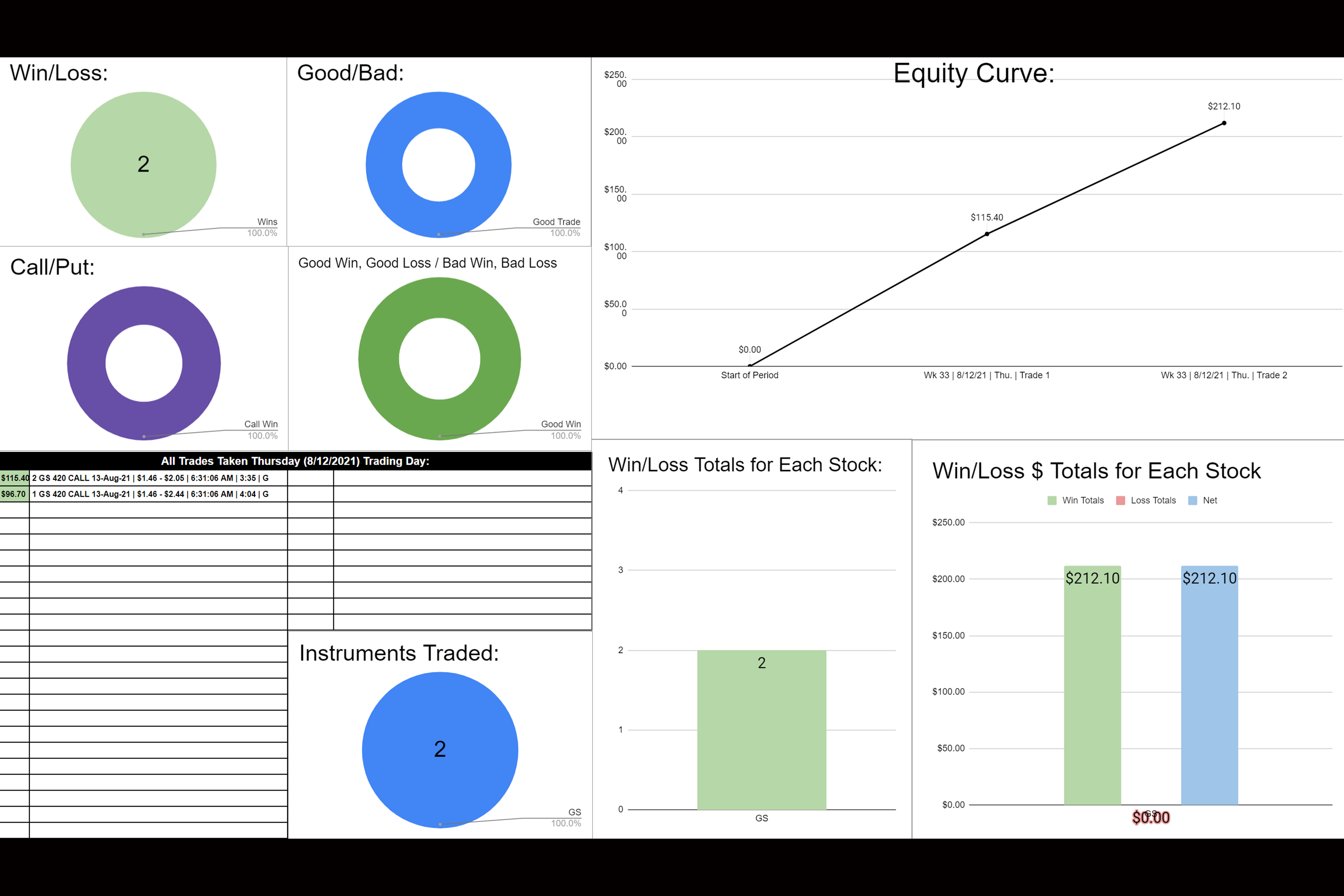

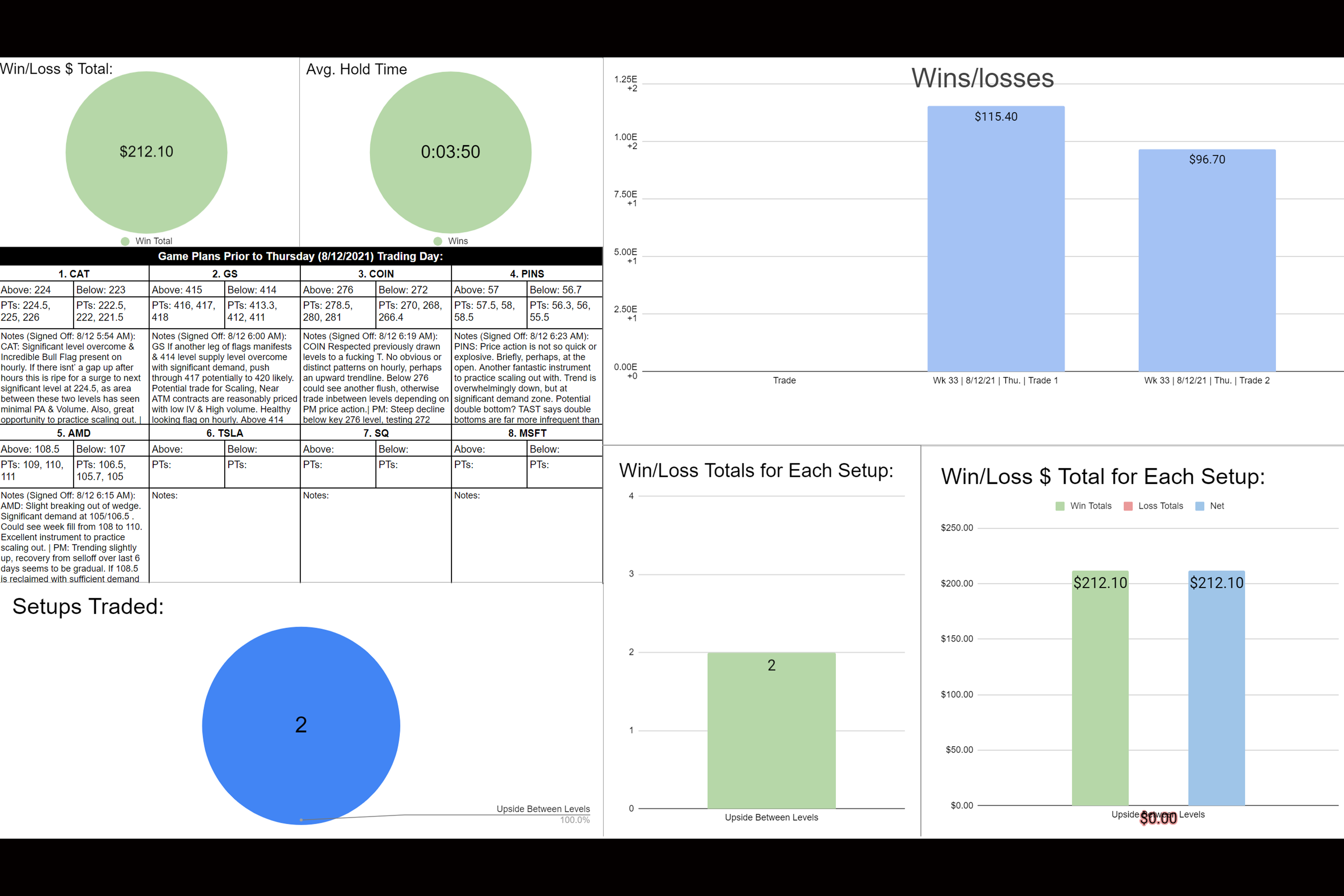

Trade 1 (GS | $115.40 | 39.52%):

-Entered Because Saw GS break above & hold 415 level I’d charted previously, EMAs were in favor & larger time horizon trend was in favor of direction I was playing.

-Exited because My first level was reached and I wanted to—& had planned to—lock in the first phase of my profits.

-Trade 1 Mistakes: Not considering the context of the overall market, which was beginning to sell off. The only mistake (if it can be called that) was trading what turned out to be the very top of a larger move. Not sure this can be helped. The greater trend was bullish. I could not have known beforehand how much further the trend would or would not go, and I traded cautiously on a small leg of the trend—exiting before a massive level—which was my plan & my goal. But this is to be considered, how can one determine if a larger move is ‘over extended’? Is there such a thing & is it possible to anticipate? For weeks now I’ve been watching moves play out, where I’m certain there’s no way they can keep running or dumping, and almost every time I’m proven wrong, and the ‘overextended’ trend extends even further. I’ve missed out on more money sitting out of moves for fear of them having reached their climax than I have lost on moves that I got in on a strong trend & got caught at the moment of reversal. The trend is your friend until it ends. Do not be deterred. The chances that you buy the exact climax of a move are less likely than getting in at some point in the middle, especially with the quick scalping strategy you’re employing. When you begin to trade on larger time frames you can revisit this potential issue.

-Trade 1 Successes: I addressed previous shortcomings by holding through some dips. I was not a peewee paper hands weenie. I was disciplined at the pullback, I let the EMAs on the 1 & 5 min guide me and reassure me that the trend was still intact, and that a break below these lines MAY indicate a switch in sentiment, but not to fret otherwise. In doing so I was able to hold through to a profit. I took profits at my predetermined level, selling into the final surges of strength. I waited for confirmation above key level for entry and sold at next key level, I followed my plan & was calm & collect throughout. I had the wind of the trend at my back on larger time frames, I gave time for the price action to hold before entering and scaled out at an appropriate level based on the planned trade style. Sold into strength, sold likely to those chasing the move, was cognizant of this & leveraged what I imagine was FOMO of others to lock in my own profits. (Be careful with this speculation, this ‘mind reading’, I don’t exactly know what was happening on the other end of my trade, only the levels that have been established & respected over time.) I’m tempted to say this is my best trade to date. I am thoroughly proud of this trade.

-The better trade would have been… For what your plan & strategy were, there wasn’t much of a better trade you could have taken with this instrument. You could have anticipated a sell off later had you been paying more attention to the indices—you could have exercised more caution accordingly. Maybe the better trade would have been not taking this trade, given the divergence with the indices. Later in the day, there was a massive flush and the greater move of the day was bearish, but this manifested later & your plan had been to take a quick scalp at the open between levels in the direction of the greater trend—which at the time had been established as bullish on larger time frames. You happened to buy & sell out at nearly the exact top, and so there is not much more you could have done better.

-Trade 1 Key Takeaways: You must pay attention to the trend of the overall market & understand the context within which the instrument you’re trading operates in the grander ecosystem of the market. Stack trends & confirmations in your favor and only execute on the crème de la crème. Trade well so that you don’t have to do such thorough reviews and can thus trade more. Trade well because you don’t want to have to work so hard; trading poorly makes more work for you.

Trade 2 (GS | $96.70 | 66.23%):

-Entered Because Same entry as first trade -Exited because Next key level had been surpassed & price began deliberating. Wanted to protect profits at this tenuous zone & walk away green

-Trade 2 Mistakes: Could have had a limit order at a target set rather than a trailing limit but being that this was your trailing contract a trailing limit was reasonable.

-Trade 2 Successes: Got out while I was ahead, locked in profits, anticipated deliberation & reversal & exited. Sold into strength. Certainly my best scale out trade to date, though I’ve only executed a few so far. |

-The better trade would have been Turning around and playing the downside would have been a way to get more out of this instrument, but that was not your plan and so not applicable for consideration in this category. There was only $12 more of upside to be had, I sold near the exact top, of not just this short move, but of the grander trending move over the course of the last.

-Trade 2 Key Takeaways: This trade presents further evidence of the validity of levels & of the viability of your strategy of scalping between them. You were playing at the top of a grander move, but still were able to walk away profitably because you acknowledged, respected, & leveraged the action within the supply & demand levels. |

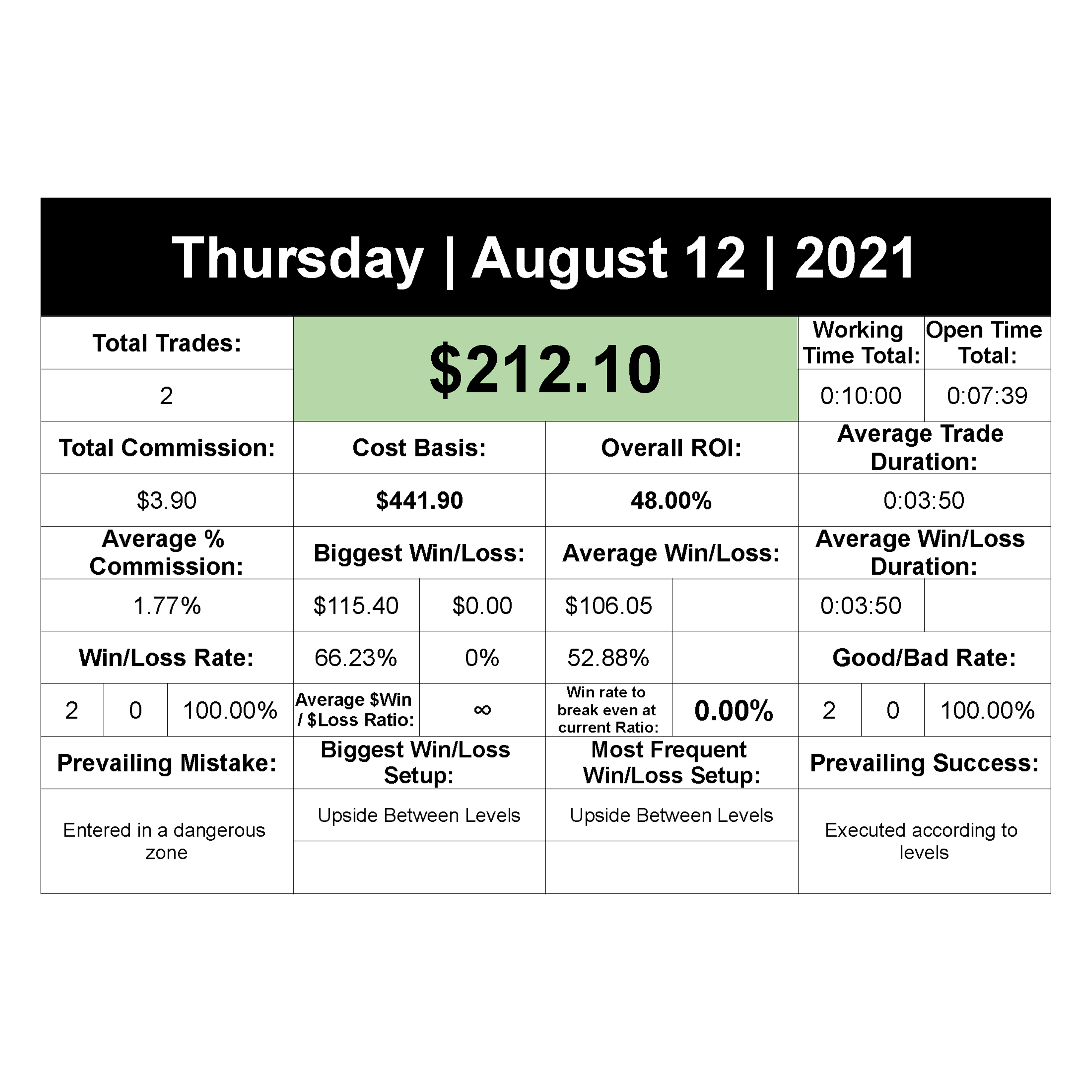

8.12.2021 Statistics:

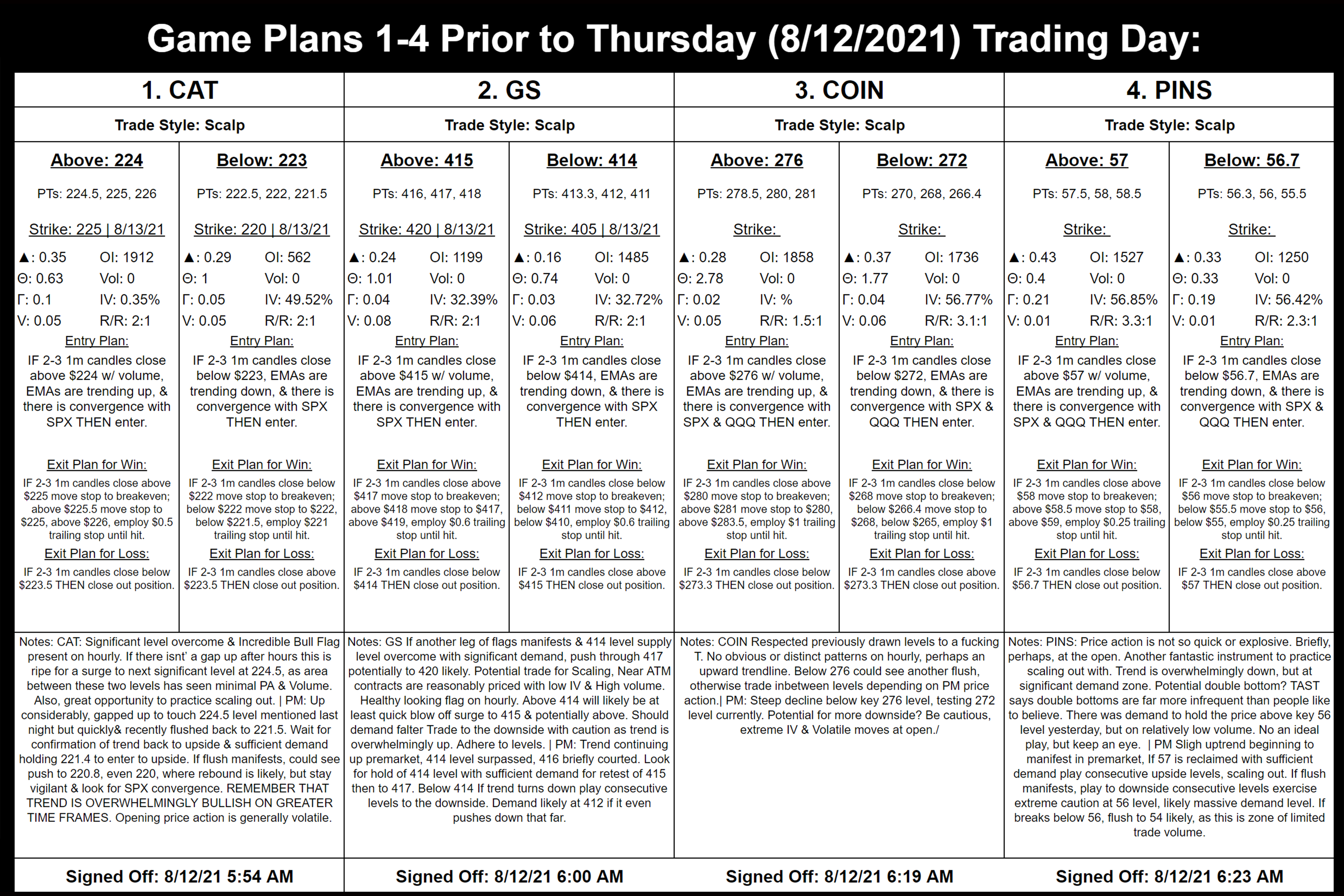

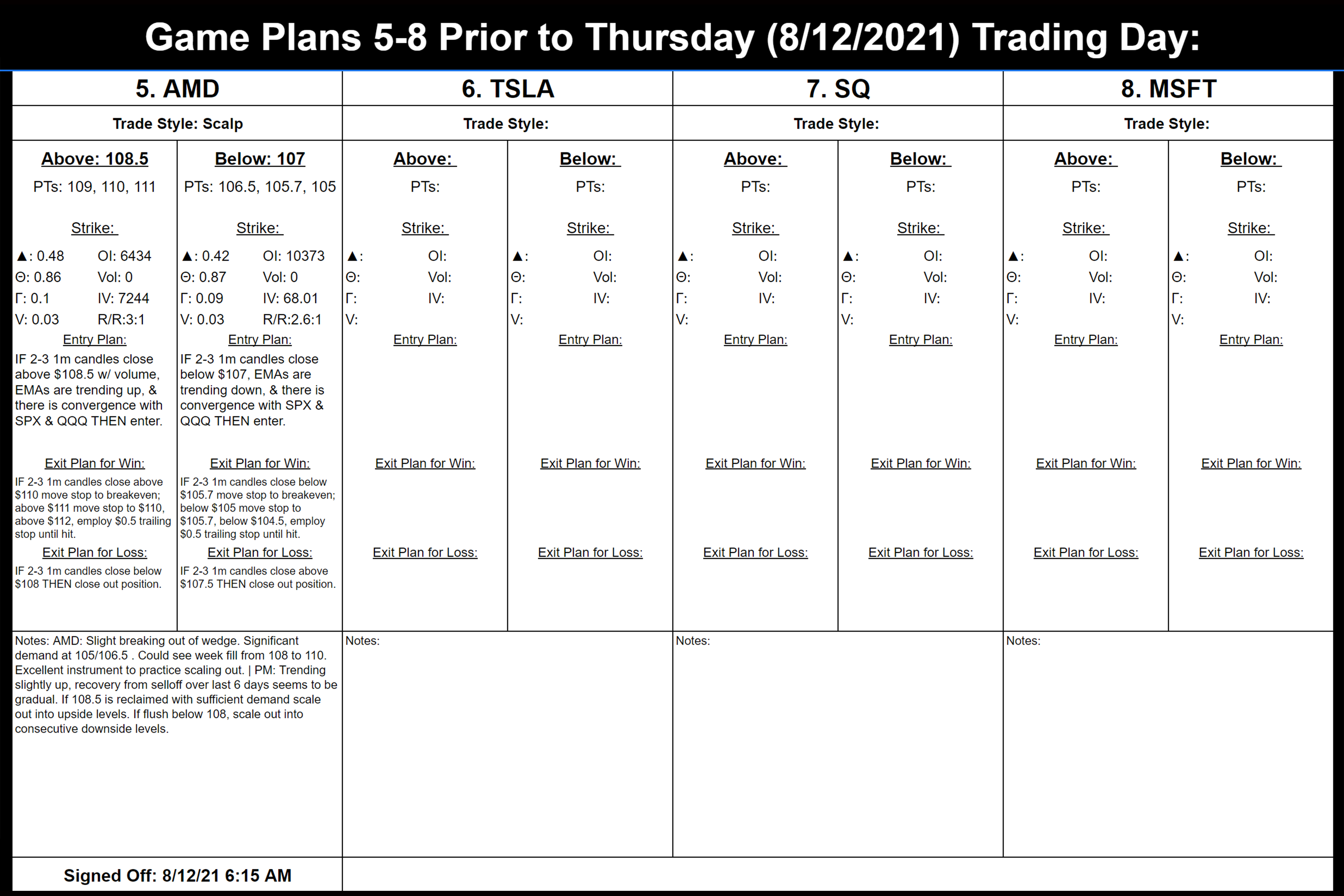

8.12.2021 Game Plan: