Key Takeaways 6.9.2021:

-Need to be faster identifying choppy price action & trading defensively accordingly.

-Need to protect larger percentage of paper gains. Must establish more explicit rules to protect profits. Did better today than last week. Don’t let Greed affect your Green.

-Trust Your Levels. Give trades time & room to fluctuate. You put in the time & executed thorough analysis; have faith in it.

-Establish EXPLICIT candle by candle criteria for when to exit/enter. Setup closer view of 1 min chart.

Trade 1 (ROKU | $15.70 | 4.64%):

-Entered Because Roku broke above planned 342 level and was holding, EMAs were trending to the upside, SPX & QQQ convergence & above EMAs

-Exited because placed a limit order near my entry order to protect paper gains should the price fail to continue its ascent, which it did. Price action was choppy, unable to break above next key level.

-Mistakes: I could have been more vigilant protecting paper gains, wanted to give trade room to work out but I missed 75% of potential profit I could have taken had I exited at the highest point while I was in the trade. Capturing 50% would have been a better success.

-Successes: Entered decisively, had thorough gameplan with entry & exit criteria & adhered to it. I did well in protecting profits after learning from mistakes of last week: Breakeven is better than a loss. All criteria in gameplan were met, But I hesitated to enter because initial break of my level was on opening 1 minute candle, & price action is often erratic, unpredictable, with poor fills which gave me pause. Perhaps I shouldn’t have hesitated to enter.

-The better trade would have been Protecting more of my paper gains & getting in a little bit earlier, perhaps right at the open, but the chaos of the open seems—more often than not—to be more harmful than beneficial. I may need to re-evaluate this perspective. When I have a winning position, I need to protect it. I need to define what ‘Winning’ position means and establish more explicit rules for protecting profit & when I should take the money and run.

–Key Takeaways: Need to be faster identifying choppy price action & trading defensively accordingly. Need to protect larger percentage of paper gains.

Trade 2 (NVDA | -$41.30 | -19.39%):

-Entered Because Level had been broken below, ema’s were trending down & had convergence in QQQ & SPX. Indices were below ema’s as well.

-Exited because price crossed above level I’d planned to take my exit at, but I was watching 1m chart on too small of a frame & the distance seemed more significant than it was so I got shaken out without strong confirmation. I didn’t see that only 1 candle had closed above the level. I should have given it more space. I followed my plan, but not explicitly in that I did not allow adequate confirmation of loss.

-Mistakes: Did not have PATIENCE with price action. Did not trust my levels & did not have more explicit/precise plan for what criteria justified exiting. I did not have explicit plan laid out for how many candles I’d tolerate closing above stop level before exiting and I panicked, I didn’t have chart zoomed in enough to even SEE how many candles had closed above, & I also didn’t have exit levels well thought out based on imperfect entry, which is something I need to consider making contingencies for. I didn’t give the trade room to work out and as a result basically bought the top and sold the bottom. I was in a good trade. The likelihood that I’d bought the exact a reversal was low, but nevertheless I let the fear of that being the case get to me. Stop expecting you’ve entered the exact reversal point, especially when you have multiple confirmations in your favor. Be prepared to handle WIDER fluctuations, you are still getting psyched out by larger trade size, but this trade performed beautifully within the levels you’d set out. TRUST YOUR LEVELS!!!!

-Successes: I had a good entry, I followed my plan for entry, and I remained calm. I did also follow my plan for exiting but not with the proper precision it necessitated. Need to have closer view of 1m chart and have TOS charts automatically align to be zoomed in.

-The better trade would have been having conviction in the trade I was in, for one, there was no meaningful close above the planned levels to warrant an exit & what played out was a typical bounce off the ema’s which I should have anticipated & endured. What could have been even better would have been an earlier entry. My first level was broken through at the open but out of fear of losing out, fear that I’d be chasing & that I’d missed the move, I hesitated. At the time there was not clear convergence with the indices, which also gave me pause. I was hesitant entering a move that was diverging from the overall market at that time.

-Key Takeaways: Trust Your Levels. Give trade time & room to fluctuate, have EXPLICIT criteria for when to exit/enter. Setup closer view of 1min chart if you’re going to be trading based off it so you can act on explicit plans. Have one chart zoomed in closer on 1 minute chart so you can be more precise with your decision making. TRUST YOUR LEVELS. Price reacted almost perfectly to the levels you’d charted and had you had more patience & faith and let the price action play out, just waiting for even 2 candles to close above level you’d resolved to take your loss at, you would have stayed in this trade and been profitable.

Trade 3 (NVDA | $44.70 | 20.6%):

-Entered Because Price was breaking below planned level, ema’s were trending in downside direction, & there was convergence with indices SPX & QQQ

-Exited because I wanted to protect profits & there was considerable deliberation taking place at 692 level on chart & tape. Demand was holding level on NVDA & indices were beginning to reverse which prompted my exit.

-Mistakes: Selling out of the last position that was going in the same direction. I should have stayed in this move from earlier and saved the commission & slippage I shelled out getting back in.

-Successes: I acted on multiple confirmations, I traded my levels, and in the middle of the trade I, out loud, calmed myself, just saying trust the levels. I’d done everything that I could to prepare and I came to terms with the truth that it was out of my hands at this point & I had to just react to the charts. Just let it play out and follow my plan, which I had crafted in thorough detail.

-The better trade would have been getting in earlier. I did well enough protecting profits & respecting levels on this trade but there was more to be won had I entered on one of the first level breaks.** -Key Takeaways: Same as last trade: Trust your levels & commit to them. set up charts so you can more closely see what is happening on the 1m level. You put in the time & the analysis, have faith in it. **Also, I was able to actively watch the tape on this one and used it to justify my exit. I was able to see levels present themselves on the tape, watching supply hold price below 293 for some time & I used the insight from the tape to justify my hold & exit.

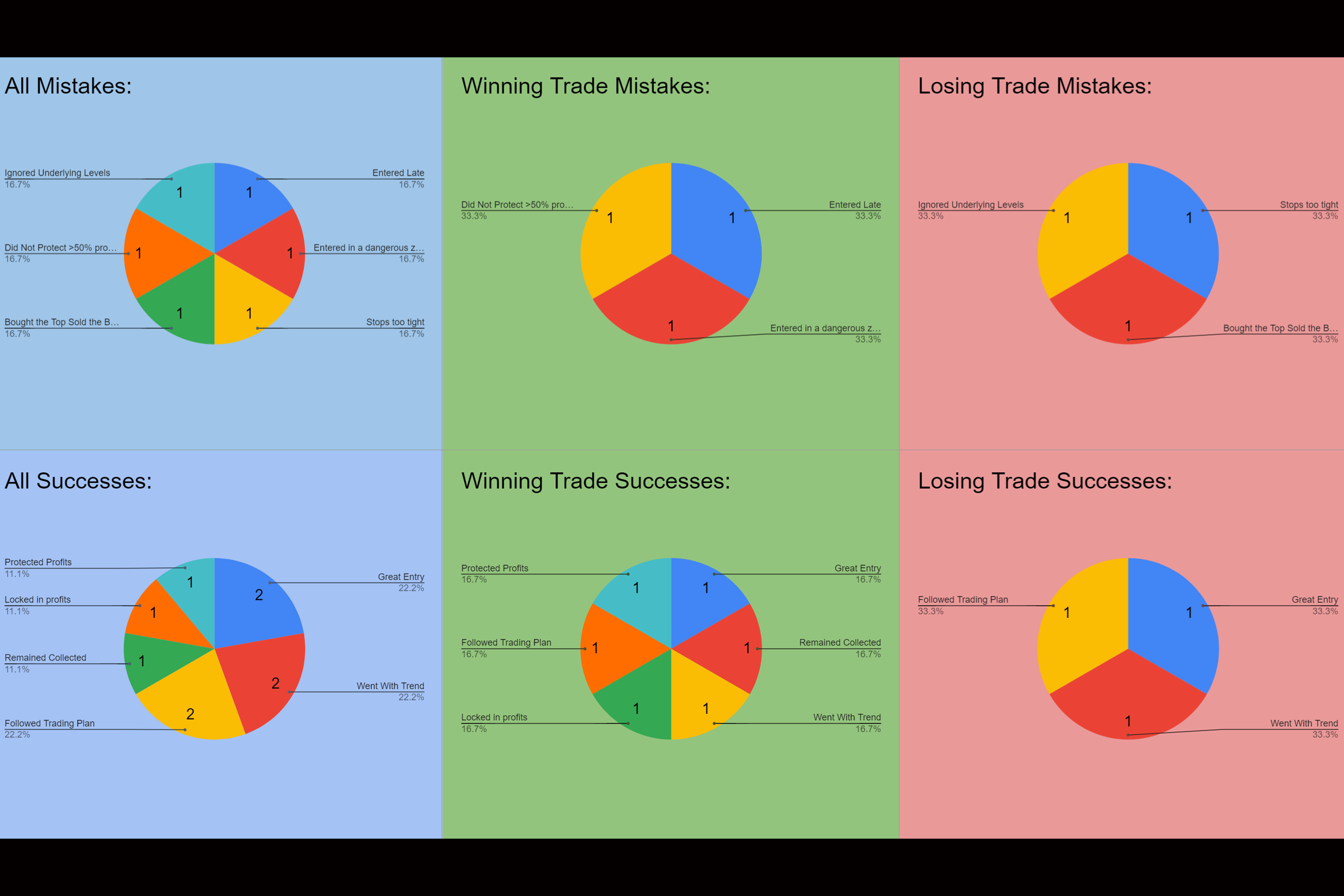

6.9.2021 Statistics:

6.9.2021 Game plan: