Night Before Game Plan:

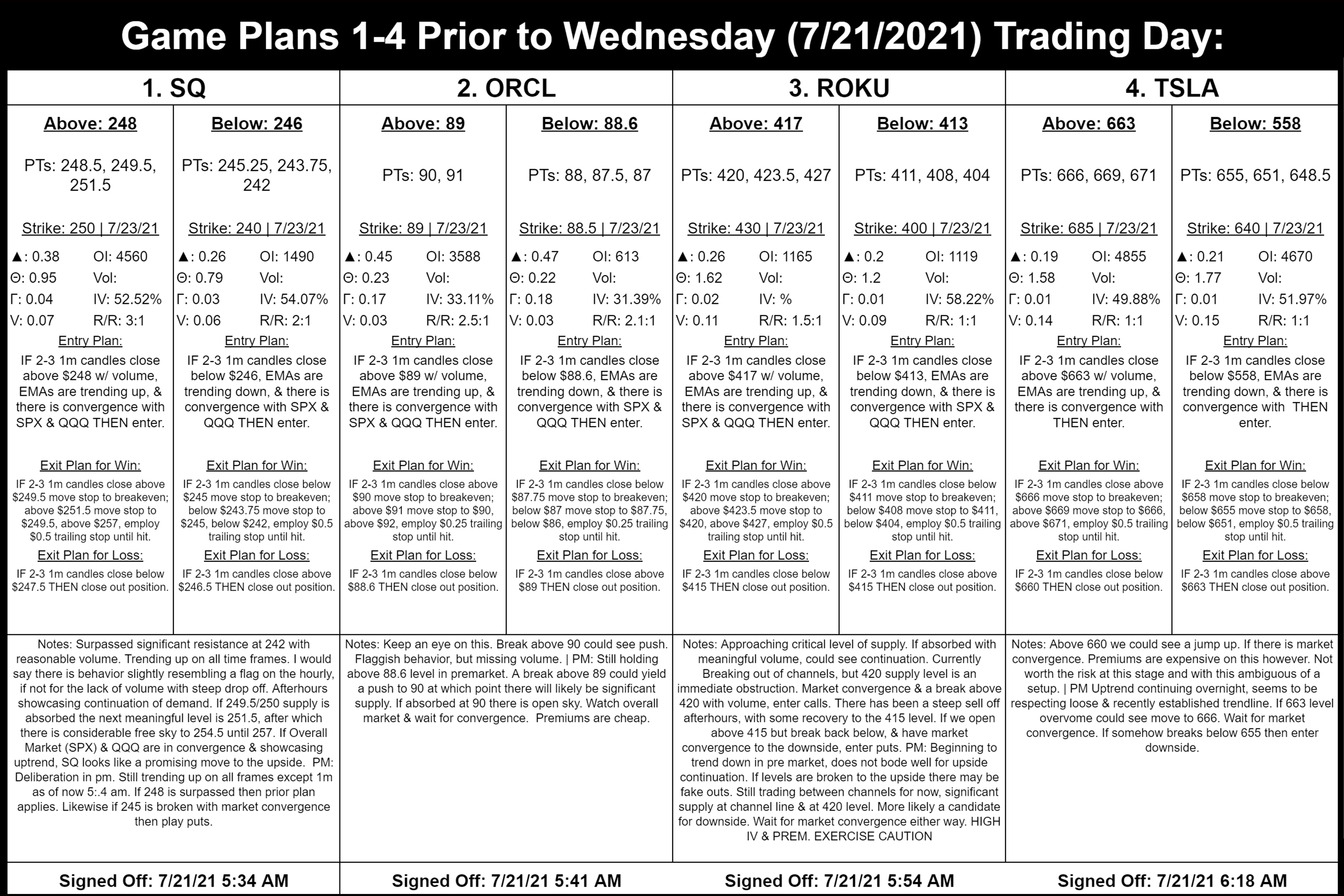

Sq: Surpassed significant resistance at 242 with reasonable volume. Trending up on all time frames. I would say there is behavior slightly resembling a flag on the hourly, if not for the lack of volume with steep drop off. Afterhours showcasing continuation of demand. If 249.5/250 supply is absorbed the next meaningful level is 251.5, after which there is considerable free sky to 254.5 until 257. If Overall Market (SPX) & QQQ are in convergence & showcasing uptrend, SQ looks like a promising move to the upside. PM: Deliberation in pm. Still trending up on all frames except 1m as of now 5:.4 am. If 248 is surpassed then prior plan applies. Likewise if 245 is broken with market convergence then play puts.

Above 249.5 to 251.5 With indices supporting move.

ORCL: Keep an eye on this. Break above 90 could see push. Flaggish behavior, but missing volume. | PM: Still holding above 88.6 level in premarket. A break above 89 could yield a push to 90 at which point there will likely be significant supply. If absorbed at 90 there is open sky. Watch overall market & wait for convergence. Premiums are cheap.

ROKU: Approaching critical level of supply. If absorbed with meaningful volume, could see continuation. Currently Breaking out of channels, but 420 supply level is an immediate obstruction. Market convergence & a break above 420 with volume, enter calls. There has been a steep sell off afterhours, with some recovery to the 415 level. If we open above 415 but break back below, & have market convergence to the downside, enter puts. PM: Beginning to trend down in pre market, does not bode well for upside continuation. If levels are broken to the upside there may be fake outs. Still trading between channels for now, significant supply at channel line & at 420 level. More likely a candidate for downside. Wait for market convergence either way. HI IV. BE CAREFUL

DOCU: Broke above strong 290 supply level. If it can take out 304 with volume, room for upside to 306. Below 300 if there is market convergence. PM: Faltering in pre market. Broken below 300 level from 304 at close yesterday.

BA: Continuation to upside from shellac down last week if market continues rebound.

TSLA: Above 660 we could see a jump up. If there is market convergence. Premiums are expensive on this however. Not worth the risk at this stage and with this ambiguous of a setup. | PM Uptrend continuing overnight, seems to be respecting loose & recently established trendline. If 663 level overcome could see move to 666. Wait for market convergence. If somehow breaks below 655 then enter downside.