Key Takeaways 5.27.2021:

You must have plans for your exits as well as your entries. You did well with your technical analysis and had great entries, but you fumbled your exits because you had no plan for when to take profits and missed out on massive upside as a result. You must make the most of good trades when you’re in them. You put good work into your technical analysis. When it comes time to act on it, have faith in your work & analysis. You can address mistakes in your TA if/when they’re made. Have faith.

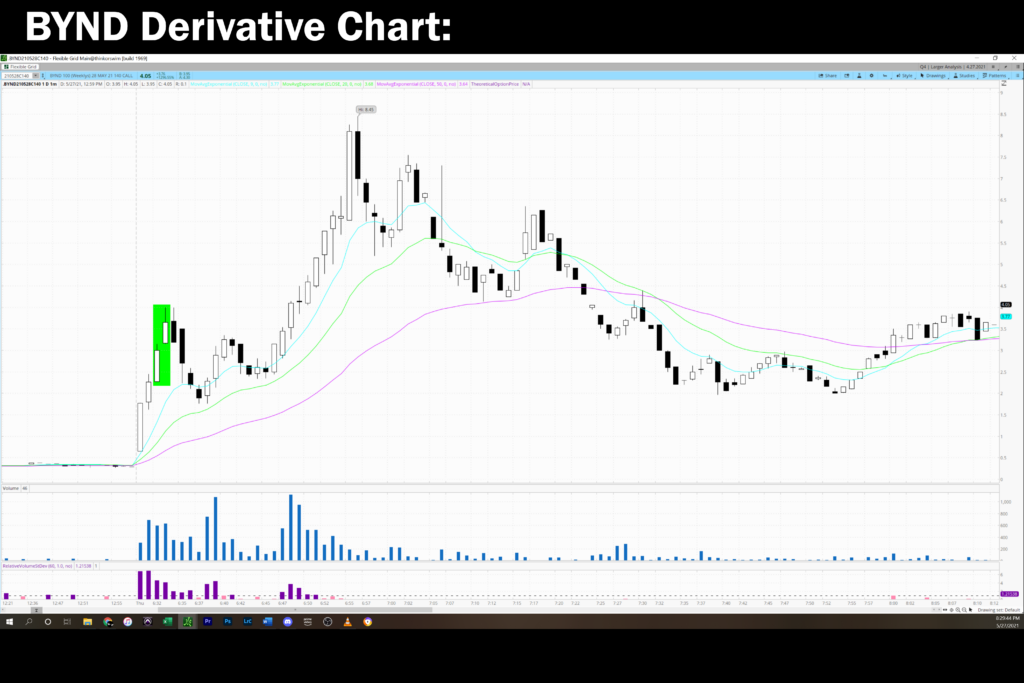

Trade 1 (BYND | $40.70 | 14%):

-Entered Because price broke through my level of 135 at the open & held above this level on extraordinary volume. EMAs were trending in my favor on all time frames. There had been a gap up in premarket breaking above my previous level of 130, which I interpreted as a potentially bullish sign.

-Exited because I was immediately in the money and wanted to protect profits I’d accrued.

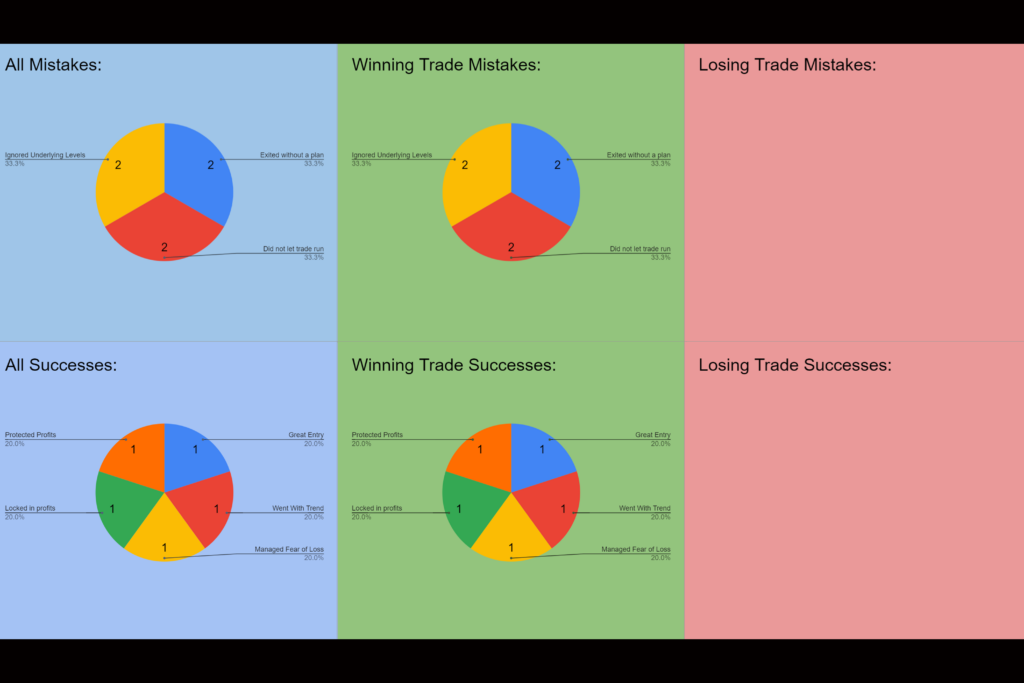

-Mistakes: DID NOT HAVE GAME PLAN FOR EXIT. I did not trade based on the charts. I traded based on arbitrary dollar amounts in option price. Again. While I was profitable and did well in protecting a portion of my paper gains, I missed out on 95% of the upside potential of this trade. Had I traded the price action of the underlying and had conviction in my analysis, which was solid, I could have captured a larger piece of the move. I had levels in place and price action followed those levels beautifully, but I wasn’t there for it. While I have some empathy for myself and my paper handedness considering this is one of the first trades I’ve taken of an option this size, and the first time I’ve been in a live trade watching contract fluctuations of this size, I should have had more faith in my technical analysis and traded based off that analysis. I’ve done work now to prepare better beforehand and be aware of what normal fluctuations in the option price will look like. To be sure, more experience feeling those fluctuations will be necessary, but the mental prep beforehand of being able to go into the trade knowing the extent of fluctuations I might be exposed to will help me maintain my nerve through them and trade based off the technical analysis of the underlying issue.

-Successes: I had good technical analysis, I focused my attention on a solid setup, I went with the trend I entered on confirmation, and I protected profits. All in all, I am proud of this trade for where I’m at in my trading journey, and It’s a testament to my improvement, and my learning from my past mistakes. I uncovered new mistakes I’m making but they are reasonable mistakes considering this is my first foray into contracts of this size, and the emotional challenge the fluctuations present. I need to trust myself and my analysis. but I did well enough and walked away with profit.

Key Takeaways Trade 1: Must have a game plan for EXIT as well as ENTRY. Have FAITH in your technical analysis & trade based off it.

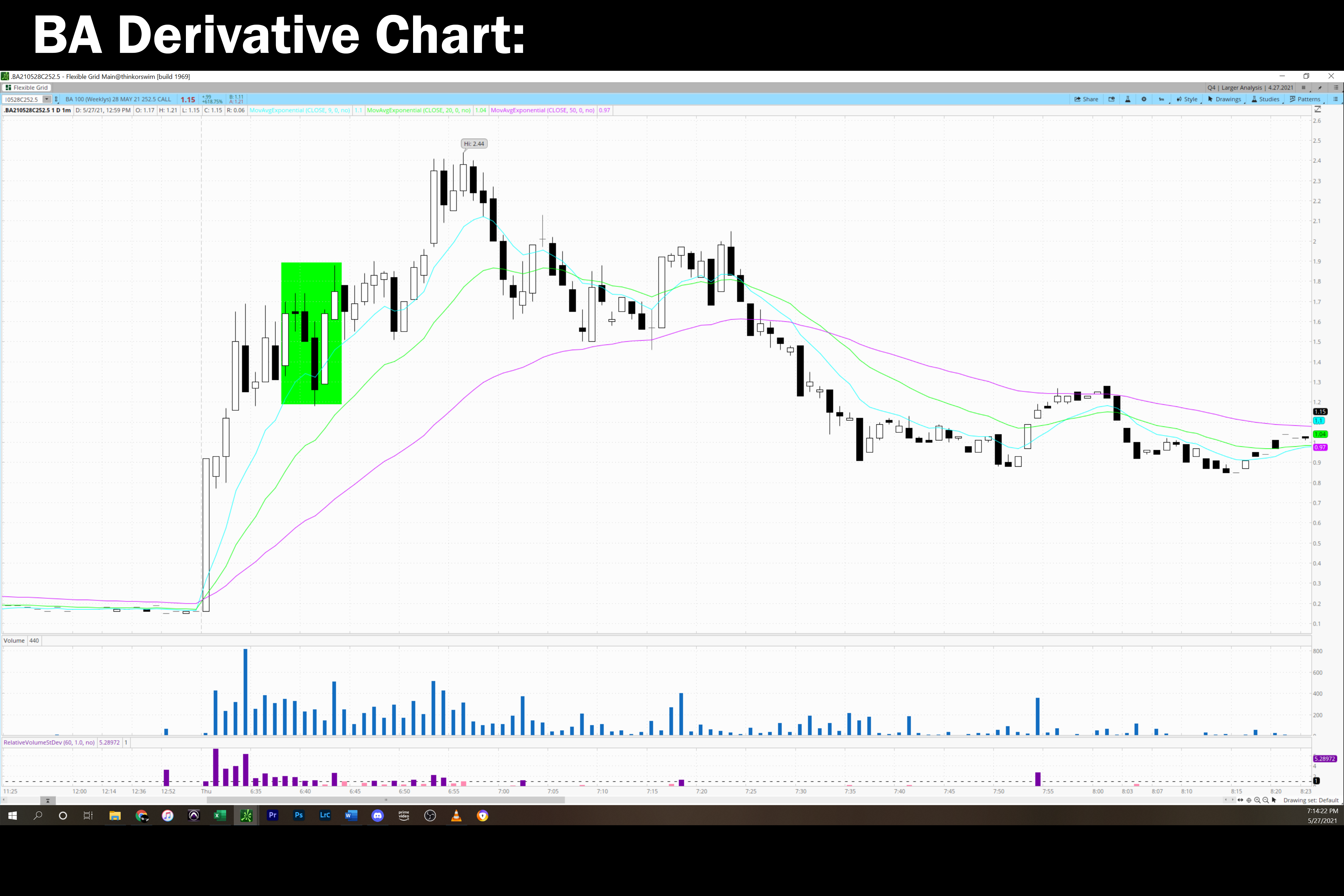

Trade 2 (BA | $9.70):

-Entered Because BA broke above 249.50 level and was holding above it on significant volume, EMAs were trending in my favor on all time frames, SPX was also pushing. I interpreted the morning gap up as a bullish sign, and like BYND, BA had broken through my last level of resistance of 246 over night and was testing this next level. I waited after seeing the first break of the level, then when the price held above it on volume for a bit I entered.

-Exited because of an arbitrary underlying profit goal of staying green for the day, for no good technical reason. Immediately after I entered the price dropped on me and at its lowest point would have negated all my prior profits on the day. I held on because the price was holding above the 20 EMA on the 1 minute chart and I had faith it could recover. I did not want to walk away red for the day, so the second the stock rebounded I determined I didn’t want to stick around for any chop and I got out. At the time BA was having a hard time pushing above 249.50 in a clear cut fashion, so I got out because I didn’t want to hold through the deliberation. Had I waited 10 minutes I would have been rewarded more, but I did walk away green for the day.

-Mistakes: HAD NO GAME PLAN FOR EXIT. GREAT FOR ENTRY NOT FOR EXIT. Again, did not trade the charts, and got shaken out. My logic was I was green on the day from the last trade and did not want to risk giving anything back, so the second I was in the green on this trade I exited to protect my profitable status for the day. (On further examination I could have interpreted this massive spike of volume on which I entered as a potential blowing off top and proceeded more cautiously

-Successes: I did well holding through the dip & while I didn’t hold on for more significant profit, I usually have paper hands at first sign of draw down and take the loss, usually with no real technical reason. I did not indulge that impulse today and held through the pain with technical justification. I literally just clenched my fists, and watched the chart, rationalizing that while PA was testing my level of 249.5 it had not closed below it, and the price was deliberating right at the 9 & 20 EMAs on the 1 minute which are often zones of demand. Sure enough, the price bounced from these areas, but I did not stick around for the bulk of the upside that manifested after the recovery. I held through the worst of the pain but didn’t stick around for the bulk of the gain.

Key Takeaways Trade 2: You must have a game plan for exit as well as entry.

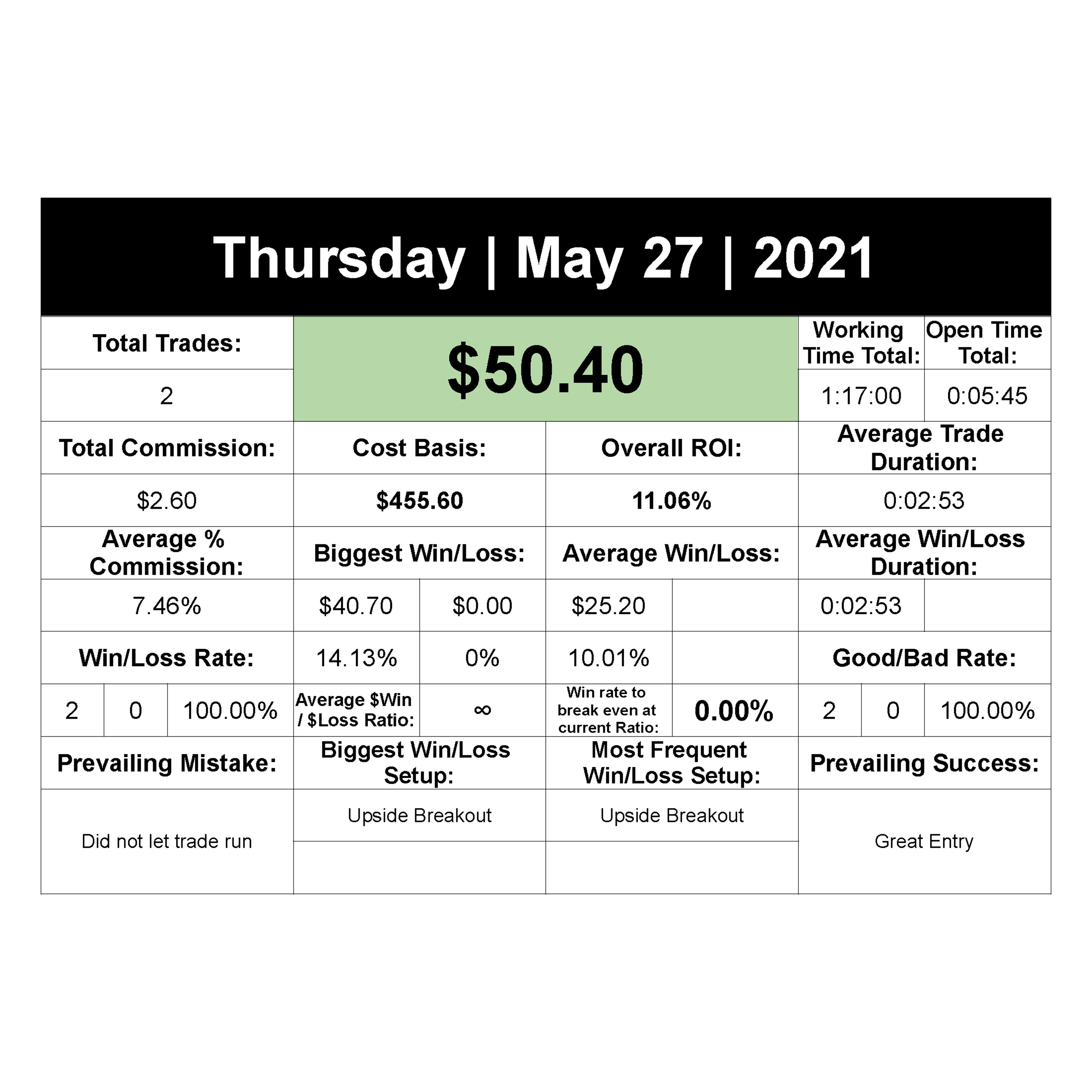

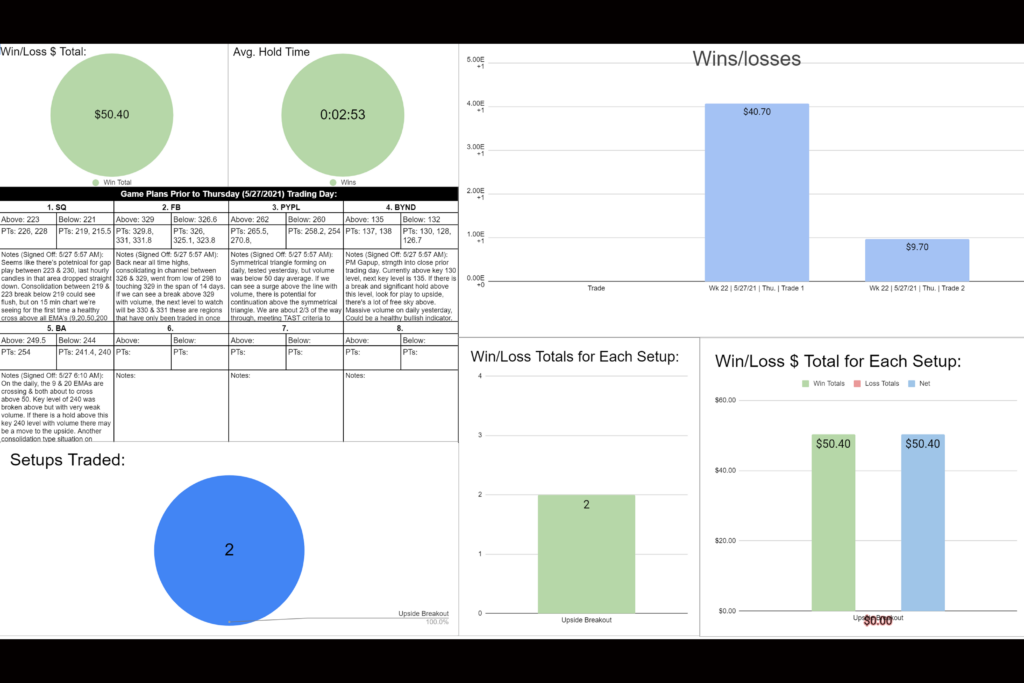

5.27.2021 Statistics:

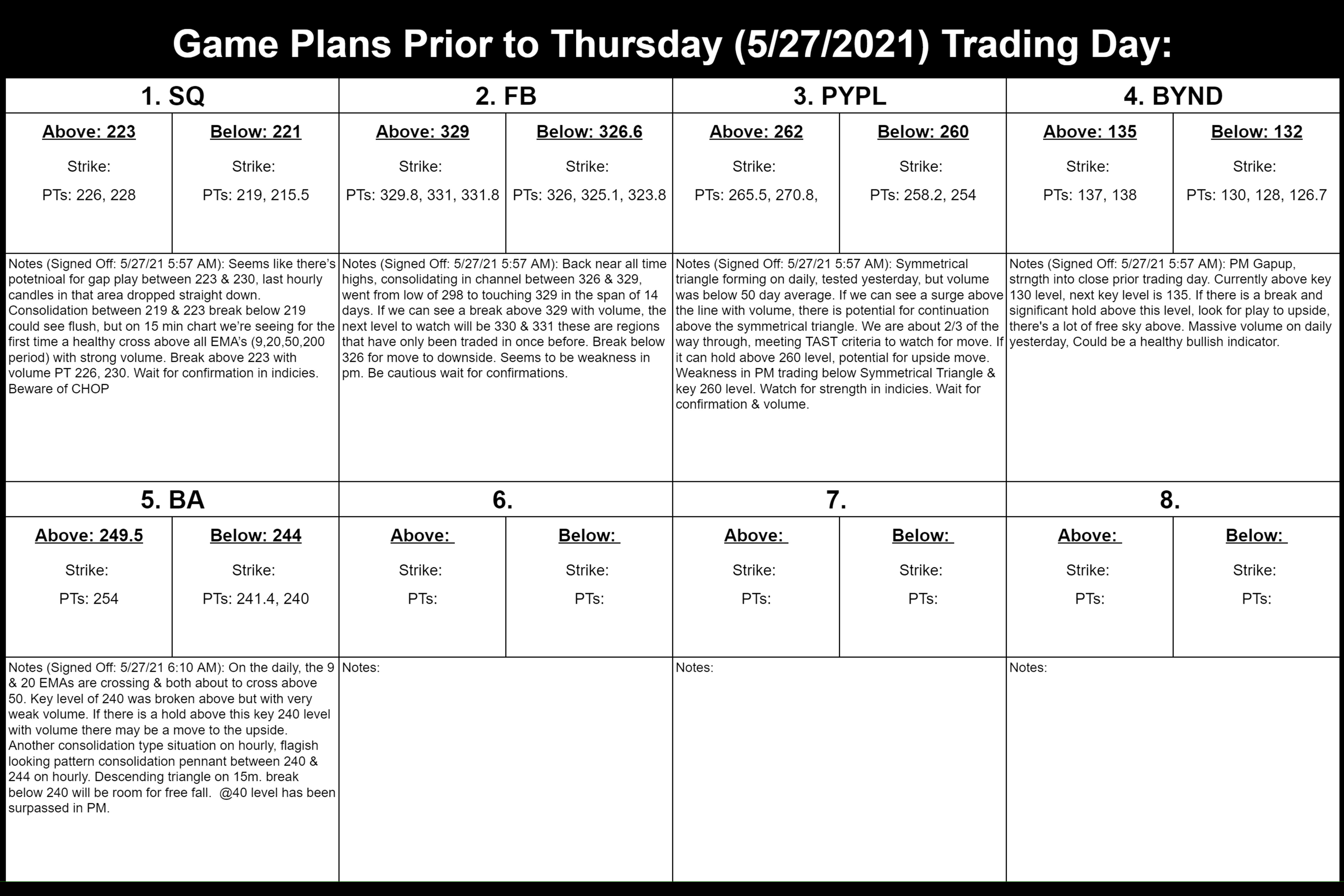

5.27.2021 Game plan: