Key Takeaways 6.3.2021:

-Break even is better than loss. If you are in the money & past a level there is generally no good reason to let such a trade become a big loss, don’t let greed rob you of green.

-You need to be up a bit earlier to have your game plan more thoroughly established so you have time to think & regulate before market open.

-Be cautious going long when overall market is trending down or in a deliberative state.

-You need to account for imperfect entries when determining your risk to reward ratio during game plan.

-You need to understand & account for the affect IV will have on the option price and try to be on the right side of it.

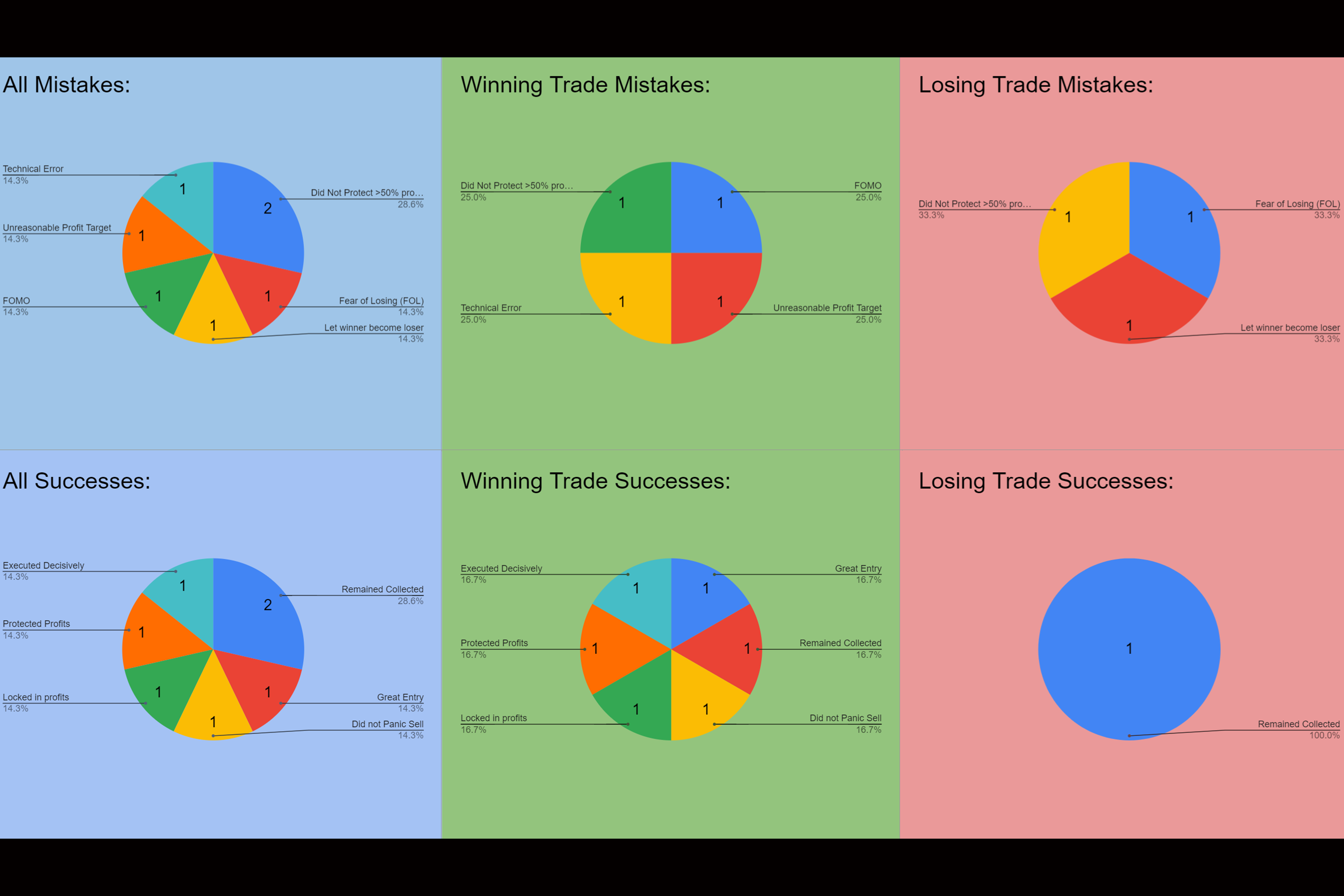

Mistakes | 6.3.2021:

- Didn’t maka a thorough gameplan. Failed to protect profits

- Failed to protect profits. Did not follow Gameplan.

- Fell victim to IV Crush.

Activity Log | 6.3.2021 | Thursday | 631 min | 10.52 hrs

Summary: Charted, Traded, Reviewed Trades (Daily), Posted to Solace Journal, Created Weekly Activity Log, Created Daily & Weekly Key Takeaway Journal, Updated & Refined Data Journal.

Updated charts for PM, created game plan for trading day in a rush. Traded (60 min). Organized desktop, organizing/archiving/cataloging content from prior day trades. Remuxed past trade videos from 5.20.21 Added activity log text to insta posts & finished adding 5.27.21 text to insta. Created Weekly Activity log journal. Created Daily & Weekly journals for dumping all individual key takeaway daily overview content for easier viewing.

Changed Volume section in gameplan to $ at Risk. Updated data table labels & Created calculation to estimate dollar risk based on delta. Did trade review of day’s trades. Added % win/loss of trade, key takeaways & what would have been better trade to formula pulling data from modules to columns & compiling it in one place. Finished trade review of day’s trades & Posted.

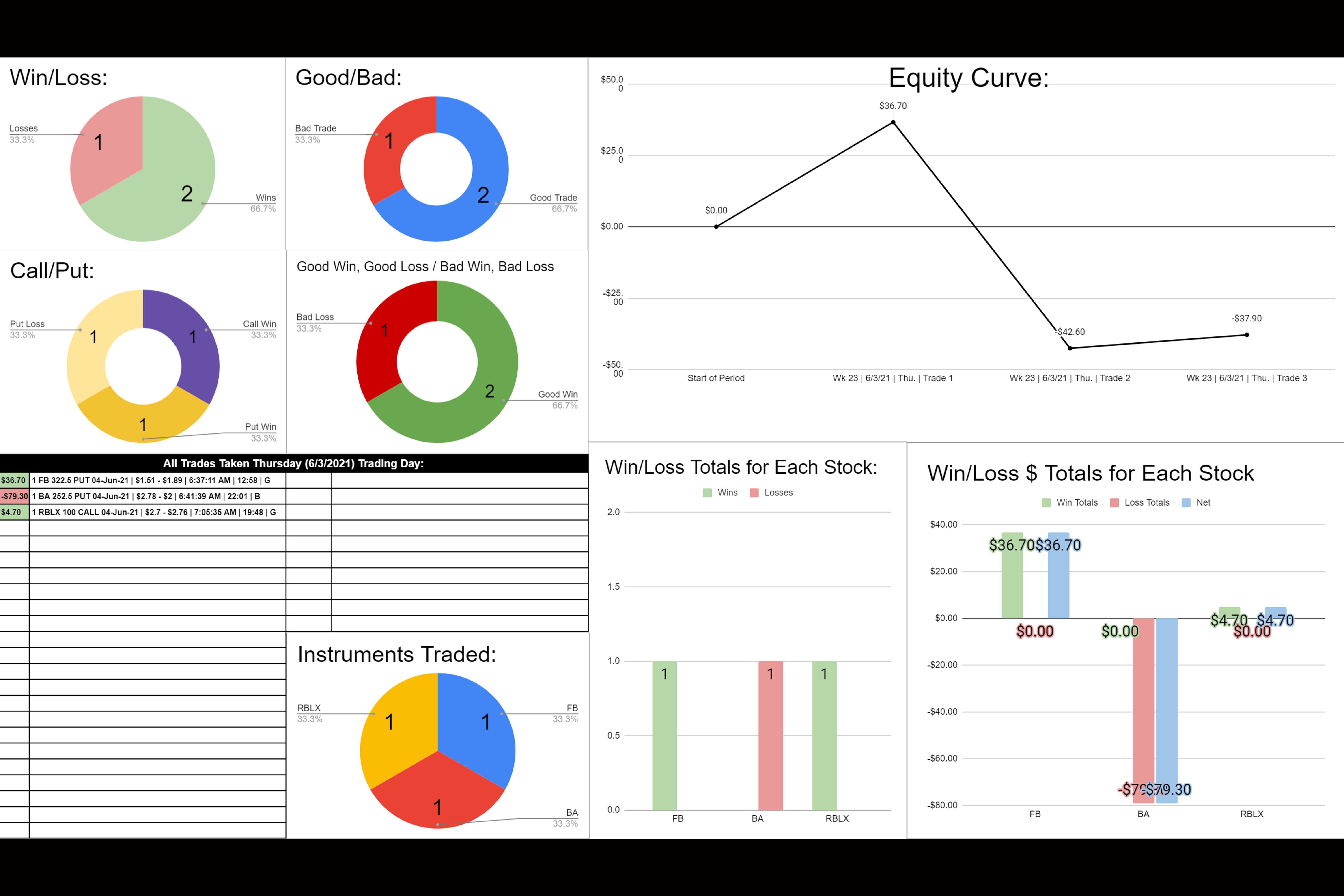

Trade 1 (FB | $36.70 | 24.3%):

-Entered Because saw massive flush below 325.18 level with convergence with spy & QQQ. Did not have explicit entry & exit plans laid out but had charted levels and made night before & morning of gameplan. -Exited because I was in the money, the flush was approaching the next demand level, & I wanted to protect gains. Also, I was in another trade (BA), & did not want to have to monitor two stocks at once.

-Mistakes: Didn’t make as detailed of a plan before hand on this as I had on other issues; impulse buy. Got in for good reasons (Level break, EMAs in favor, indices in favor) but it was partially impulse, saw the flush out of corner of my eye.

-Successes: I had levels updated and prepared, I went with the trend, I had confirmation and I protected profits.

-The better trade would have been: there’s not too much more I could have done. I sold out at almost the exact bottom. I could have entered a bit earlier but that would have been an entry without strong confirmation. I could have locked in more paper profits but having too tight of stops has hurt me before. Solid trade.

-Key Takeaways: Always Protect Profits. Good job not expecting too much out of the move & protecting profits. Make sure to make more thorough game plan in the future, but insight of this trade is that you can paralyze yourself if you have too rigid of a game plan as well. The purpose of being so rigid and excessively thorough in game planning is to refine the skill set for it to become second nature, then you can let off the gas a bit and let the subconscious instinct you’re hopefully curating guide your once it knows what to do.

[9:47 PM]

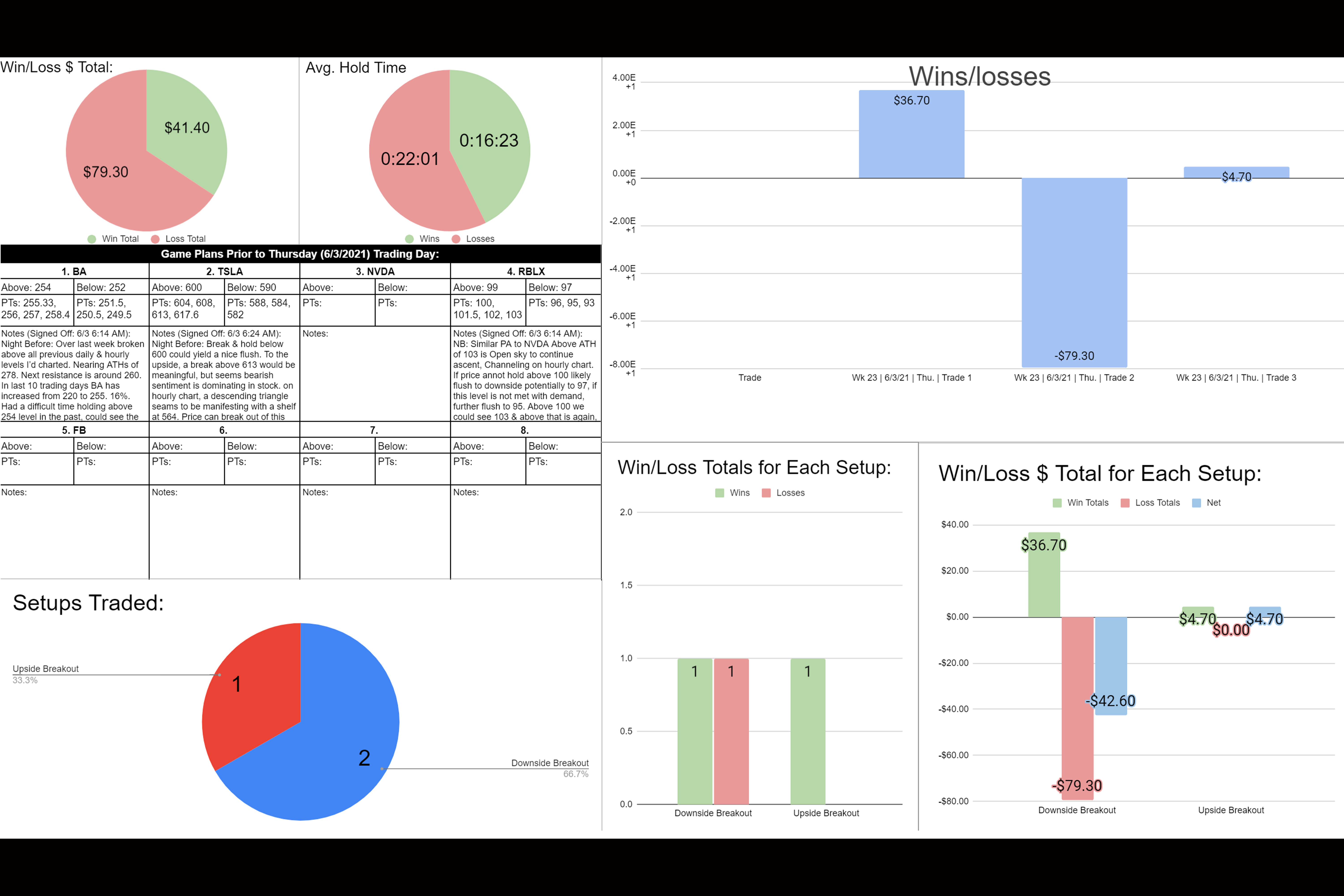

Trade 2 (BA | -$79.30 | -28.53%):

-Entered Because saw the break of the 252 level, EMAs were trending in favor of downside, indices trending down.

-Exited because Stock reversed & closed above my planned exit. -Mistakes: Did not protect profit & did not follow my explicit plan for protecting profits in part because my entry was a bit after the planned break of the 252 level. I need to accommodate for imperfect entries in my plans. While in the trade, I thought I needed to give it more room to work out as the range of chop was considerable & I didn’t want to get ‘stopped out’ based on arbitrary option amount, but my plan of placing a .25 cent trailing stop on the underlying was solid & I should have had conviction in it. Had I done so I would have been able to walk out with this should have been a small win. On the break of the second level I should have moved my stop to the 252 level.

-Successes: I followed my game plan for entry & for taking the loss, but only after neglected the game plan for breaking even. -The better trade would have been: on the break of 251.5 I should have immediately moved my stop up to 252. Break even is better than a loss, and I let this loss get out of hand considering the circumstances. I also should have charted 251 as a level. Dollar levels should be charted. That could have given me some more insight in to where demand would manifest. Also, I think I may have gotten caught in an IV pump on my entry, I got filled at an expensive price on the break of the 252 level and it took a while to recover.

-Key Takeaways: Account for imperfect entries. Break-even is better than a loss—don’t get greedy. Account for how IV crush/pump can affect entries. Consider factoring in 5 period ATR when determining how much room to give stock to fluctuate. Need to figure out how Implied Volatility affects option price. MUST HAVE OPTION DATA PUT UP ON SCREEN RECORDER SOMEHOW TO SEE REVIEW TIME GREEKS.

Trade 3 (RBLX | $4.70 | 1.74%):

-Entered Because RBLX had broken above key level of 100 & was holding, EMAs were trending in favor of upside move, SPX & QQQ were at demand levels & bouncing, though still below EMAs, which should have been a warning. -Exited because my trailing stop was hit

-Mistakes: I think I got caught in an IV Crush & it blew past my active trader limit order. Lost a frustrating amount of potential profit ($15) on slippage during exit of trade and lost $5 in slippage on entry. Could have kept tighter trailing stop but the fluctuations on this were wide and I am still not clear on what best policy for trailing stops on options should be. Need figure this out. All in all this was a decent trade based on entry, but I was robbed by ignorance of what I think is IV, or if not IV then just dog shit fills.

-Successes: Followed plan, entered on reasonable confirmations, held through fluctuations with justifiable technical analysis. Protected profitable status. I should have been out with more profit but got hit with massive slippage ($15).

-The better trade would have been keeping the stops tighter to protect paper profits. Need to learn more about IV, and how it affects option prices; determine if this is what affected the poor fill. -Key Takeaways: Be cautious going long when overall market is trending down. Learn details of IV & don’t get caught in IV crush BS.

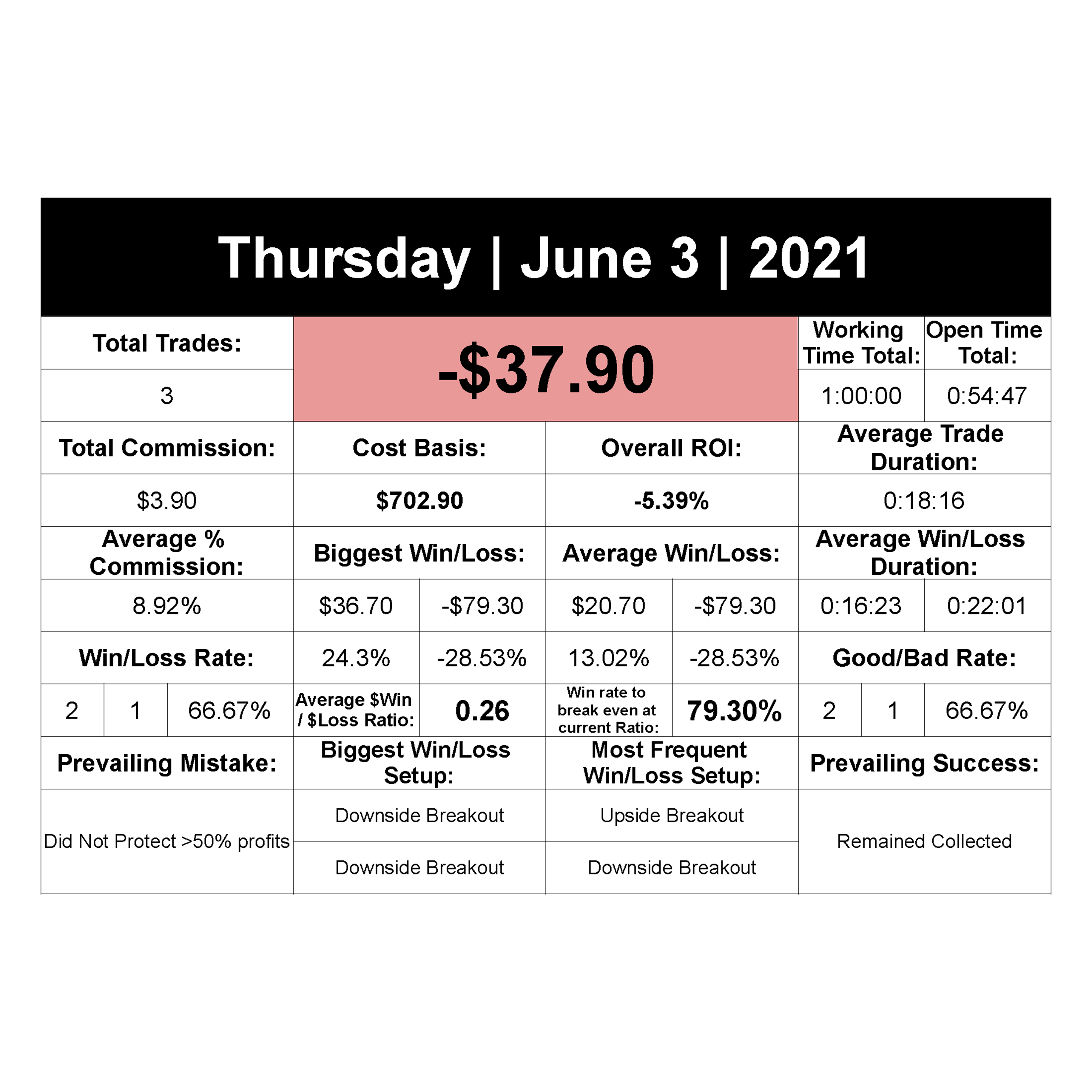

6.3.2021 Statistics:

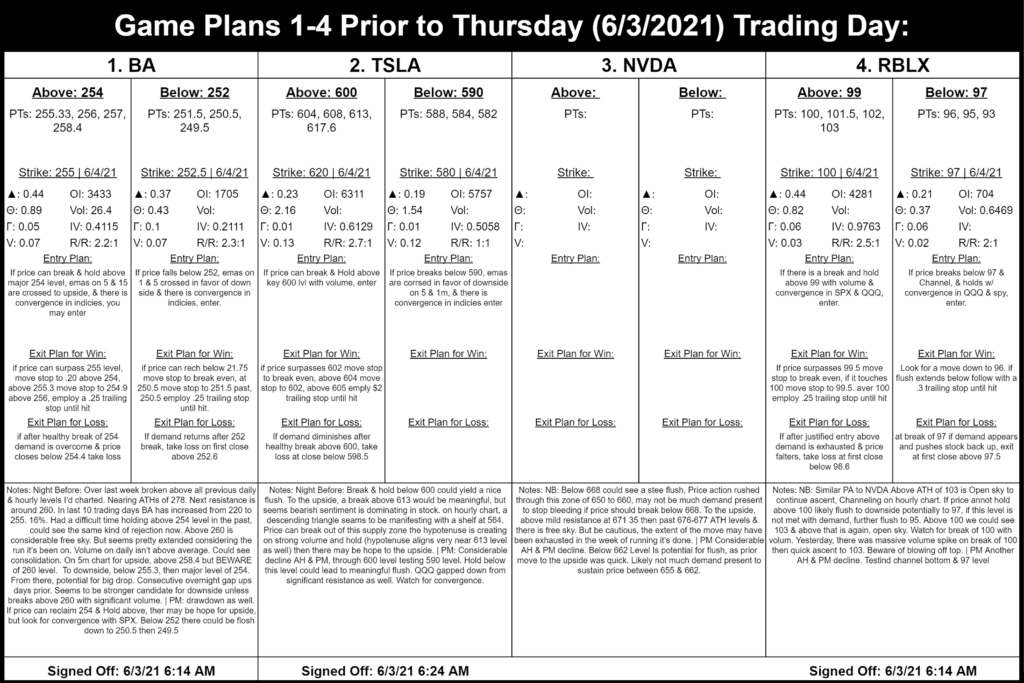

6.3.2021 Game Plan: