Key Takeaways: 5.20.2021

My biggest mistake today, I’m learning, was trying to scalp too far OTM options. Scalping OTM might be a viable strategy on 0DTE, but most of the time it seems there are far more elements working against you (particularly theta) from the start than if you were scalping ITM or ATM contracts. If I’m understanding correctly, the rate of theta decay to premium is higher the further OTM you are, meaning a greater % of the premium is lost to theta each passing moment the further OTM you are—which in turn means the underlying instrument must move disproportionately more to make up for theta decay in OTM options. Theta is smaller on OTM contracts, but it makes up a larger percent of the premium. I guess intuitively this makes sense—as time to expiration decreases, the probability that a far OTM option ends up ITM decreases. That probability is inversely reflected in the rate at which the premium loses value over time.

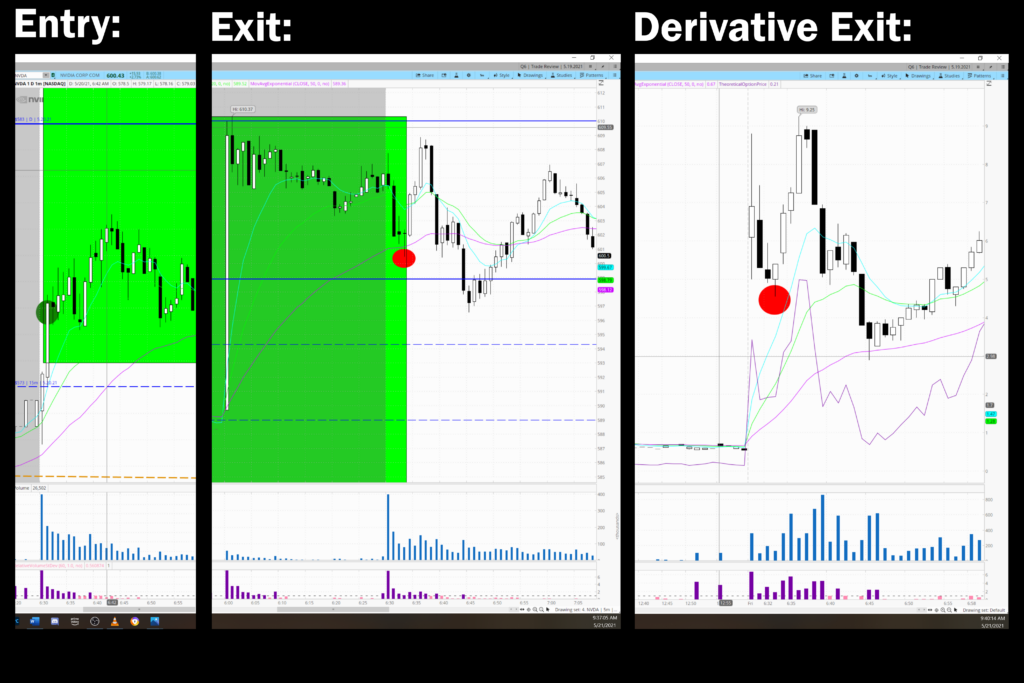

So with my far OTM strike play even though I was right on the direction, the rate at which the underlying was moving up was not high enough to neutralize the rate at which theta was eating away at my premium. Here is a break down of what plays at different strikes looked like across the 2 hour period after I placed my trade:

NVDA (underlying):

6:32am = $576.40 — 8:32am = $583.30 (+1.2%)

*NVDA 550 Call (ITM)

6:32am = $2,716 — 8:32am = $3,380 (+24.4%)

*NVDA 570 Call (ITM)

6:32am = $1080 — 8:32am = $1462(+35.3%)

*NVDA 605 Call (OTM)

6:32am = $93 — 8:32am = $74 (-20.4%)

Choosing an appropriate strike is as important as predicting the direction of the underlying stock. LEARN.

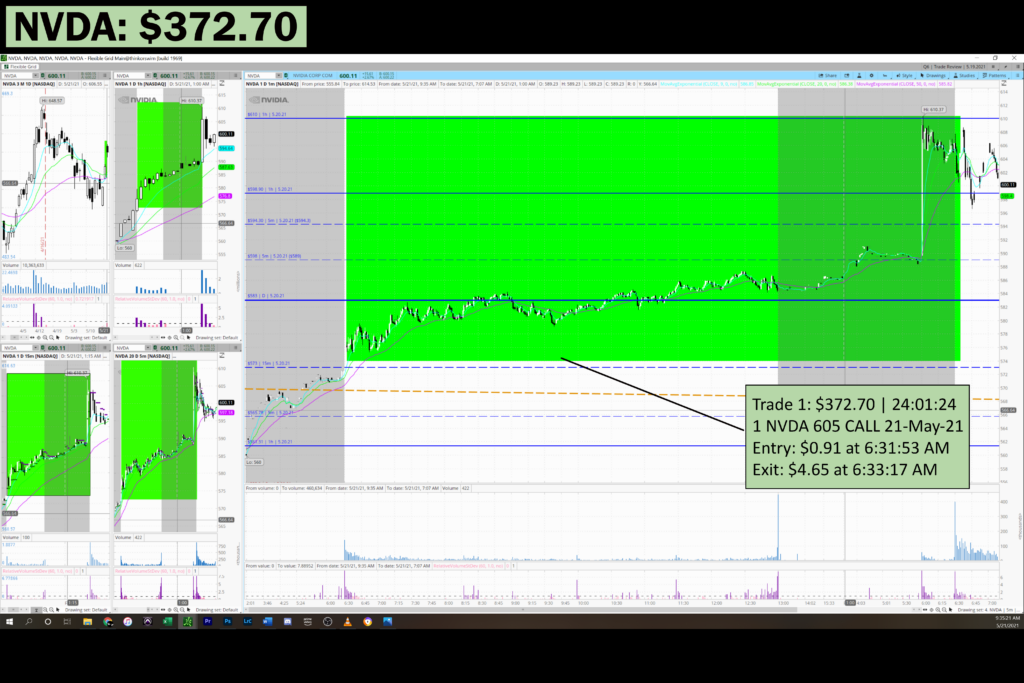

Trade 1 (NVDA | $372.70):

-Entered Because Saw break & hold above $573 level I had in my game plan, ema’s were trending in my favor & QQQ was pushing as well. HELD this position because NVDA was holding above levels, trending well (especially on larger time frame) all day & I decided I was comfortable with the risk of losing the entire premium if the stock plummeted the next day. I also held out of frustration, since I was on the right side of the move with a good entry, but not seeing any reward reflected in my premium even as the underlying was moving up. I reasoned that there was a small chance for a healthy move on NVDA, & if that happened the premium would sky rocket. I got lucky and that’s what ended up happening.

-Exited because I saw the price falling sharply & panicked. I locked in profits yes but out of fear not a plan. I did not trust levels of the underlying and I let price fluctuations get the better of me, then sold the exact bottom of the wave. While all in all this worked out well enough, it could have worked out twice as well had I waited a bit, but that’s the nature of the game. I must keep in mind that it also could have worked out 4 times as bad had I held too long. It seems to be that when there is a significant overnight gap-up there’s a chance the news gets sold off aggressively in the morning. I got lucky on this trade but I’ll take it. I was going to exit earlier but at market open the spread on the contract was huge and I was worried I’d get a poor fill If I tried to sell. In retrospect, a poor fill would have been preferable to literally selling the bottom.

-Mistakes: Did not have a clear exit plan. Panic Sold. I ALMOST didn’t, I’d clicked a price in active trader but had held down the click button thinking the platform wouldn’t execute my order until after I released the click, but the moment I clicked down the order had been placed. I have a talent for picking the exact bottom lmao. Should have sold the news at the open.

-Successes: Solid entry, made & followed game plan. I’m proud of how I followed my plan for my entry & of the levels I’d placed beforehand. I also did not do anything stupid, just did some things over-cautiously which is infinitely preferable. My exit wasn’t brilliant, to be sure, but I locked in profits & that’s a success. I could have tried to get back in right after selling and knowing me would have bought the mf top and gave back profits, but I abstained from the temptation. I was lucky enough to be in before the news dropped over night. Know when to sell the news. You got lucky with this, but LEARN.

Trade 2 (FB | -$49.30):

-Entered because I saw a hold with volume above the level I’d charted earlier this morning ($315.60), price was above ema’s, & qqq was pushing upwards and through a charted level as well.

-Exited because there was no significant movement towards the strike I’d entered in & contract was on the way to expiring worthless. Wanted to lose less premium at stake and had had a large winning trade so I took the loss on this one.

-Mistakes: Choice of strike price. A hard lesson I’m learning now in my first trades with stocks other than apple. I was in the green for a moment, but I did not take the profit, hoping that there would be more room for upside, but even though the underlying price trended within a range and not broken below my initial stop level, my contract has depreciated considerably. If I’m going to be trading new issues, I need to be trading ITM strike prices if I’m going to continue trying to scalp or capitalize on short term movements.

-Successes: Multiple confirmations on entry. Cut losses. I waited for confirmation before entering, I had multiple confirmations, was with the ema trends, had a hold above a level I’d charted earlier, and got a good entry before a move upwards.

Trade 3 (SPCE | -$17.30):

-Entered because I saw the break and hold above the $20 level, thought there was room for continuation

-Exited because the price closed below the level I’d planned my MSL to be at.

-Mistakes: Entered in a dangerous zone. Stops too tight. I saw the break of level with volume, and treated volume as confirmation, but I should have considered the large move up before the break of this level and realized that there was a good chance the volume was an indication of a blowing off top. Another mistake seems to be my stops being a bit too tight, and easily triggered. I should have given the stock more room to move, and had my MSL around 19.5 instead “Place your stop where it’s hard to get to”.

-Successes: Made & followed game-plan. I entered with the confirmation I’d made the plan for and exited when the price broke below the level I’d set & the plan I’d made.

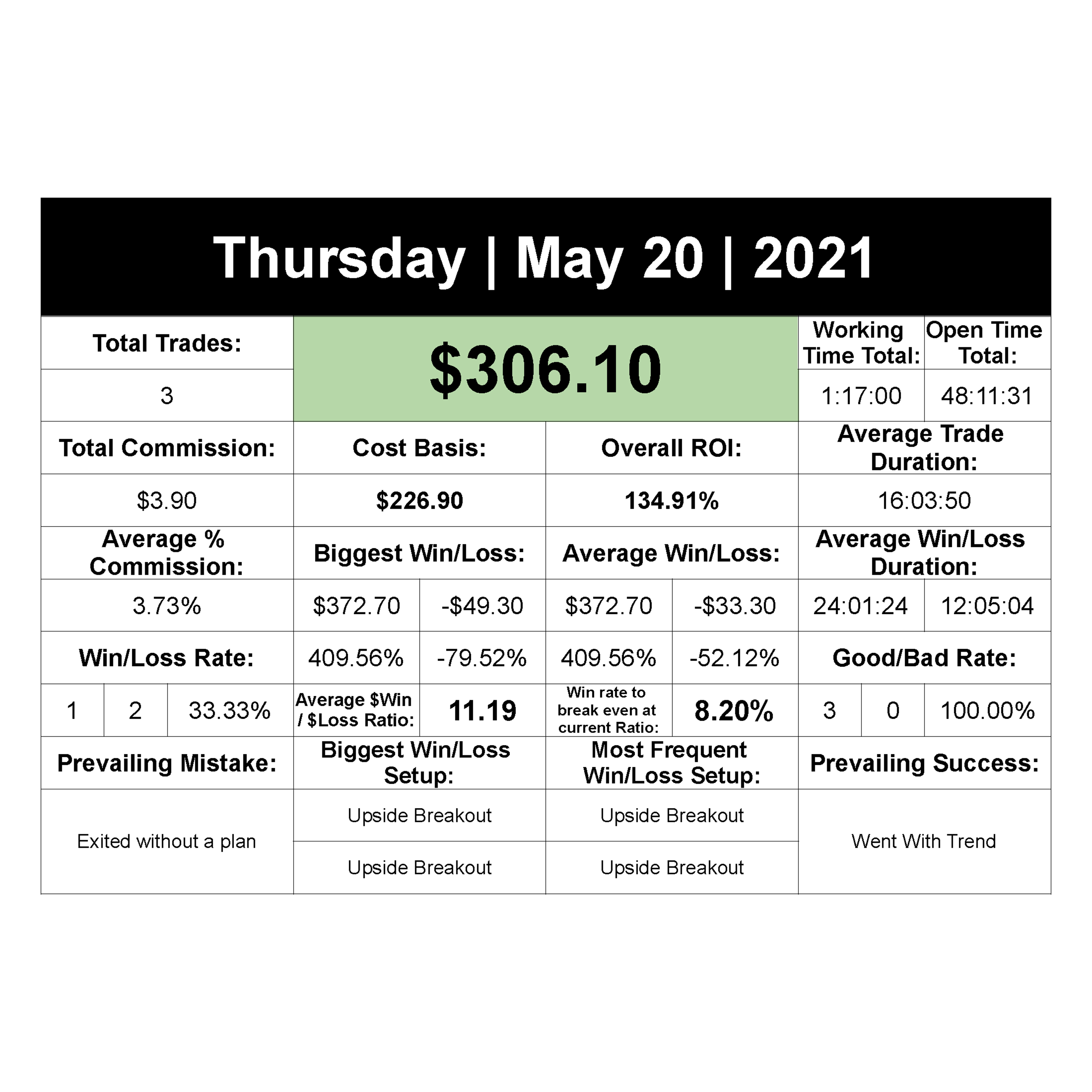

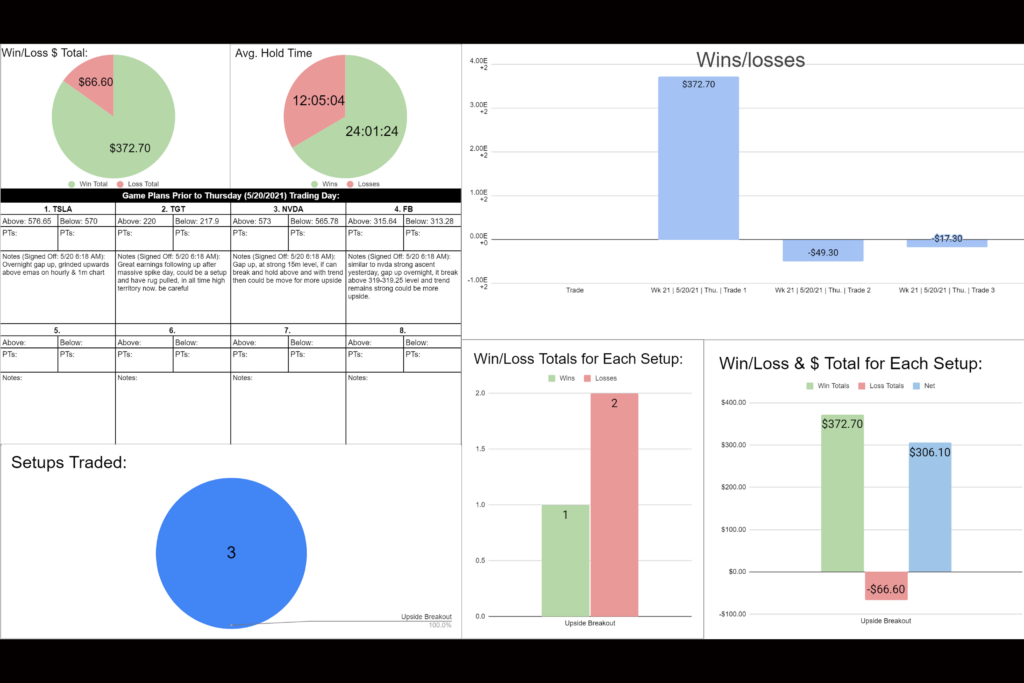

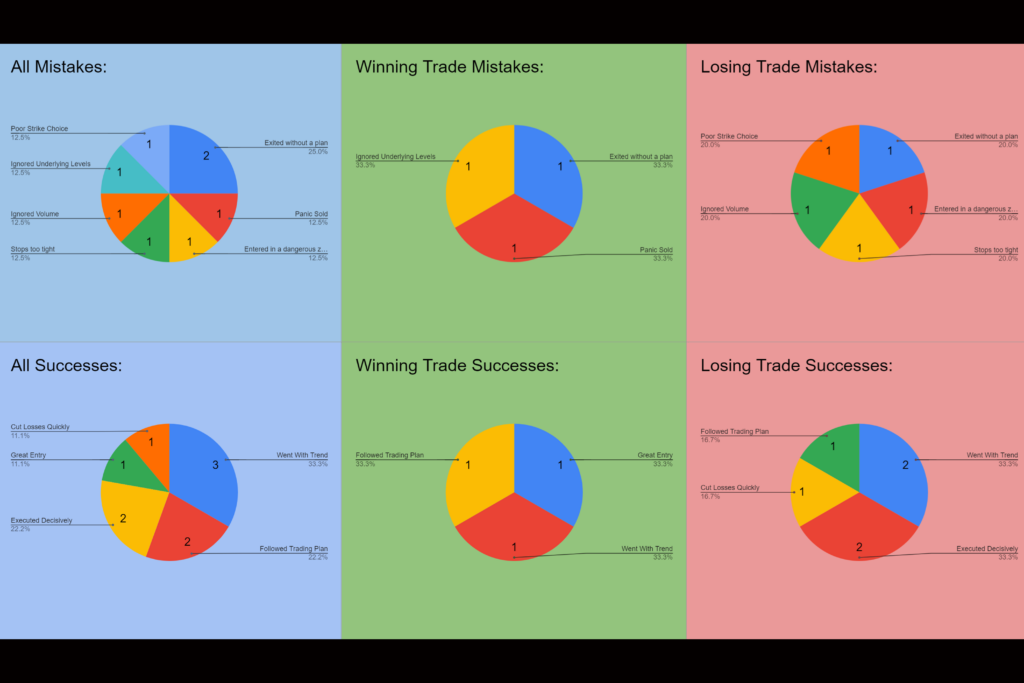

5.20.2021 Statistics: