Key Takeaways 6.22.2021:

- Establish explicit rules for protecting paper gains. Know beforehand what style you’re trading (scalp/day trade/swing) & your goal

- Need to get more out of your winners. Identify style you’re trading, stick with it, judge performance based on that.

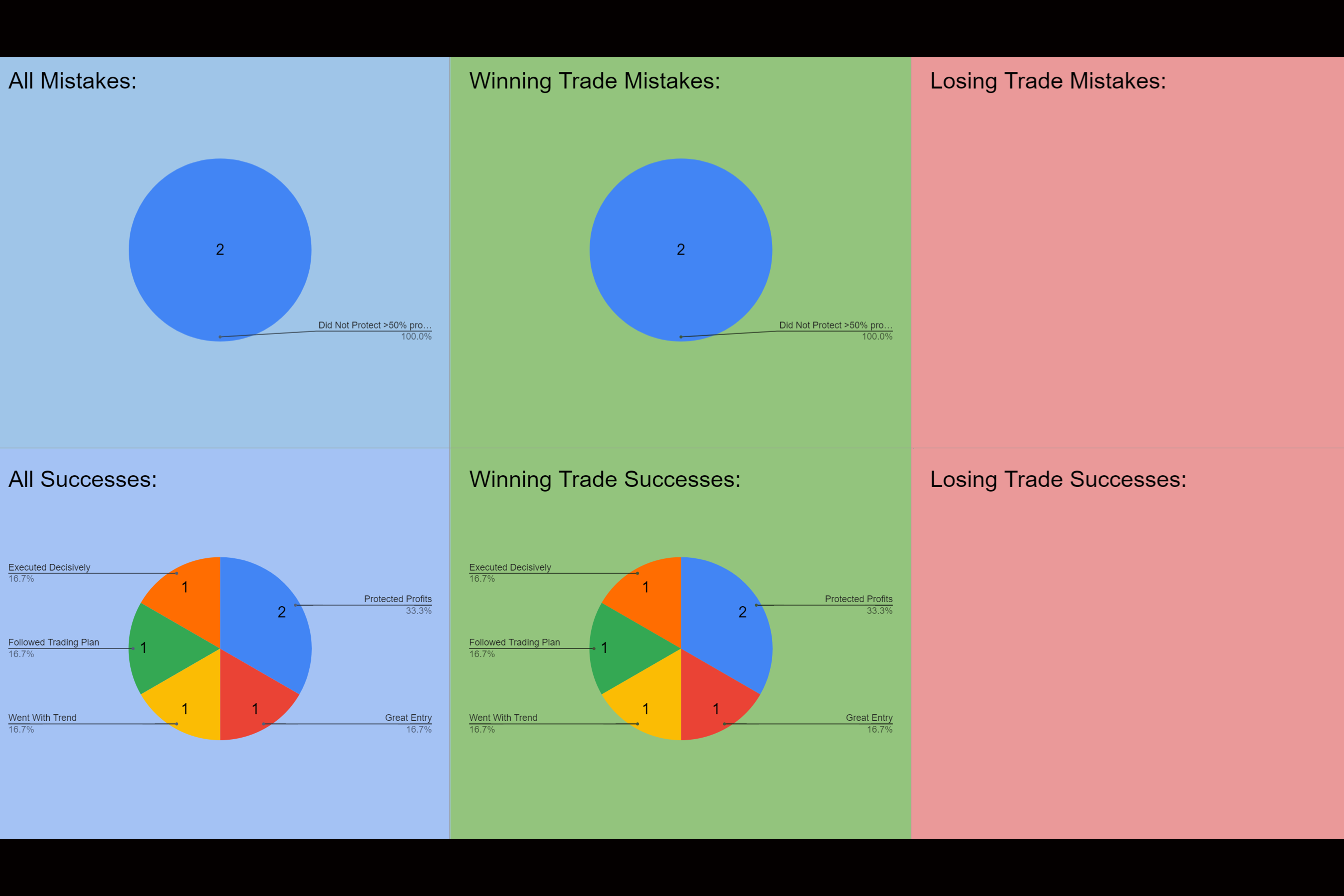

Mistakes | 6.22.2021 | Tuesday

- Did not protect sufficient profits. Must establish explicit rules for protecting profits.

- Did not protect sufficient profits. Must establish explicit rules for protecting profits.

Successes | 6.22.2021 | Tuesday

- Entered Decisively

- Protected Profits

- Followed Game Plans

Activity Log | 6.22.2021 | Tue. | 9.32 hrs

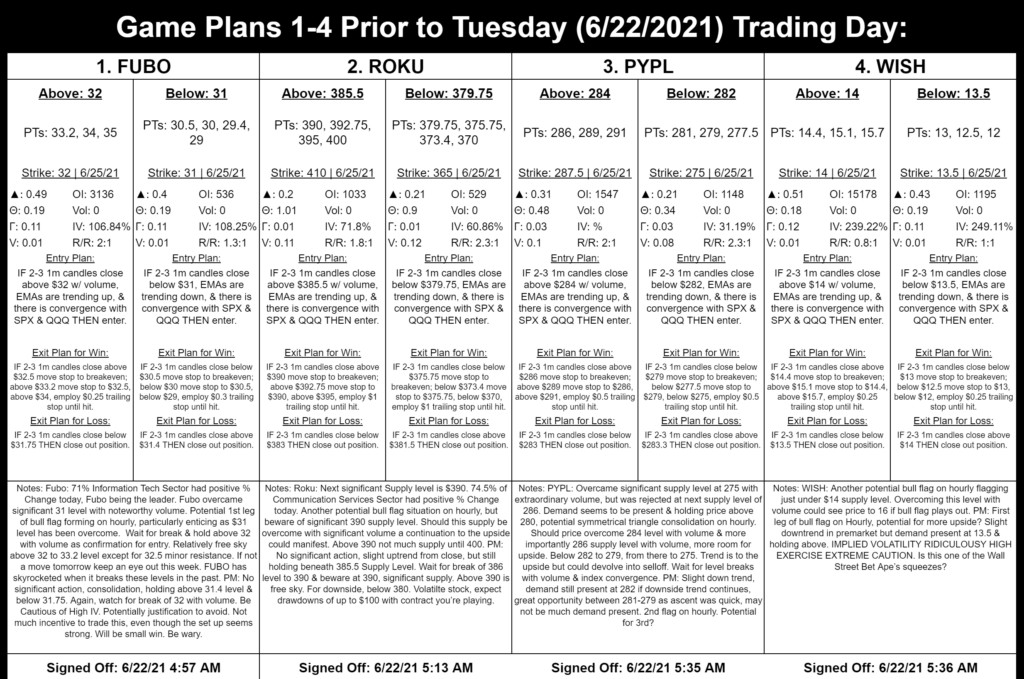

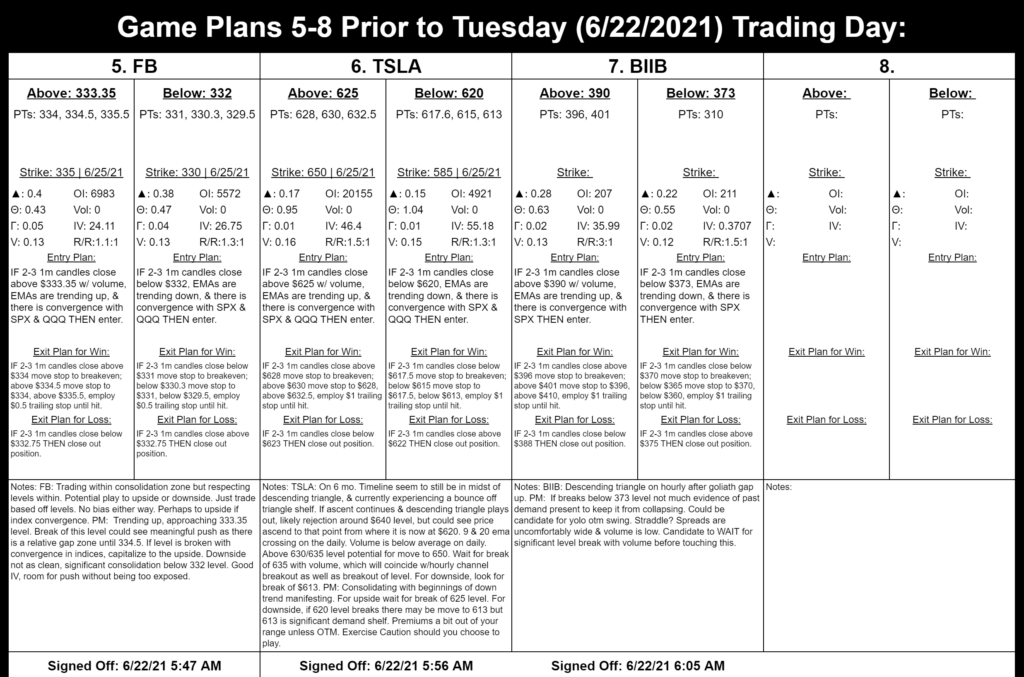

- Game Planned: 6.22.2021 & 6.23.2021

- Charted

- Traded

- Reviewed Trades

- Updated: Game Plan page, Daily Activity Log

Game Planned before trading day & finalized charts form night before. Screenshotted charts of issues to be traded. Traded. Posted Game Plans to Site with Screenshots & formatted daily Gameplan Journal. Updated Daily Activity Log. Updated Weekly Activity Log. Trade Day Review. Studied ‘The Great Depression 3 – New Deal, New York’ . Trade Review. Charting light charting & game planning. | 559 min

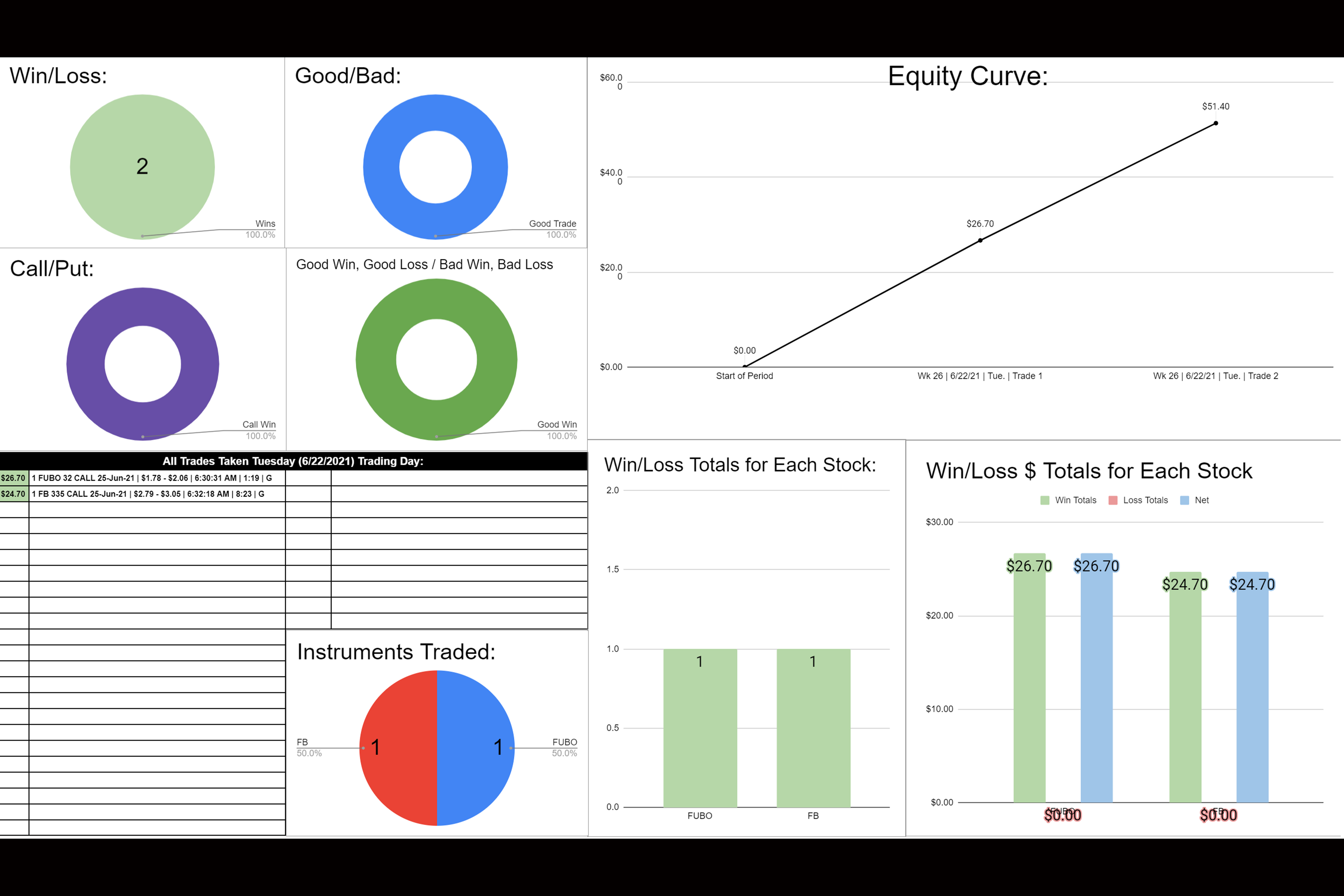

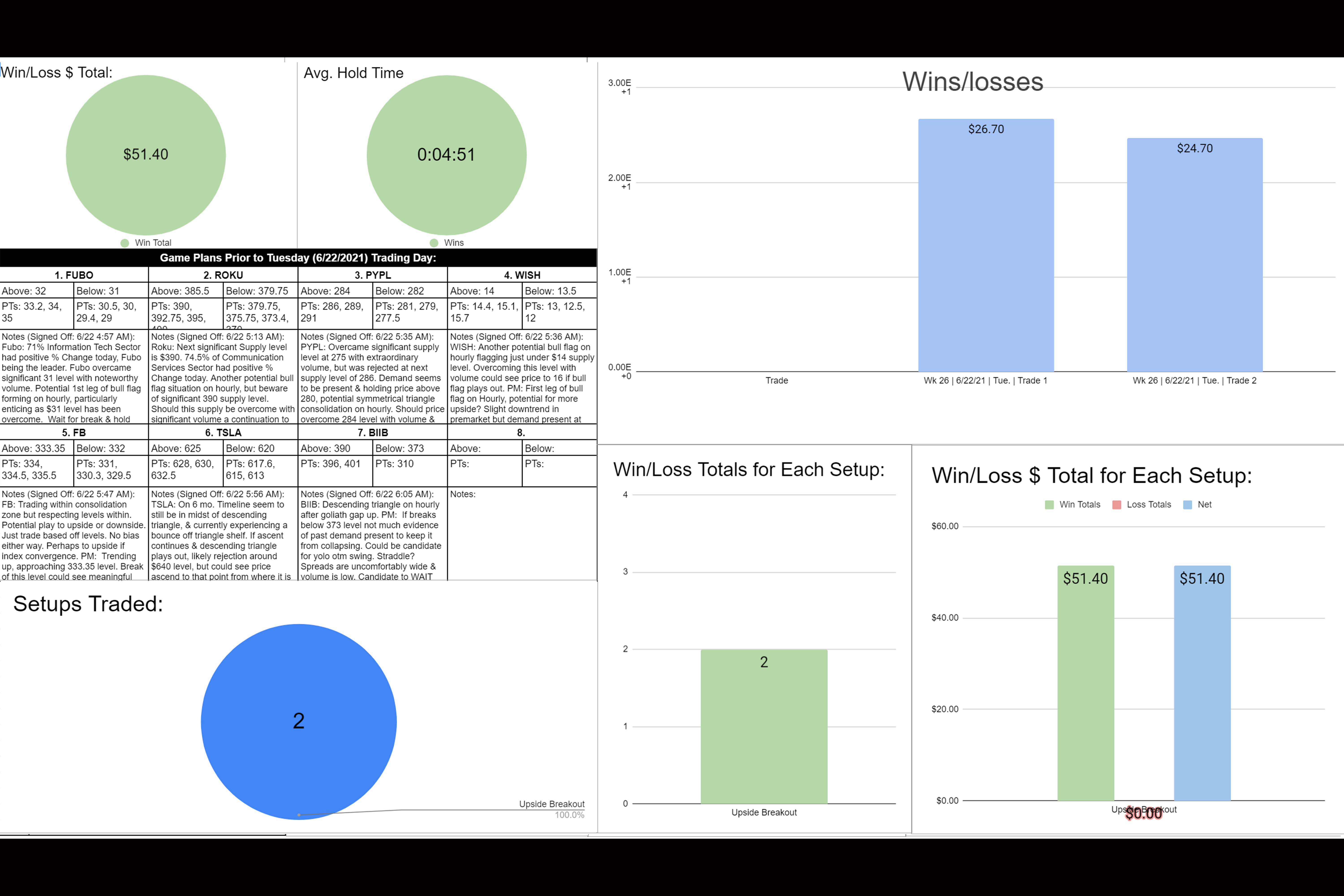

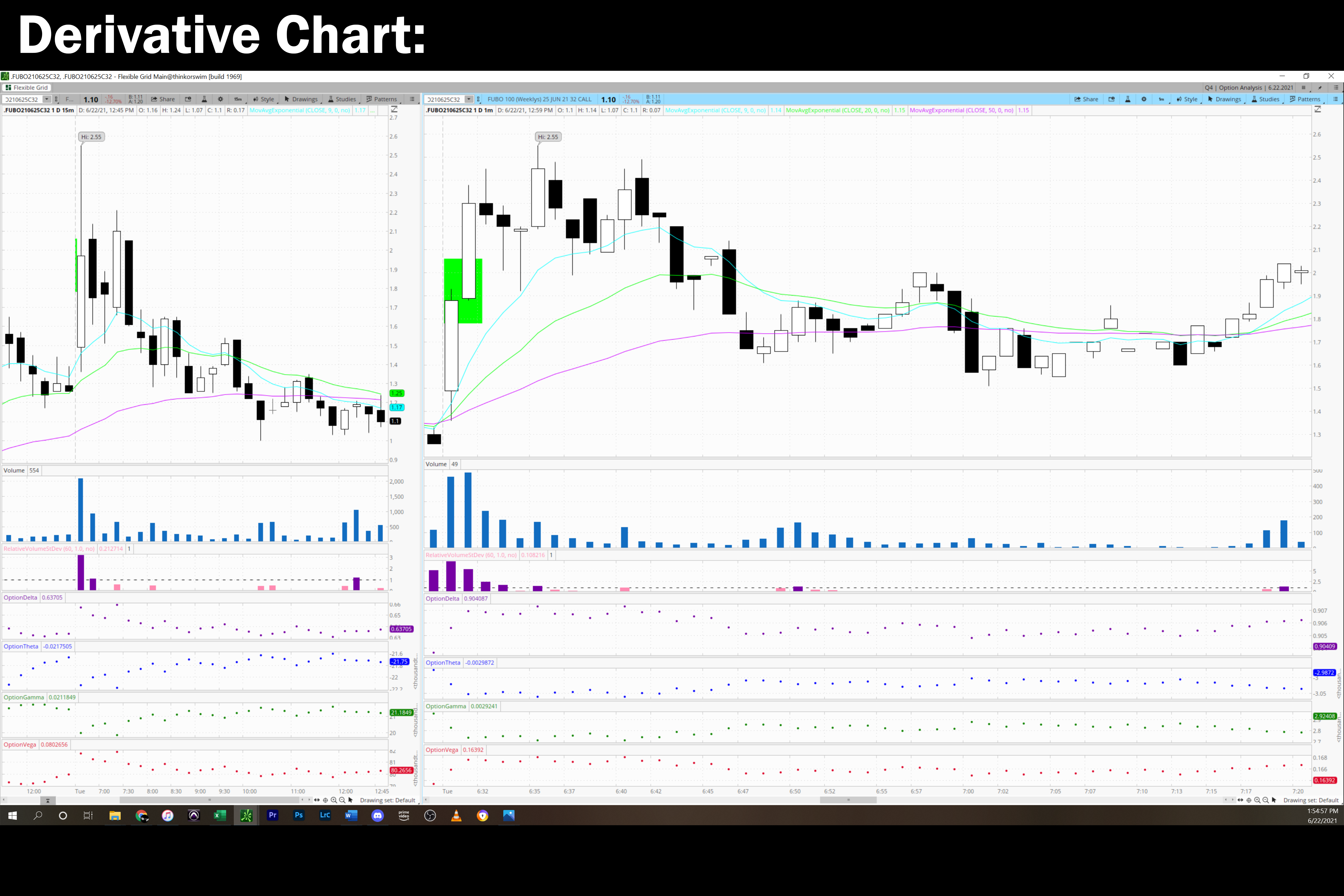

Trade 1 (FUBO | $26.70 | 15%):

-Entered Because had multiple confirmations: EMAs were crossed in favor of upside, Fubo was trending up premarket, opened above 32 level in game plan w/ volume, QQQ EMA’s also in favor of upside & price pushing. I also believe I had tape & L2 Confirmation on my entry. I prices printing just below 32 on the tape & then an flush of prices printing above 32 at which point I reasoned supply was sufficiently overcome & entered.

-Exited because protective stop I placed once first level was reached was hit.

-Trade 1 Mistakes: MUST Establish more explicit rules for protecting profits. Did better this time than last week traded, but still leaving a bit too much on the table. Need to consider level breaking as sign to potentially protect profits. This may become an easier issue to address once I begin trading with more contracts. I can take some off. Also, got fucked by slippage, but cant well be helped.

-Trade 1 Successes: Great entry, did not hesitate, adhered to gameplan, and protected profits. Great entry even though you got sodomized by entry slippage. The moment you saw on the tape the supply around 32 given up you entered the trade. Beginnings of learning to tape read effectively. Review further, but good job for now.

-The better trade would have been protecting more of the paper gains you’d accumulated. You missed over 60% of potential paper gains. Create some sort of calculator to make this easier, you’re not executing the math fast enough/you aren’t going in with plan for how to protect gains. You’re setting low stops to ‘give the trade room’ to work out, but time and again, those stops have just been hit and you’re caught in the middle. Without having given enough room for the trade to really work out but too much room to be proactive about protecting paper gains. Decide on one or the other. Perhaps leave the working out / longer time frame trades for later on in your career when you’re trading more contracts/are more comfortable with larger fluctuations. You’re mastering scalping right now. Stick to that.

-Trade 1 Key Takeaways: Establish explicit rules for protecting paper gains. Know your trade style & your goal. Cultivate your tolerance for drawdowns. Could have traded more off EMAS, after level break price bounced off emas beautifully. Otherwise, solid trade. Followed plan & did protect profits, just need to do even better now. Perhaps build out game plan entry to have spot to put entry price in to calculate everything for you in real time.

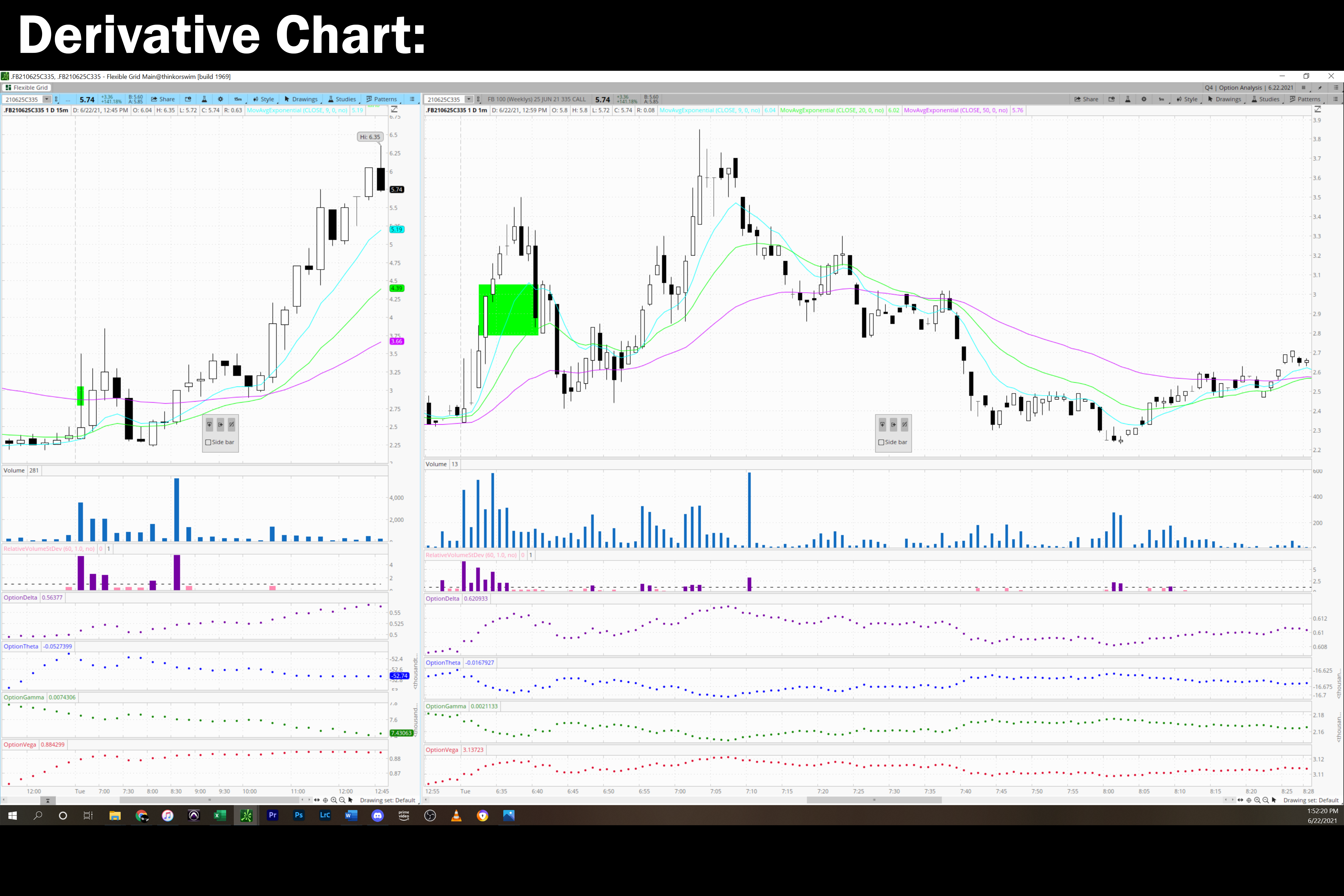

Trade 2 (FB | $24.70 | 8.85%):

-Entered Because FB broke & held above level, had EMAs trending up, had convergence with QQQ. FB price was holding above first level before my planed entry level, & then on the break of the planned 333.35 level I entered.

-Exited because price broke below target level after surpassing it & protective stop was taken out.

-Trade 2 Mistakes: Did not protect sufficient profit. Doing better, but still need to improve. Missed just under 60% of potential profit from high point while in trade. Other than not protecting more profits, this was a solid trade. Must establish explicit rules for protecting profits, or else go into trades preparing to endure larger fluctuations. Had I endured a 20% draw down I would have had the opportunity to capitalize on an over 100% return. Hindsight is 20/20, but must refine method to capitalize more on good trades.

-Trade 2 Successes: Entered decisively, followed gameplan, had market convergence & EMA confirmation as well as broken level confirmation. Solid trade.

-The better trade would have been protecting more paper profits, OR going into the trade on larger time frames & letting the larger move play out. But based on what my goals were, which where scalping on break of a level on a 1 minute time frame, this was a reasonably well executed trade that I can live with.

-Trade 2 Key Takeaways: Need to get more out of your winners. Identify style you’re trading before hand & stick with it. Judge performance based on selected style.

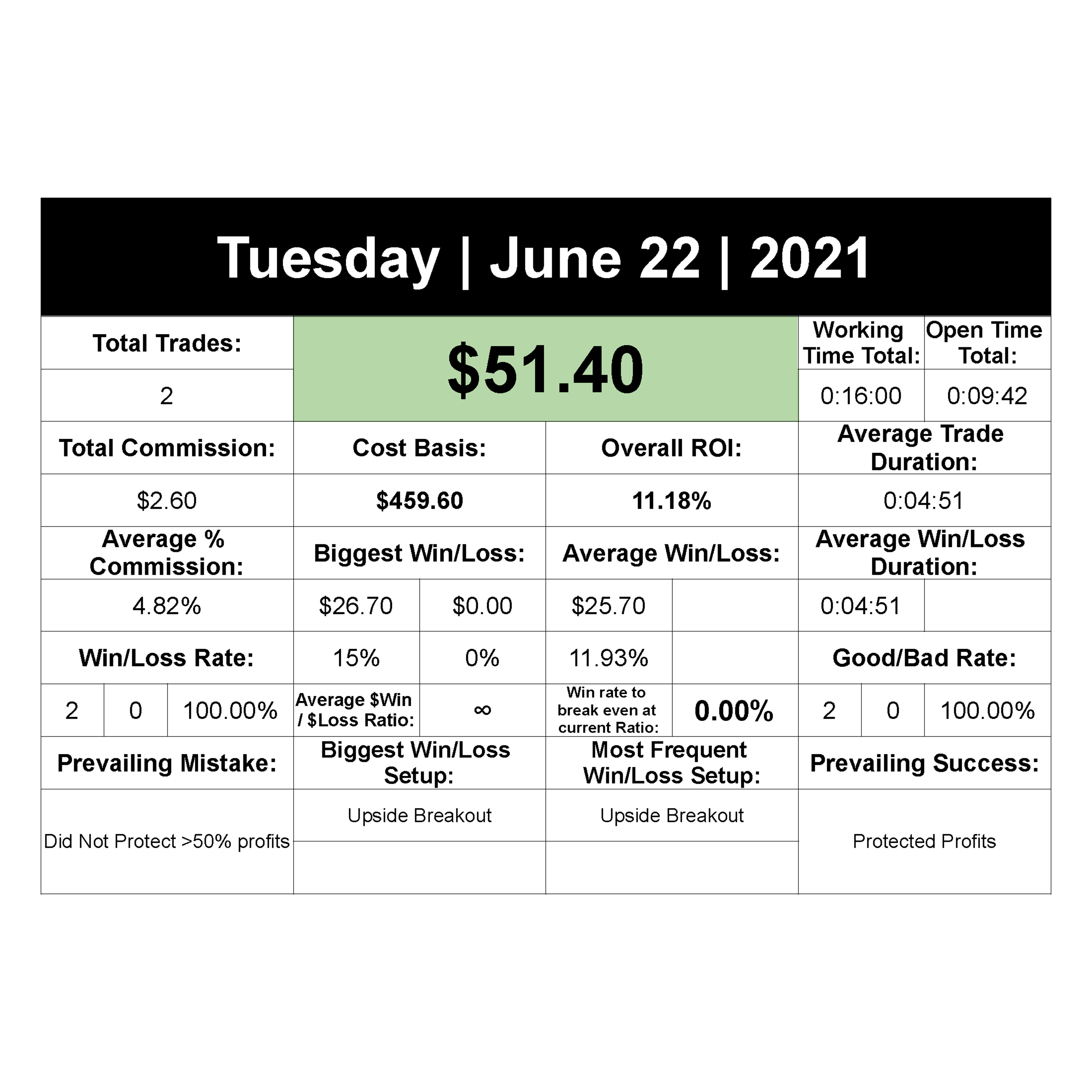

6.22.2021 Statistics: