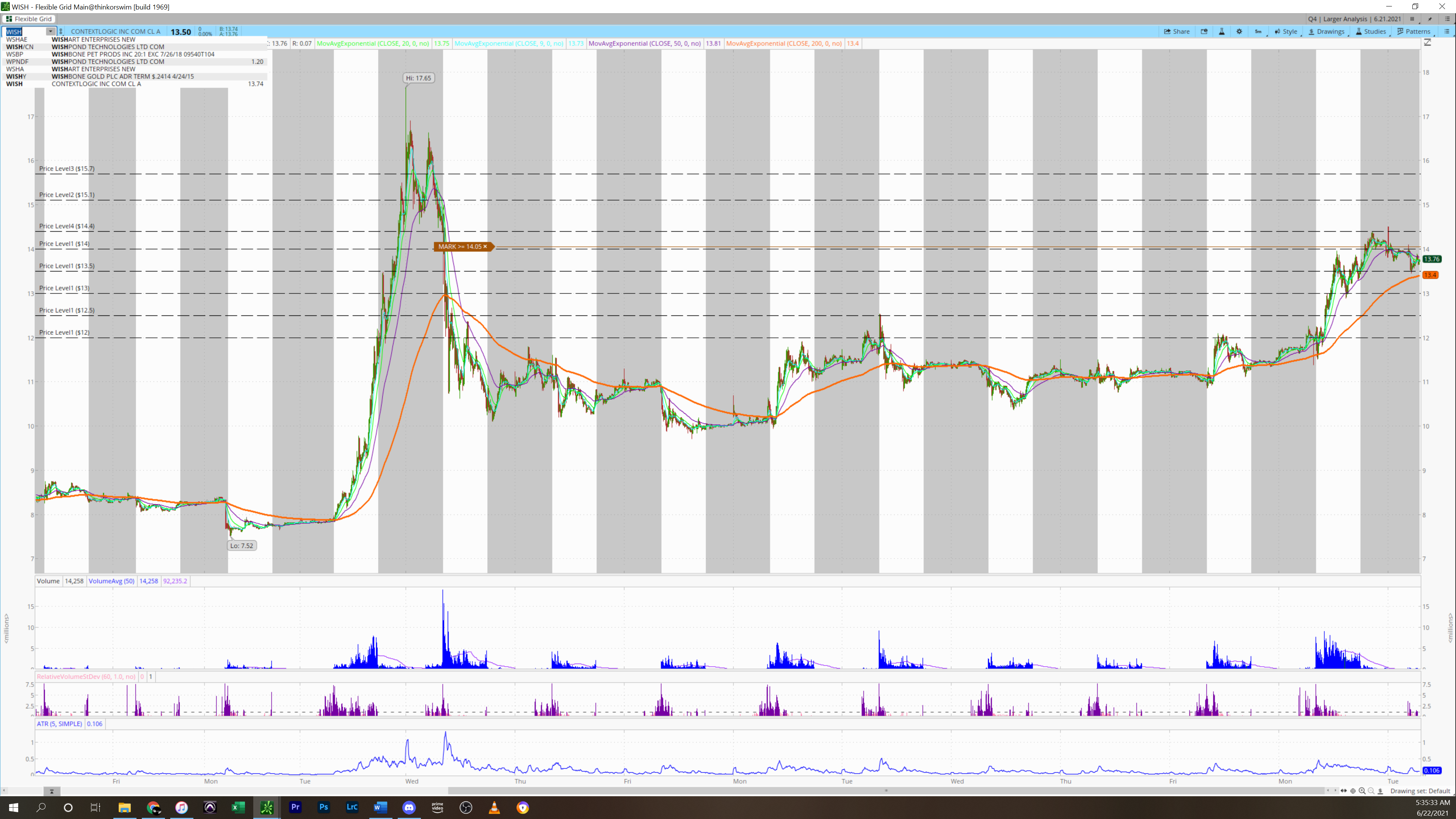

Solace Game Plans Night Before & Pre-market:

Fubo: 71% Information Tech Sector had positive % Change today, Fubo being the leader. Fubo overcame significant 31 level with noteworthy volume. Potential 1st leg of bull flag forming on hourly, particularly enticing as $31 level has been overcome. Wait for break & hold above 32 with volume as confirmation for entry. Relatively free sky above 32 to 33.2 level except for 32.5 minor resistance. If not a move tomorrow keep an eye out this week. FUBO has skyrocketed when it breaks these levels in the past. PM: No significant action, consolidation, holding above 31.4 level & below 31.75. Again, watch for break of 32 with volume. Be Cautious of High IV. Potentially justification to avoid.

Roku: Next significant Supply level is $390. 74.5% of Communication Services Sector had positive % Change today. Another potential bull flag situation on hourly, but beware of significant 390 supply level. Should this supply be overcome with significant volume a continuation to the upside could manifest. Above 390 not much supply until 400. PM: No significant action, slight uptrend from close, but still holding beneath 385.5 Supply Level. Wait for break of 386 level to 390 & beware at 390, significant supply. Above 390 is free sky. For downside, below 380. Volatilte stock, expect drawdowns of up to $100 with contract you’re playing.

PYPL: Overcame significant supply level at 275 with extraordinary volume, but was rejected at next supply level of 286. Demand seems to be present & holding price above 280, potential symmetrical triangle consolidation on hourly. Should price overcome 284 level with volume & more importantly 286 supply level with volume, more room for upside. Below 282 to 279, from there to 275. Trend is to the upside but could devolve into selloff. Wait for level breaks with volume & index convergence. PM: Slight down trend, demand still present at 282 if downside trend continues, great opportunity between 281-279 as ascent was quick, may not be much demand present. 2nd flag on hourly. Potential for 3rd?

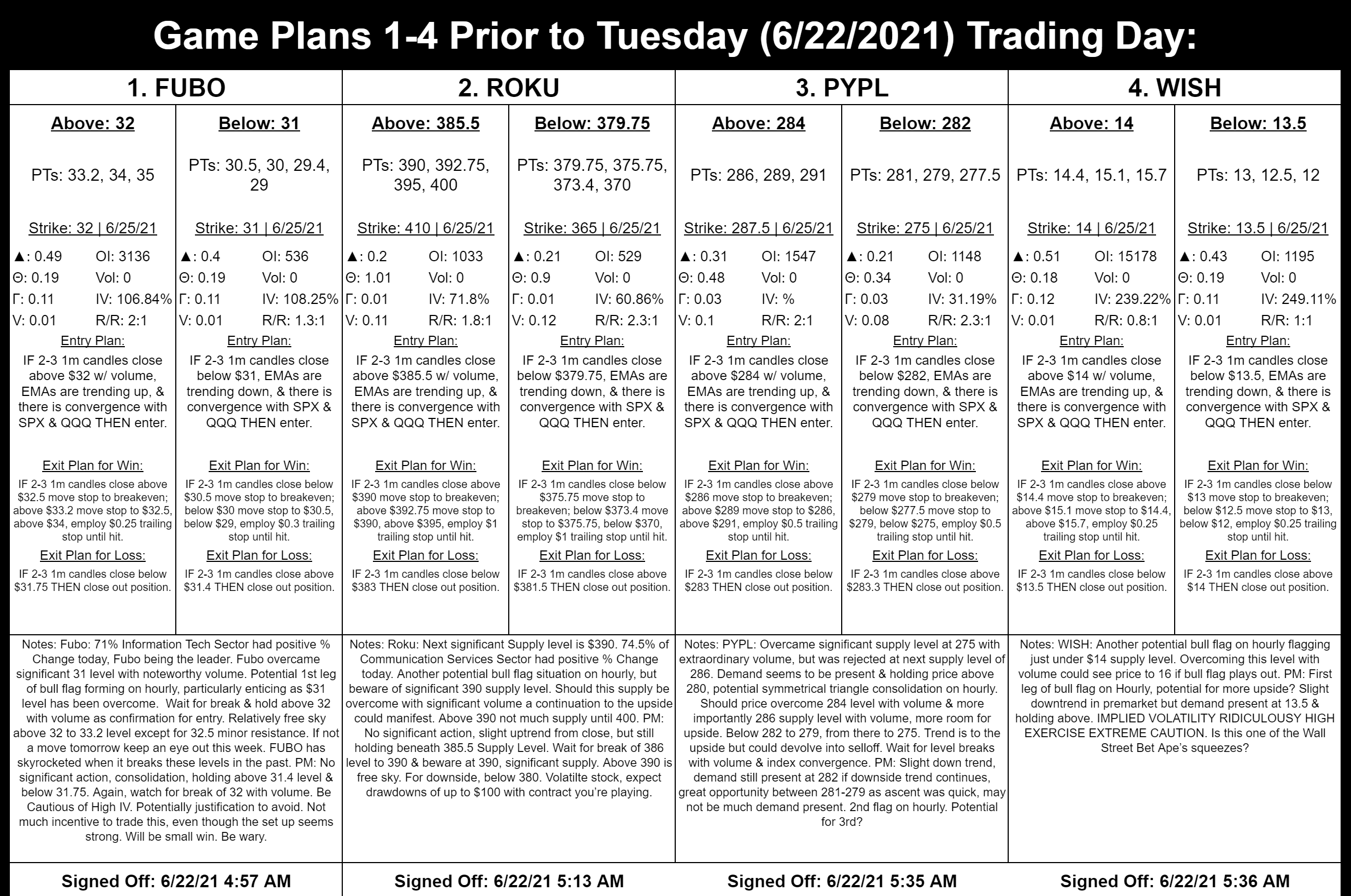

WISH: Another potential bull flag on hourly flagging just under $14 supply level. Overcoming this level with volume could see price to 16 if bull flag plays out. PM: First leg of bull flag on Hourly, potential for more upside? Slight downtrend in premarket but demand present at 13.5 & holding above. IMPLIED VOLATILITY RIDICULOUSY HIGH EXERCISE EXTREME CAUTION. Is this one of the Wall Street Bet Ape’s squeezes?

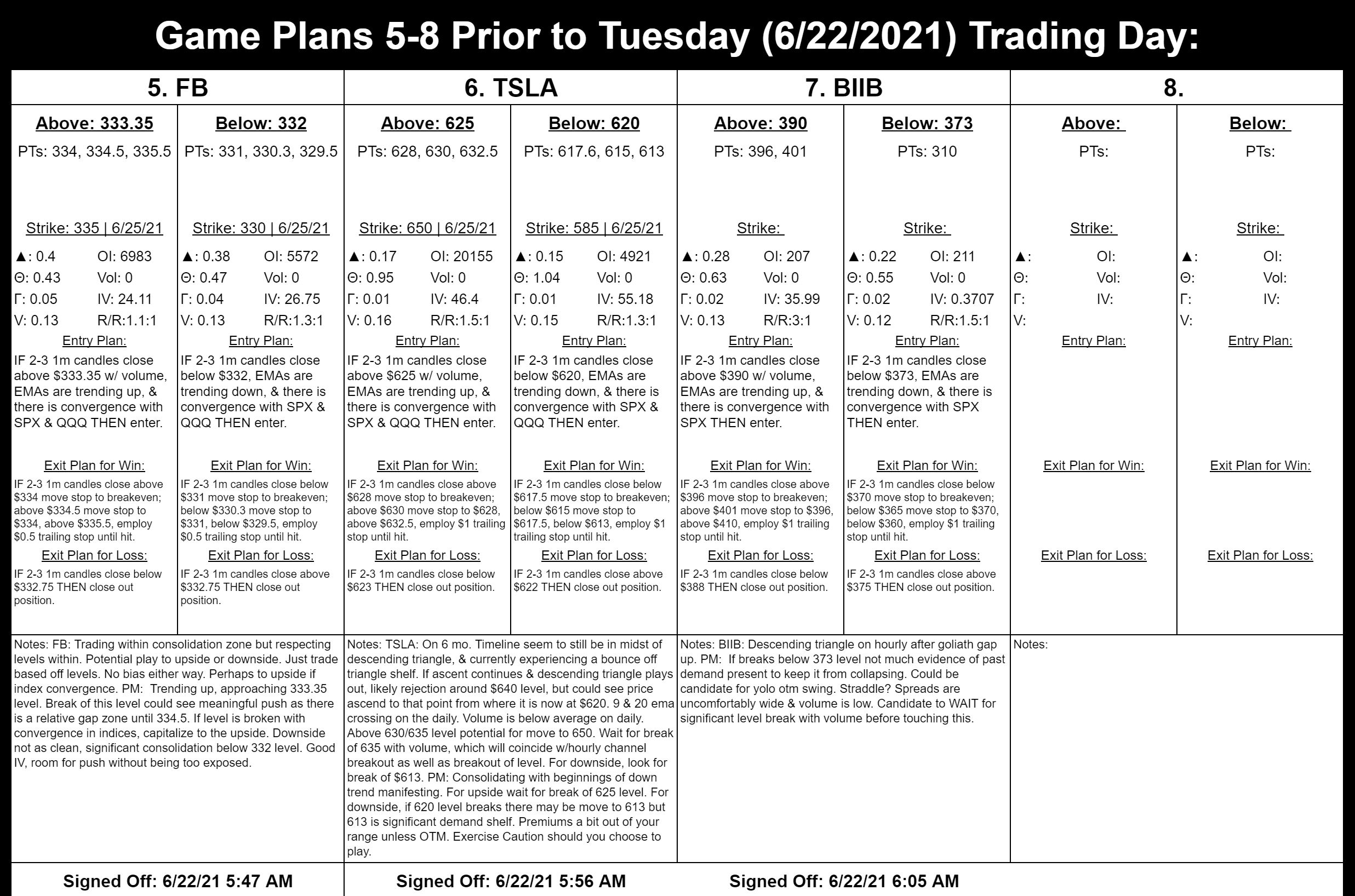

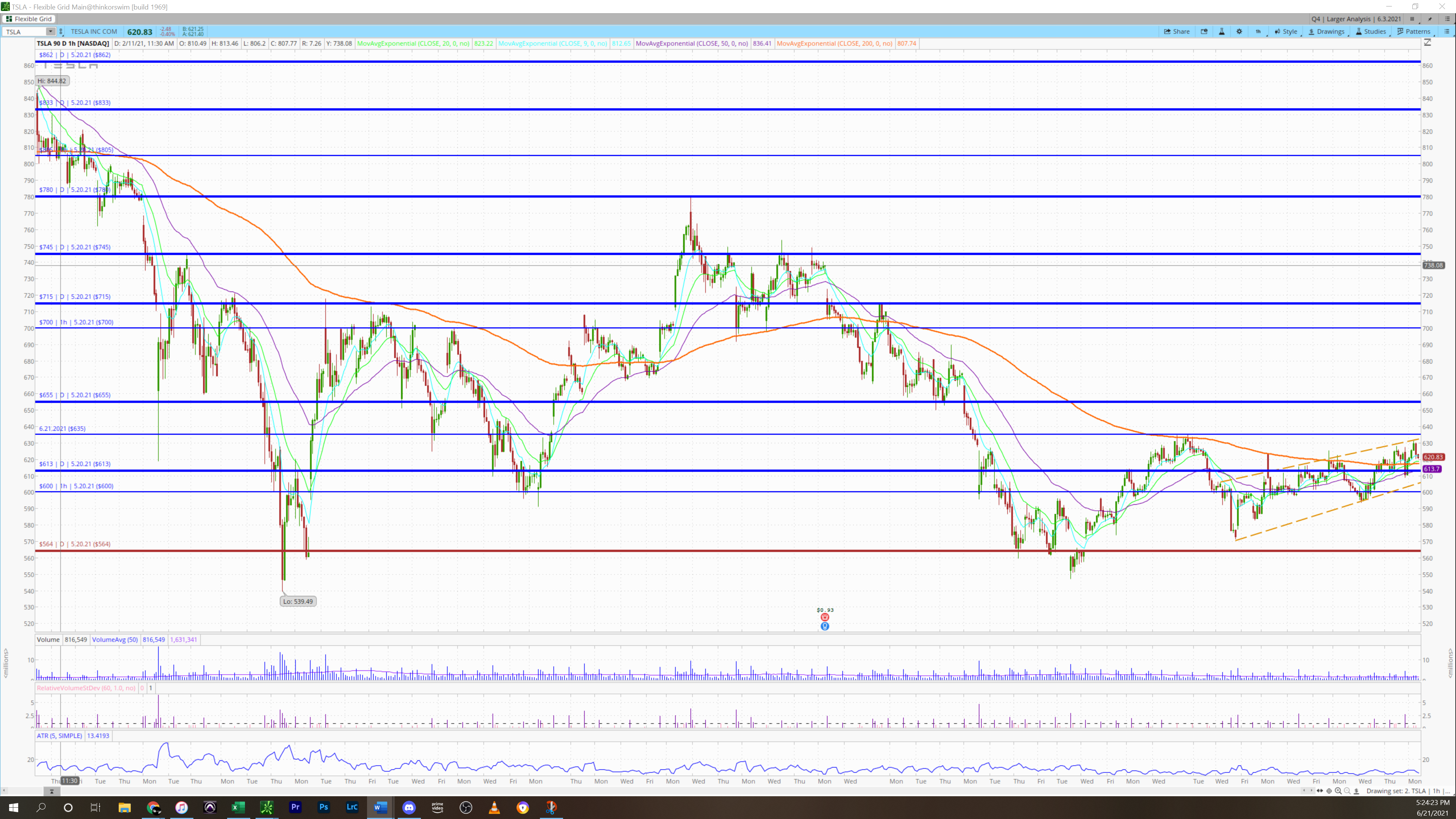

TSLA: On 6 mo. Timeline seem to still be in midst of descending triangle, & currently experiencing a bounce off triangle shelf. If ascent continues & descending triangle plays out, likely rejection around $640 level, but could see price ascend to that point from where it is now at $620. 9 & 20 ema crossing on the daily. Volume is below average on daily. Above 630/635 level potential for move to 650. Wait for break of 635 with volume, which will coincide w/hourly channel breakout as well as breakout of level. For downside, look for break of $613. PM: Consolidating with beginnings of down trend manifesting. For upside wait for break of 625 level. For downside, if 620 level breaks there may be move to 613 but 613 is significant demand shelf. Premiums a bit out of your range unless OTM. Exercise Caution should you choose to play.

FB: Trading within consolidation zone but respecting levels within. Potential play to upside or downside. Just trade based off levels. No bias either way. Perhaps to upside if index convergence. PM: Trending up, approaching 333.35 level. Break of this level could see meaningful push as there is a relative gap zone until 334.5. If level is broken with convergence in indices, capitalize to the upside. Downside not as clean, significant consolidation below 332 level. Good IV, room for push without being too exposed.

BIIB: Descending triangle on hourly after goliath gap up. PM: If breaks below 373 level not much evidence of past demand present to keep it from collapsing. Could be candidate for yolo otm swing. Straddle? Spreads are uncomfortably wide & volume is low. Candidate to WAIT for significant level break with volume before touching this.

$DJI Played oput exactly as you fucking predicted with your wedge. TRUST YOUR MOTHER FUCKING TECHNICAL ANALYSIS. TRUST TAST.

SPX Charts: