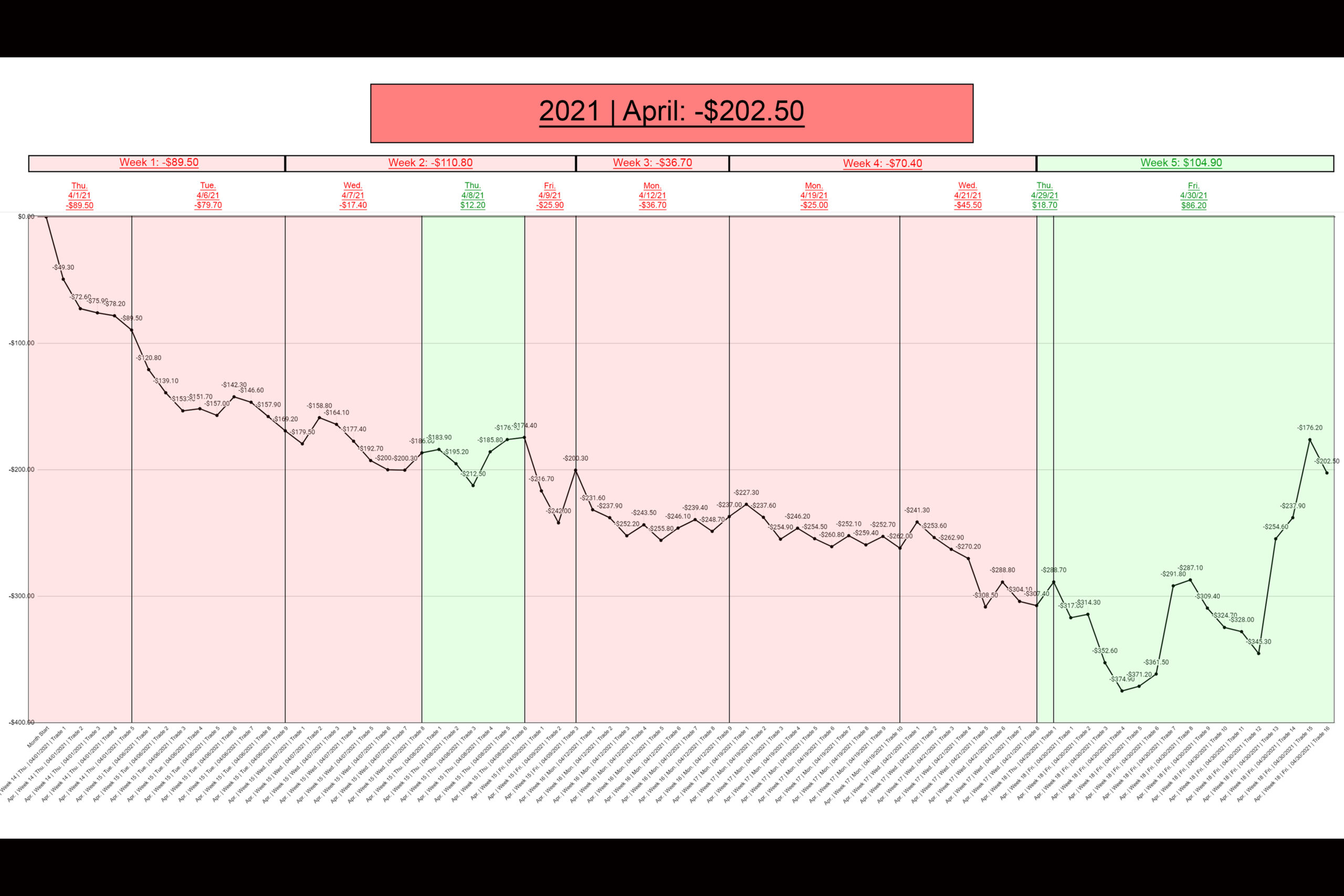

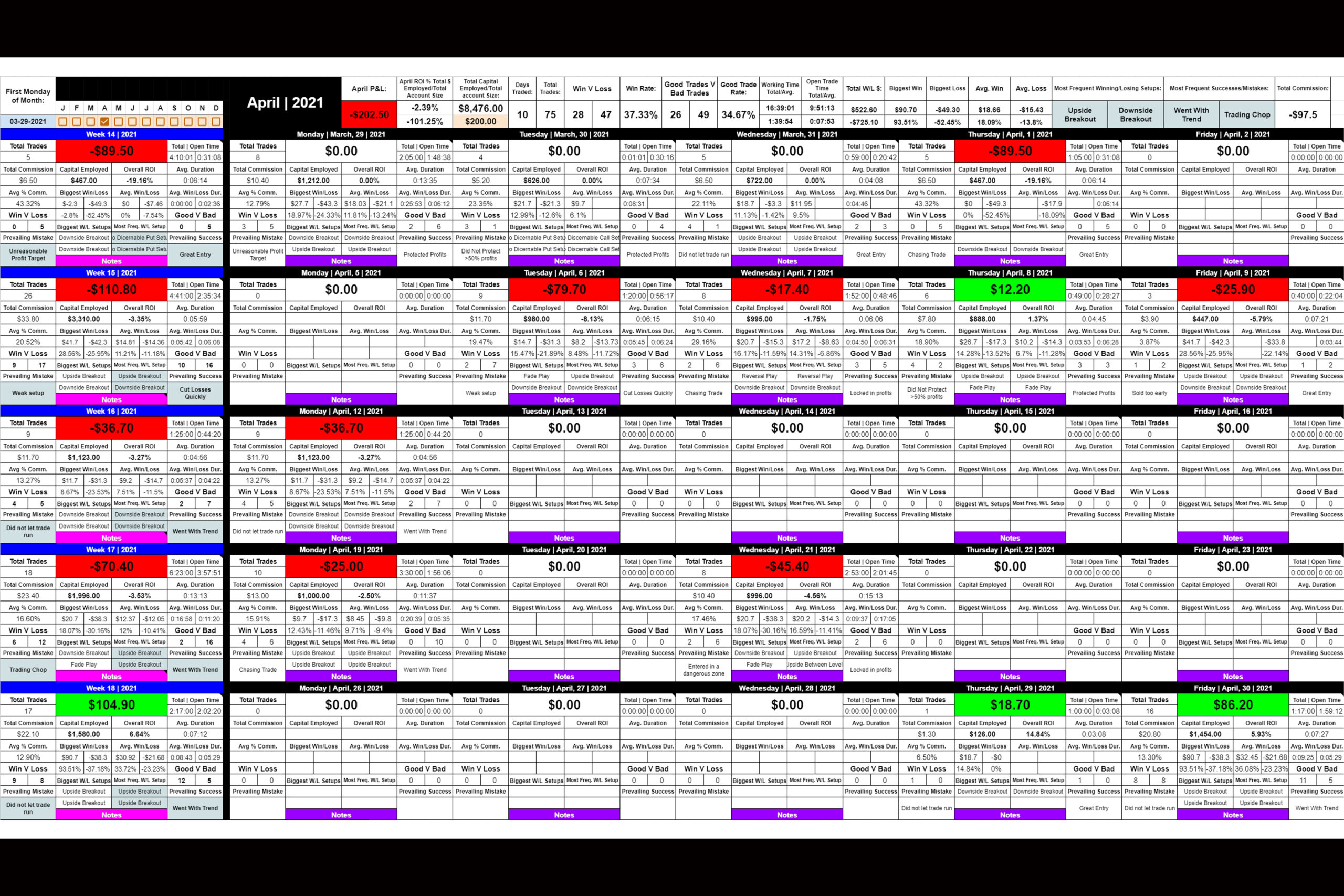

Rough month with some recovery at the end. I’ve been trading Apple options exclusively in 2021 with the goal of learning the ins & outs of options without blowing up my account. But lately I’ve been feeling fatigue from trading the same stock and getting frustrated when opportunities aren’t present. Out of frustration I ended up trading chop days, weak setups, overthinking good trades, forcing bad trades, & revenge trading. This resulted in me losing capital unnecessarily and compromising my ability—psychologically & financially—to take advantage of days when opportunities did show up. Now that I have learned how to trade options to some extent, am doing ok managing risk and not letting any one trade blow me up, & am aware of the effects Greeks, IV, & open interest can have on positions, I feel prepared to move on to the next stage of my option trading journey & introduce multiple names into my trading plan. I’m sure I will encounter another learning curve stepping into multiple names, but I’m ready for it.

Psychologically, I took an emotional blow the first day of April & had a hard time recovering. I’d just come off my first green month (+$89.50 March 2021) since I began trading options in December 2020. I went into April overly hopeful and I think I was subconsciously believing that I was going to be green from now on. My exuberance was quickly curbed. On literally the first day (April fool’s day) I gave all of the small profits I did have from the month of March back. I let this get to me more than I should have but I was able to regroup and reassess my situation—I’m relatively early in my trading journey, I’m trading one stock, and I’m containing my losses well enough to stay alive for the rest of this year. It would be nice to be immediately profitable but it’s unreasonable to expect after just 4 months of trading. I need to keep that in perspective. I need to use what I’ve learned this month to contribute to my improvement and continue building on my experience.

My biggest Mistakes in April 2021 were:

-Not Stopping while I was ahead. During my profitable month I was consistently ending my days green, even if it meant stopping after 1 or 2 trades. This month, if I started my day red I kept trading until I was green, but never stopped when I was green, I’d just keep on trading and inevitably end up red again.

Solution: Stop while you’re ahead.

-Trying to Time the Market. Did this so many fucking times this month. Trying to time right when ‘reversals’ were happening which is a completely flawed strategy. It worked out really well for me ONE time last month and I got all excited thinking it was a viable way to trade. Since that big win I’ve lost at least 3x trying to replicate the same result. I guess this is a good lesson that sometimes bad habits that made you money are the hardest to weed out.

Solution: NEVER FIGHT THE TREND.

-Trading Chop & Weak Setups. As I mentioned above, I’ve been trading one stock only (AAPL), expecting there to be plays every day & trying to force trades when there were none just because I wanted to trade. The solution to this is to move on from names that do not have any movement, and if no names have decent movement or plays then do not trade.

Solution: Do not trade names without clear trend.

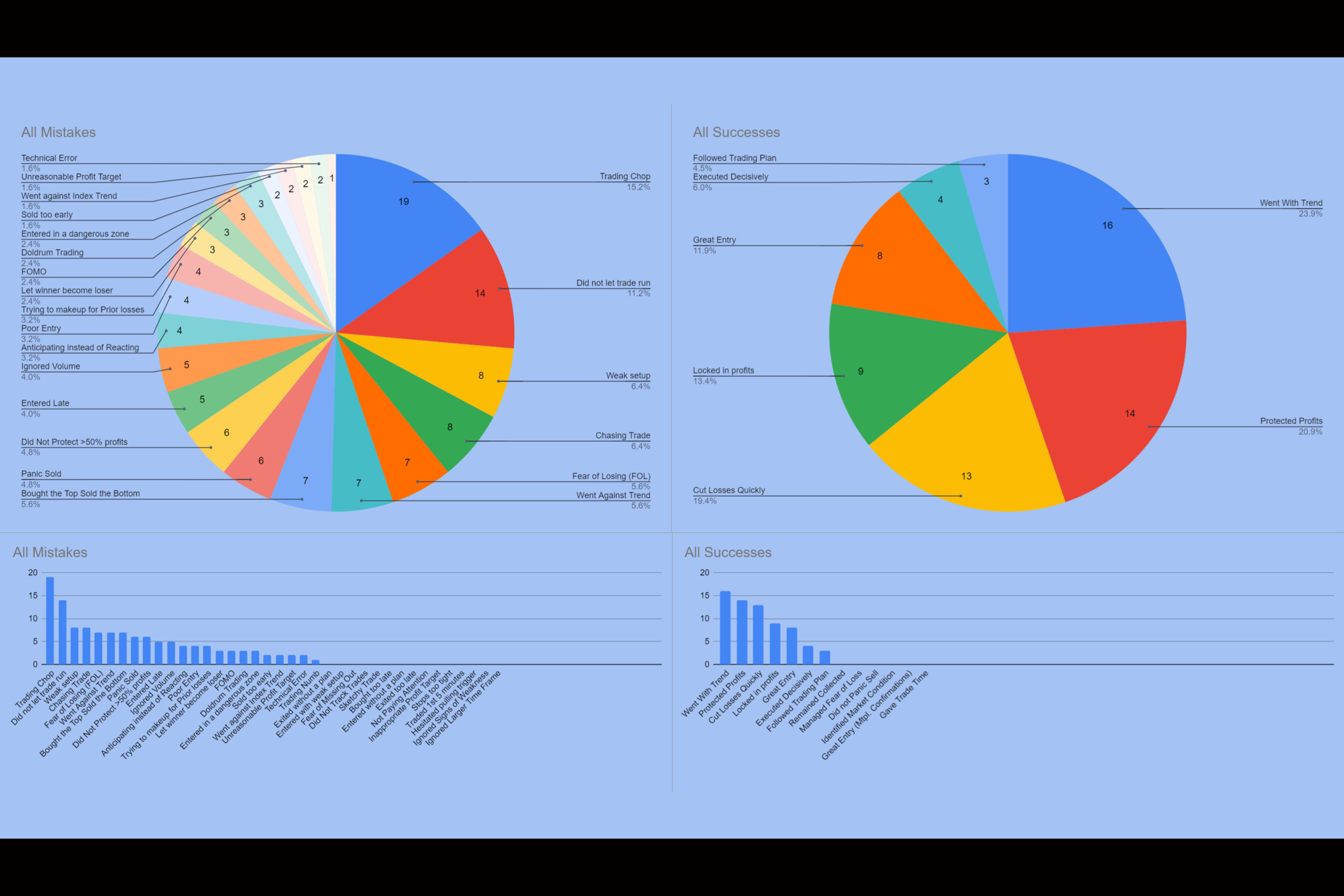

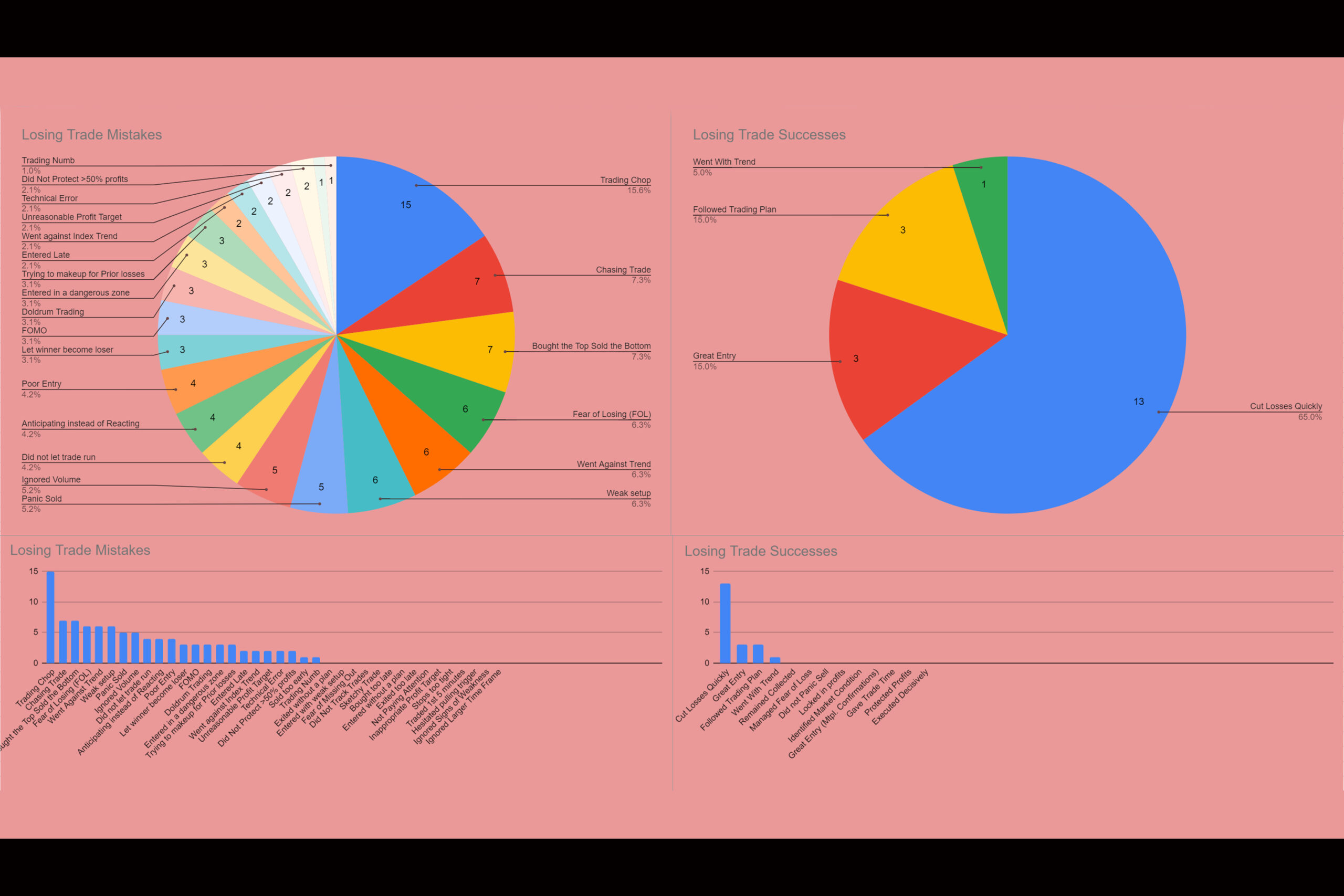

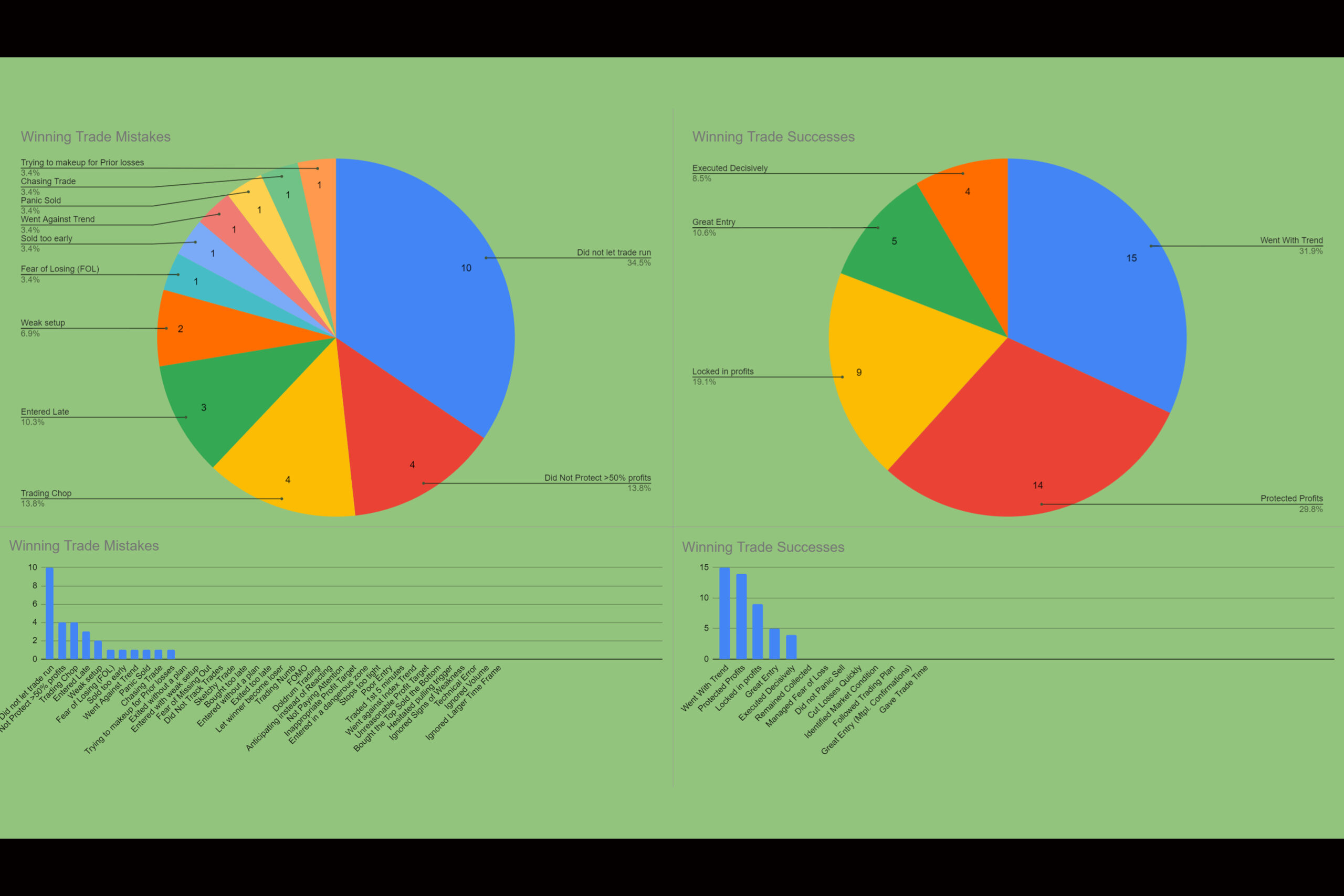

April 2021 Successes & Mistakes Statistics: